Refinance car loan with gap insurance – Refining a car loan with gap insurance presents a complex financial decision. This review examines the intricacies of the process, from understanding refinancing options to evaluating the necessity of gap insurance and potential alternatives.

The process involves careful consideration of interest rates, loan terms, and fees, while gap insurance adds another layer of complexity. A thorough understanding of the potential benefits and drawbacks is essential for making an informed choice.

Understanding Refinancing Options: Refinance Car Loan With Gap Insurance

Yo, gengs! Refining your car loan can be a total game-changer, especially if you’re looking to snag a better deal. It’s like getting a fresh start on your car payment, and we’re gonna break down the whole process, from the different types of loans to the pros and cons. So, buckle up and let’s dive in!Refining a car loan basically means replacing your existing car loan with a new one from a different lender.

This could mean getting a lower interest rate, a longer loan term, or both. It’s a smart move if you can snag a better deal, but it’s crucial to weigh the pros and cons before jumping in.

Refining Car Loan Process

The refinancing process usually involves a few key steps. First, you’ll need to shop around for different lenders and compare their offers. Then, you’ll need to gather all the necessary documents, like your loan history and income verification. Next, the lender will assess your application and approve or deny it. Finally, if approved, you’ll sign the new loan agreement, and the old loan will be paid off.

It’s a relatively straightforward process, but make sure you understand each step to avoid any headaches down the road.

Types of Car Loan Refinancing

There are various types of car loan refinancing available. A fixed-rate loan has a set interest rate for the entire loan term, offering stability and predictability. On the other hand, a variable-rate loan has an interest rate that fluctuates based on market conditions, potentially leading to changes in your monthly payments. It’s essential to understand the implications of each type before making a decision.

Fixed-Rate vs. Variable-Rate Car Loans

Fixed-rate car loans offer consistent monthly payments throughout the loan term, making budgeting easier. However, if interest rates rise, you might miss out on potentially lower rates available with a variable-rate loan. Conversely, variable-rate loans could result in lower payments initially but might increase significantly if market interest rates rise. Consider your financial situation and risk tolerance when choosing between these options.

Benefits and Drawbacks of Refinancing

Refining a car loan can offer significant advantages, such as a lower interest rate, which translates to lower monthly payments. A longer loan term can also ease your monthly burden, but you’ll pay more interest overall. However, refinancing also comes with potential drawbacks. There might be fees associated with the refinancing process, and the new loan might have different terms and conditions compared to your original loan.

Comparison of Refinancing Options

| Option | Interest Rate | Loan Term | Fees |

|---|---|---|---|

| Option 1 (Fixed Rate) | 6.5% | 60 months | $200 origination fee |

| Option 2 (Variable Rate) | 5.5% (currently) | 72 months | $150 origination fee |

This table presents a simple comparison of two potential refinancing options. Remember that actual rates and fees will vary depending on the lender, your credit score, and other factors. Always thoroughly research and compare different options before making a decision.

Gap Insurance and Refinancing

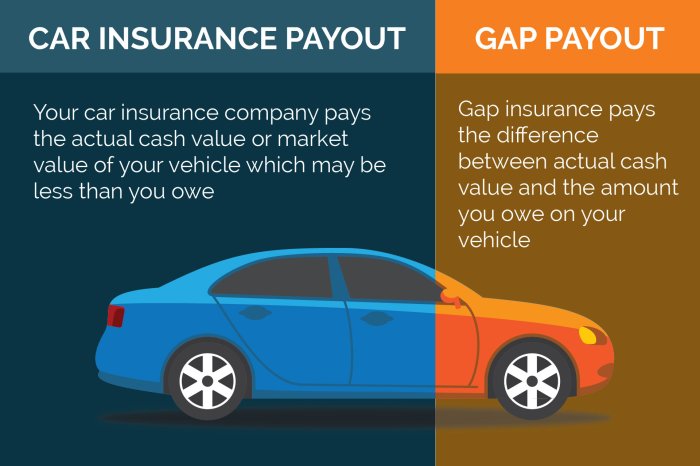

Yo, gengs! Refining your car loan? Gap insurance is a crucial factor to consider. It’s like a safety net, protecting you from potential losses if your car’s value drops below what you owe on the loan. Let’s dive into how it works with refinancing.Gap insurance is a type of insurance that covers the difference (the “gap”) between the outstanding loan balance and the market value of your vehicle in case of a total loss or theft.

If your car is totaled, and the insurance payout doesn’t cover the full loan amount, gap insurance steps in to pay the remaining balance. This means you’re not on the hook for the difference. Crucially, it’s a way to protect your financial wellbeing if something unfortunate happens to your ride.

