$1 a day car insurance NJ presents a compelling, yet potentially perilous, path to affordable vehicle protection. This journey delves into the intricate details, uncovering the promises and pitfalls of such remarkably low-cost policies. The allure of saving money must be weighed against the risks of inadequate coverage, guiding you toward informed decisions.

We’ll examine the types of coverage often included, highlighting the crucial distinctions between $1 a day policies and more comprehensive options. Understanding the typical exclusions and limitations is paramount, equipping you with the knowledge to navigate this financial landscape with clarity and confidence.

Introduction to $1 a Day Car Insurance in NJ

The siren song of $1 a day car insurance in New Jersey can be tempting. Imagine paying a minuscule amount for protection on the road. However, the reality is often more complex than the catchy headline. This affordable option, while alluring, comes with caveats that prospective customers should be aware of. Understanding the potential pitfalls and the types of coverage offered is crucial to making an informed decision.The common misconception surrounding this type of insurance is that it offers comprehensive protection at a ridiculously low price.

This isn’t always the case. Often, these policies come with significant limitations. Understanding these limitations is paramount to avoiding financial hardship should the unexpected occur.

Common Misconceptions and Pitfalls

Low-cost car insurance policies frequently have limitations in coverage amounts. This means that if a claim exceeds the policy limits, the policyholder may be responsible for a substantial portion of the expenses. Furthermore, these policies may exclude certain types of damages, such as damage to your own vehicle in an accident, or injuries sustained by others.

Types of Coverage Available

The types of coverage available in these low-cost policies often vary. Basic liability coverage, protecting you from damages you cause to others, is typically included. However, comprehensive coverage, protecting your vehicle from damage unrelated to collisions (like vandalism or weather), is often limited or excluded entirely. Collision coverage, which protects your vehicle if you’re involved in an accident, might also be severely restricted.

It’s vital to carefully examine the policy documents to determine what is and isn’t covered.

Suitable Situations

A $1 a day policy might be a suitable option for someone with a very low-risk driving history and a vehicle of low value. This might apply to a person who drives infrequently, lives in a low-crime area, and doesn’t need the full spectrum of coverage. For example, a college student who drives occasionally and has a basic vehicle might find it suitable.

It’s also important to consider that such policies might be suitable for temporary or supplemental coverage.

Unsuitable Situations

Conversely, this type of policy is unsuitable for individuals who frequently drive or have a high-value vehicle. If you’re involved in a significant accident, the limited coverage could leave you with substantial out-of-pocket expenses. Similarly, if you have a history of accidents or traffic violations, a low-cost policy may not offer the adequate protection you need. A driver with a history of traffic violations, living in a high-crime area, and possessing a high-value vehicle would likely find this type of policy insufficient.

Consider, for example, a professional driver with a high-value truck or a driver who regularly commutes through congested areas with higher accident risks.

Coverage Details:

A Day Car Insurance Nj

Stepping into the world of budget-friendly car insurance in New Jersey, a $1-a-day policy promises affordability but comes with specific limitations. Understanding these exclusions and limitations is crucial to making an informed decision about your protection. While this type of policy offers a significantly lower premium, it sacrifices some of the comprehensive coverage found in more expensive options.

Exclusions and Limitations

A $1 a day policy in New Jersey is designed for basic liability protection. It’s not a comprehensive insurance plan and will not cover everything. Think of it as a safety net for the most common scenarios, but not a complete shield against all potential risks. Crucially, these policies often have stringent limitations and exclusions that differ significantly from more traditional plans.

Types of Accidents and Incidents Not Covered

These policies typically exclude coverage for incidents like vandalism, theft, damage caused by weather events not explicitly covered in the policy, and damage to the vehicle itself from a non-accident incident. For example, if your car is damaged due to a hailstorm, the $1-a-day policy might not provide compensation. Similarly, if someone intentionally damages your car, you might need to explore additional coverage options.

Policies also frequently exclude incidents involving a driver under the influence of drugs or alcohol.