Understanding Gap Insurance

Gap insurance essentially covers the difference between the amount you owe on your car loan and the amount the insurance company pays out in the event of a total loss or theft. This protects you from any financial responsibility for the unpaid balance. For example, if your car is totaled and the insurance payout is lower than your loan balance, gap insurance will cover the shortfall.

How Gap Insurance Interacts with Refinancing

When you refinance a car loan, you’re essentially taking out a new loan with a potentially different interest rate and terms. Gap insurance isn’t automatically transferred with the refinance. You need to decide if you want to keep or drop it during the refinancing process. Sometimes, lenders might offer to include gap insurance in the refinance package, making it more convenient.

Scenarios Where Gap Insurance is Beneficial During Refinancing

Gap insurance can be particularly beneficial during refinancing if the market value of your car has decreased since you took out the original loan. This is especially important if you’re concerned about the possibility of a total loss or theft. It’s important to note that even with a new loan, the risk of damage or theft remains.

Cost Implications of Gap Insurance in Refinancing

The cost of gap insurance during refinancing will vary based on several factors, including the car’s make, model, and current market value. You’ll need to evaluate the current loan balance, the car’s value, and the risk factors involved to determine the optimal strategy. Some lenders may bundle gap insurance into the refinance agreement, while others might require you to purchase it separately.

This impacts the overall cost of the refinancing process.

Examples of When Gap Insurance is Essential

A prime example is a situation where you financed a high-value vehicle, but its market value has significantly depreciated over time. If you’re considering selling the car and buying a new one, gap insurance will protect you from potential financial loss. A used car that was worth a lot when purchased could be worth significantly less in the market now.

If you experience a total loss or theft, gap insurance will ensure you aren’t responsible for the difference.

Gap Insurance Scenarios and Refinancing Costs

| Scenario | Vehicle Value | Loan Amount | Gap Insurance Impact |

|---|---|---|---|

| Car value depreciates significantly | Rp. 100 juta | Rp. 150 juta | Gap insurance is highly recommended to cover the difference and protect you from financial liability. |

| Accident causes significant damage | Rp. 50 juta | Rp. 100 juta | Gap insurance is crucial to cover the remaining loan amount. |

| Vehicle is stolen | Rp. 75 juta | Rp. 125 juta | Gap insurance will cover the difference in value to protect you from potential debt. |

Refinancing with Existing Gap Insurance

Yo, peeps! Refinancing your car loan can save you serious moolah, especially if you’ve got gap insurance already in place. But how does that existing policy play into your new loan? Let’s dive in and break it down, so you can make the smartest move for your ride.Having gap insurance on your current loan means you’ve already covered a potential difference between the car’s value and the loan amount.

This is crucial when considering refinancing. Understanding how your existing policy interacts with the new loan is key to avoiding unnecessary costs or gaps in coverage.

Impact of Existing Gap Insurance on Refinancing Options

Your existing gap insurance policy directly impacts your refinancing options. It’s not just a simple yes or no; it alters the terms and conditions, affecting your eligibility for certain refinancing deals.

How Refinancing Affects Gap Insurance Policy

Refinancing your car loan usually means a new loan agreement. This new agreement may or may not include a gap insurance option. If the new loan does not include gap insurance, you’ll need to decide whether to keep your existing policy or purchase a new one. If you decide to keep your existing policy, ensure the terms of your new loan are compatible with maintaining the existing gap insurance.

Comparison of Refinancing Options for Borrowers with Existing Gap Insurance, Refinance car loan with gap insurance

Several refinancing options exist for borrowers with existing gap insurance. A direct comparison would highlight the differences in the loan terms, interest rates, and the treatment of the existing gap insurance policy. Some lenders might allow you to keep your current policy, while others may offer a new gap insurance policy as part of the refinance package. Shop around and compare these options to find the best fit for your needs.

Advantages and Disadvantages of Keeping Existing Gap Insurance During Refinancing

Maintaining your existing gap insurance during refinancing has both upsides and downsides. Think of it like this: You already have a policy, so potentially, it’s easier to maintain. However, the new lender may not honor the terms of your existing policy, which might require a new policy. Weigh the pros and cons before you decide.

- Advantages: Avoiding the hassle of obtaining new gap insurance, potentially lower cost, maintaining the coverage you’re used to.

- Disadvantages: Possible complications with the new lender regarding existing policy, potential for reduced coverage under the new loan terms, or the lender might not accept the existing gap insurance.

Comprehensive Overview of Handling Gap Insurance During Car Loan Refinancing

Handling gap insurance during a car loan refinance requires careful consideration. Don’t just assume it’ll transfer automatically. Carefully review the terms of your existing policy and the new loan agreement. Confirm whether the new lender will honor the existing policy or if a new one is required. A proactive approach is key to avoiding any unexpected financial surprises.

Step-by-Step Process for Refinancing a Car Loan with Existing Gap Insurance

A clear step-by-step process is crucial to ensure a smooth refinance process with existing gap insurance. This process will minimize stress and ensure a successful outcome.

- Assess your existing gap insurance policy: Review the policy details, including coverage limits and any remaining policy terms. This is essential for understanding your current protection.

- Compare refinancing options: Research different lenders and their refinancing options, considering the treatment of existing gap insurance. Look for lenders that accept your existing gap insurance, and check the new loan terms to ensure that it will still work.

- Contact your existing gap insurance provider: Inform your existing gap insurance provider about your refinancing plans. This is to confirm if your policy can be transferred to the new loan or if a new one is required.

- Review the new loan agreement carefully: Ensure the new loan agreement clearly Artikels how your existing gap insurance will be handled. Pay particular attention to any changes in coverage or limitations.

- Finalize the refinance process: Once you’re satisfied with the terms of the new loan and gap insurance arrangement, finalize the refinancing process. Don’t forget to document everything.

Considerations for Refinancing

Yo, peeps! Refinancing your car loan can be a total game-changer, especially if you’re looking to snag a better deal on interest rates. But before you dive in headfirst, there are crucial factors you gotta consider. Let’s break down the key points to make sure you’re making the smartest move for your wallet.

Credit Score Implications

Your credit score is a major factor in determining the interest rate you’ll get. A higher credit score typically translates to a lower interest rate. If you refinance, a hard inquiry on your credit report will occur, which might slightly affect your score, but it’s usually a temporary dip. The good news is, if you successfully refinance with a better rate, the improved monthly payments can help boost your credit score over time.

Think of it like this: a small blip for a potentially huge payoff in the long run.

Impact of Current Market Conditions

Market conditions play a huge role in refinancing decisions. Right now, interest rates are fluctuating. If rates are low, it might be a good time to refinance. However, if rates are high, refinancing might not be the smartest move. It’s like the stock market – you need to analyze the trends to make the best call.

Keep an eye on the overall economic climate and the interest rate forecasts to make an informed choice.

Comparing Interest Rates and Fees

Don’t just settle for the first offer you see! Comparing interest rates and fees from different lenders is absolutely crucial. Use online tools or talk to multiple lenders to get a clear picture of the different options available. Different lenders have different terms and conditions. This is your chance to negotiate the best possible deal for your situation.

Always read the fine print to avoid hidden fees.

Impact of Trade-in Value

The trade-in value of your current vehicle can significantly affect the refinancing process. A higher trade-in value means you’ll likely need a smaller loan amount, which can result in lower monthly payments and potentially a better interest rate. It’s like getting a bonus when you’re refinancing. Make sure you get an accurate appraisal of your trade-in before you finalize the refinancing deal.

Key Considerations Summary

| Factor | Description | Impact |

|---|---|---|

| Credit Score | Your creditworthiness, reflected in a numerical score. | Higher score usually means a lower interest rate, but a hard inquiry might temporarily affect the score. |

| Market Conditions | The overall economic state and interest rate trends. | Low interest rates make refinancing attractive; high rates might make it less worthwhile. |

| Interest Rates and Fees | Comparison of rates and fees from various lenders. | Finding the lowest rate and fewest fees is key to maximizing savings. |

| Trade-in Value | The assessed value of your current vehicle for trade. | Higher value means a smaller loan amount, potentially leading to lower payments and rates. |

Documentation and Procedures

Yo, gengs! Refinancin’ your car loan with gap insurance can be a smooth ride, but you gotta be clued up on the paperwork and steps. This section breaks down the essential documents, the process, and how long it typically takes. Let’s get this bread!This section details the crucial documentation and procedures involved in refinancing a car loan, including gap insurance.

Understanding these aspects is key to navigating the process efficiently and avoiding any hiccups. We’ll Artikel the necessary documents, the application steps, and the expected timeframe.

Required Documents

Knowing the documents needed beforehand will save you a ton of time and stress. These are the typical documents required for a successful refinance application. Having these ready will make the whole process way smoother.