Liability Coverage

Liability coverage in a $1 a day policy is typically limited to the minimum state requirements in New Jersey. This means that if you cause an accident and are at fault, your coverage will only compensate the other party up to a certain amount for their injuries and property damage. It’s important to check the exact limits, as they can vary significantly.

Property Damage Coverage Limitations

Property damage coverage in these policies is usually capped at a relatively low amount. This means if you cause damage to another person’s property in an accident, the coverage provided might not fully compensate the other party. Always review the specific policy details to ascertain the maximum payout amount.

Deductibles

Deductibles are a crucial component of any insurance policy, and $1-a-day policies are no exception. These policies typically have higher deductibles than comprehensive policies, meaning you will be responsible for a larger portion of the repair or replacement costs before the insurance company steps in.

Coverage Comparison Table

This table highlights the stark difference in coverage limits between a $1-a-day policy and a more comprehensive option. Always verify the specific coverage limits with the insurer before purchasing a policy.

Understanding the Risks

A $1-a-day car insurance policy in NJ might seem like a steal, but the devil is often in the details. While offering incredibly low premiums, these policies frequently come with significantly reduced coverage. Understanding the potential pitfalls is crucial before signing up. It’s not just about the initial cost; it’s about the potential financial consequences should the unexpected occur.

Potential Financial Risks

The allure of a $1-a-day car insurance policy is undeniable, but it’s essential to weigh the potential financial risks. A seemingly low premium can quickly become a substantial burden if an accident occurs. A limited policy might not cover the full extent of damages or injuries, leaving you responsible for a substantial out-of-pocket expense. This could include medical bills, property damage, or even legal fees.

Consider the example of a minor fender bender that escalates into significant repairs or a more serious accident resulting in extensive injuries. The limited coverage might not be sufficient to handle the costs.

Scenarios Where Low Cost Isn’t Justified

Sometimes, the seemingly low cost of a $1-a-day policy might not be worth the reduced coverage. For example, if you drive a high-value vehicle or live in a high-risk area, the savings might not outweigh the potential for significant financial losses in the event of an accident. Also, consider your personal circumstances. If you have significant assets, a substantial deductible, or other factors that would increase your exposure in a claim, a higher-priced policy with comprehensive coverage might be a better choice.

Comparison with Higher-Priced Policies

Higher-priced car insurance policies typically offer comprehensive coverage, including liability, collision, and comprehensive protection. These policies are generally more robust, protecting you from a wider range of potential risks, including accidents, vandalism, and even natural disasters. However, they come with a higher premium. The $1-a-day policy, on the other hand, focuses on the bare minimum to meet legal requirements.

It’s crucial to carefully weigh the risks and benefits of each option before making a decision.

Consequences of Insufficient Coverage

Insufficient coverage can lead to a cascade of financial problems in the event of an accident. Imagine a situation where your policy’s liability coverage isn’t sufficient to cover the damages to another driver’s vehicle. You could face a lawsuit and be responsible for paying substantial damages exceeding your policy limits. Similarly, insufficient medical coverage could leave you with substantial medical bills to pay out of pocket.

Impact on Personal Finances in Case of an Accident

An accident can dramatically impact your personal finances. Insufficient coverage could leave you facing significant out-of-pocket expenses, potentially impacting your ability to pay for necessities or even leading to financial instability. It’s crucial to understand the financial implications of various coverage options and choose a policy that aligns with your financial situation and risk tolerance.

Understanding the Risks – A Comparative Analysis

| Risk Factor | Explanation | Mitigation Strategy |

|---|---|---|

| Limited Coverage | Reduced protection in case of accidents, potentially exposing you to significant out-of-pocket expenses. | Consider a higher-priced policy with comprehensive coverage. Analyze your individual risk profile and needs. |

| Financial Impact | Potential for substantial out-of-pocket expenses in the event of an accident or claim. | Seek professional financial advice to evaluate your risk tolerance and financial capacity. Assess the cost of potential accidents and injuries. |

| Fraudulent Claims | Higher likelihood of fraudulent claims due to the lack of thorough underwriting and inspection processes in some low-cost policies. | Thoroughly research and compare insurance providers. Prioritize reputable companies with proven track records. |

Finding and Evaluating Policies

Unlocking affordable car insurance in New Jersey often involves a proactive approach. Knowing where to look and how to compare policies is crucial for securing the best possible deal. This section details the process of finding and evaluating $1 a day car insurance options, focusing on practical steps and key considerations.