- Original car title

- Proof of current car insurance

- Proof of income (e.g., pay stubs, tax returns)

- Current car loan documents (including the loan agreement)

- Gap insurance policy documents

- Information on your current financial situation (e.g., bank statements)

- Valid ID (e.g., driver’s license, passport)

- A completed application form

- Evidence of any outstanding payments or debts.

Application Process

The refinance application process is generally straightforward, but knowing the steps beforehand will help you navigate it with confidence. Let’s break it down.

- Gather all required documents: Make sure you have everything listed above. Double-checking prevents unnecessary delays.

- Choose a lender: Compare interest rates, fees, and terms offered by different lenders to find the best deal for you.

- Complete the application form: Carefully fill out the application form, providing accurate information. Any discrepancies can cause delays.

- Submit the application: Submit your application along with all the necessary documents to the chosen lender.

- Review and approval: The lender will review your application and documents. They might ask for further information if needed.

- Funding and closing: Once approved, the lender will fund the refinance and finalize the closing process. Expect to sign all necessary paperwork at this stage.

- Notification of completion: Receive confirmation that the refinance is complete and the loan has been transferred to the new terms.

Typical Timeframe

The timeframe for refinancing a car loan typically ranges from a few weeks to a couple of months. It depends on various factors, such as the lender, the completeness of your application, and any additional requests for information. For example, a simple application with all documents ready might take 2-3 weeks, but more complex cases might take longer.

Example Documents

Here are some examples of the documents needed for a successful refinance application:

| Document Type | Example |

|---|---|

| Proof of Income | Recent pay stubs, tax returns |

| Car Loan Documents | Loan agreement, amortization schedule |

| Gap Insurance Policy | Policy details, proof of coverage |

| Financial Statements | Bank statements, credit reports |

Alternatives to Refinancing

Yo, peeps! So, you’re lookin’ at refinancing your car loan, but it’s kinda lookin’ tricky? Don’t sweat it! There are other moves you can make that might be even better suited to your situation. Let’s explore some alternatives to refinancing.Sometimes, refinancing just ain’t the best play. Maybe your credit score ain’t cooperating, or the interest rates are still high.

Whatever the case, knowing your other options is key to makin’ the right financial decision.

Early Loan Payoff

Paying off your car loan early can save you a ton of interest over time. If you’ve got extra cash flow, this is a solid option. It’s like hitting the fast-forward button on your debt-free journey. It might not be the fastest, but it’s a guaranteed way to save money on interest charges.

Selling the Vehicle

If you’re lookin’ to get out of the loan altogether, selling your ride might be a good call. This could be a great option if the car’s value has increased or if you need to free up cash for other important things. Just remember to factor in selling costs, like commissions or advertising expenses.

Using a Personal Loan

If you’re lookin’ for a more flexible way to manage your debt, a personal loan could be a viable option. This lets you borrow a lump sum to pay off your car loan, and potentially get a better interest rate than what’s on your existing car loan. However, make sure to compare the interest rates and terms of both loans carefully before making a decision.

Negotiating with Your Lender

Sometimes, a simple conversation with your lender can work wonders. You could try to negotiate a lower interest rate or a more favorable payment plan. This could be especially helpful if you’ve got a strong history with your current lender. It’s a win-win if both sides are willing to work together.

Evaluating the Cost-Benefit Analysis

Before you commit to any of these alternatives, it’s crucial to weigh the pros and cons. For example, selling your car might seem like a fast solution, but it could also mean losing out on a reliable form of transportation. Consider your needs and goals before making a decision.

Closing Summary

In conclusion, refinancing a car loan with gap insurance requires a meticulous analysis of individual circumstances. The decision hinges on evaluating various refinancing options, understanding the implications of gap insurance, and weighing alternatives. Thorough research and careful comparison of offers from different lenders are crucial.

Popular Questions

What are the typical fees associated with refinancing a car loan?

Refinancing fees can vary significantly based on the lender, the loan amount, and the specific terms. They often include application fees, appraisal fees, and potentially prepayment penalties from the original lender. Comparing fee structures is crucial.

How does my credit score impact the refinancing process?

A higher credit score generally translates to better interest rates and terms during refinancing. A lower score might result in less favorable options, and potentially higher interest rates. Understanding how your score affects the outcome is vital.

What are some alternative options to refinancing a car loan?

Alternatives include paying off the loan early, selling the vehicle, or exploring other financing options. The best alternative depends on individual financial circumstances and the current market conditions. Evaluating these options is important.

How does the current market condition impact refinancing decisions?

Current interest rates and market conditions play a significant role in determining the optimal time for refinancing. Lower interest rates might justify refinancing, while higher rates might make it less beneficial. A comprehensive market analysis is needed.