Locating $1 a Day Car Insurance Options

Finding $1 a day car insurance in New Jersey requires a focused search. Online comparison tools are a valuable resource, allowing you to quickly compare quotes from various providers. These platforms often aggregate quotes from multiple insurers, simplifying the process. Visiting dedicated insurance websites directly is another avenue. These websites provide detailed information about specific policies and may offer more tailored quotes based on individual needs.

Don’t hesitate to ask friends, family, or colleagues for recommendations; personal referrals can sometimes lead to hidden gems.

Comparing Policies Based on Coverage and Pricing,

a day car insurance nj

A crucial step is comparing different policies. Carefully analyze the coverage limits, deductibles, and premiums associated with each policy. A policy’s coverage should align with your needs and financial situation. Understanding your coverage is critical. A thorough comparison of coverage details, including liability, collision, comprehensive, and uninsured/underinsured motorist protection, is essential.

Consider the premiums associated with each policy and compare them side-by-side. Assess deductibles as well; a lower deductible typically comes with a higher premium, and vice versa.

Key Factors to Consider When Selecting a Policy

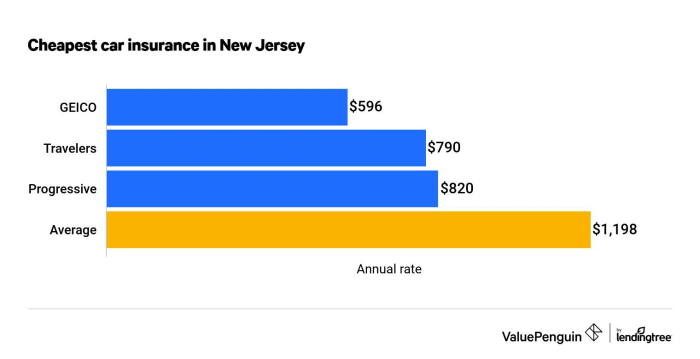

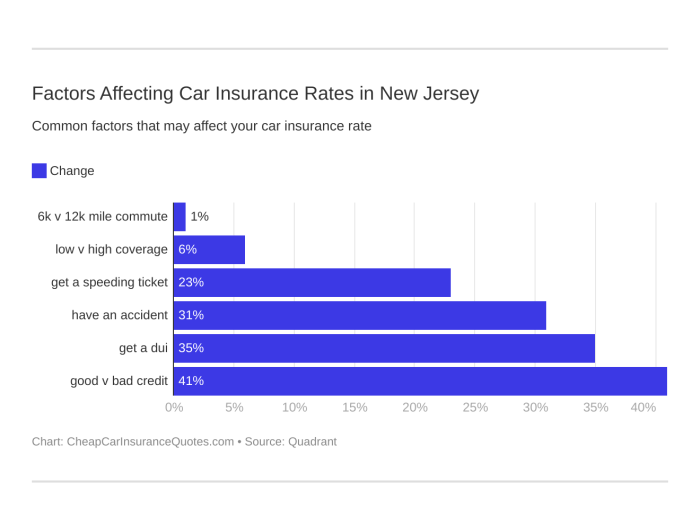

Several key factors influence the selection of a suitable policy. Your driving history is a significant factor. A clean record often leads to lower premiums. Your vehicle’s make, model, and year also play a role in the insurance cost. The more expensive the car, the higher the insurance cost, on average.

Your location within New Jersey can impact premiums. Urban areas, for example, may have higher rates due to increased traffic and accident risks.

Questions to Ask an Insurance Provider

Before committing to a policy, asking the right questions ensures clarity and understanding. Inquire about the specific coverage limits for liability, collision, and comprehensive insurance. Ask about the deductible amounts and their impact on your premiums. Understand the terms and conditions associated with the policy, including any exclusions or limitations. Clarify the claims process and payment options.

Understanding the policy’s fine print is vital to avoiding potential surprises down the road.

Policy Comparison Table

This table presents a hypothetical comparison of different insurance providers and their policies. Actual details will vary.

Alternatives to $1 a Day Insurance

While $1 a day car insurance in NJ might seem tempting, it often comes with limitations. This isn’t a one-size-fits-all solution. Understanding your specific needs and exploring alternative options is crucial for finding the best fit for your driving history, vehicle type, and financial situation.The insurance market offers a wide range of options beyond the basic $1 a day plan.

These alternatives often provide more comprehensive coverage and greater flexibility. Choosing wisely means taking the time to understand the different types of policies available and how they can protect you.

Affordable Insurance Options in NJ

Various insurance providers offer competitive rates in New Jersey, tailored to different needs. Consider options like:

- Bundled Packages: Many providers offer bundled packages that combine car insurance with other services, like home insurance. This can sometimes lead to discounts and more favorable premiums.

- Discounts for Good Drivers: Maintaining a clean driving record often unlocks substantial discounts. Programs rewarding safe driving practices are widely available. This is a practical way to save money.

- Multiple-Car Discounts: Owning multiple vehicles might qualify you for a multi-car discount, saving money on each policy.

- Discounts for Students and Young Drivers: Insurance companies frequently offer discounts to students and young drivers, recognizing the higher risk profile.

Exploring Alternative Insurance Products

Discovering these options requires active exploration. Begin by:

- Comparing Quotes: Online comparison tools can help you compare premiums from various providers. Don’t hesitate to use these tools, as they can be extremely helpful in evaluating different policies.

- Contacting Insurance Agents: Insurance agents can provide personalized recommendations based on your individual circumstances. They can guide you through the options and tailor the best fit for your needs.

- Researching Insurance Providers: Investigate the reputation and financial stability of different insurance companies. A financially sound company is essential for your coverage.

Assessing Different Options

Evaluating policies involves considering several factors:

- Coverage Limits: Thoroughly examine the coverage limits for liability, collision, comprehensive, and other important aspects of the policy.

- Deductibles: Understand the deductible amounts. Lower deductibles typically lead to higher premiums.

- Premium Costs: Compare the overall premium costs across different policies to see how they align with your budget.

- Policy Terms and Conditions: Carefully review the fine print. This ensures that you understand all aspects of the policy, including exclusions and limitations.

Finding Alternative Insurance: A Flowchart

| Step | Action |

|---|---|

| 1 | Identify Your Needs (Vehicle type, driving record, budget) |

| 2 | Use Online Comparison Tools |

| 3 | Contact Insurance Agents (for personalized recommendations) |

| 4 | Research Insurance Providers (reliability and financial stability) |

| 5 | Compare Quotes, Coverage Limits, Deductibles, Premiums |

| 6 | Review Policy Terms and Conditions |

| 7 | Select the Best-Fitting Policy |

Conclusive Thoughts

In conclusion, $1 a day car insurance NJ offers a compelling alternative, but it demands careful consideration. By understanding the risks, comparing policies, and seeking advice, you can navigate the complexities and make a decision aligned with your needs and financial well-being. Remember, true security often comes from making informed choices. The path to financial peace of mind begins with understanding the nuances of this insurance landscape.

Common Queries

Is $1 a day car insurance NJ a scam?

No, $1 a day car insurance NJ policies are legitimate, but they often come with significant limitations and exclusions. It’s crucial to understand the specifics of coverage before making a decision.

What kind of accidents are typically not covered by $1 a day policies?

Policies often exclude incidents like accidents involving uninsured or underinsured drivers, incidents stemming from severe weather conditions, and certain types of collisions. Always review the specific policy details.

How do I find reliable $1 a day car insurance providers in NJ?

Online comparison tools and reputable insurance agencies in NJ can assist you in finding and comparing various policies. Don’t hesitate to ask questions to clarify the policy’s terms and conditions.

What are some alternatives to $1 a day car insurance NJ?

Alternatives include exploring higher-deductible policies with wider coverage options, examining options with a slightly higher premium, or potentially exploring umbrella insurance that may offer additional layers of coverage.