Motorcycle insurance vs car insurance presents a crucial decision for riders. Each offers a unique tapestry of protection, yet their landscapes differ dramatically. Understanding the nuances of coverage, premium factors, and claims processes is paramount in navigating this often-complex terrain. This exploration delves into the intricate differences between these two vital forms of financial security.

This comparison will illuminate the distinctive features of each type of insurance, providing a clear understanding of the benefits and drawbacks associated with each. The considerations include coverage options, cost comparisons, and the intricate processes of filing claims. This detailed analysis will empower riders to make informed decisions aligned with their individual needs and financial circumstances.

Motorcycle Insurance Coverage: Motorcycle Insurance Vs Car Insurance

Motorcycle insurance, unlike car insurance, presents unique risks and considerations due to the nature of the vehicle. This necessitates a tailored approach to coverage, often with different premiums and limitations compared to policies for automobiles. Understanding the various coverage options is crucial for motorcycle owners to adequately protect their investment and liability.

Typical Motorcycle Insurance Coverage

Motorcycle insurance policies typically include similar coverages to car insurance, but with specific nuances. Liability coverage, for example, is fundamental and protects against financial responsibility in the event of an accident where the insured is at fault. Collision and comprehensive coverages address damage to the motorcycle, regardless of who is at fault. Uninsured/underinsured motorist coverage is essential for protection against drivers without adequate insurance.

Liability Coverage

Liability coverage is mandated in most jurisdictions and compensates for bodily injury or property damage caused to others in an accident where the insured is deemed responsible. The policy limits define the maximum amount the insurer will pay for these claims. For instance, a $100,000 limit would mean the insurer’s maximum payout for any one claim would be $100,000.

This coverage mirrors similar provisions in car insurance but often has lower limits due to the perceived higher risk associated with motorcycles.

Collision Coverage

Collision coverage pays for damages to the insured motorcycle if it’s involved in a collision, regardless of fault. This protection is essential to cover repairs or replacement costs following an accident. Comparing this with car insurance, collision coverage remains comparable in its function, but premiums and policy limits might differ.

Comprehensive Coverage

Comprehensive coverage protects the motorcycle from damage caused by events other than collisions, such as theft, vandalism, fire, or weather-related incidents. The coverage often includes damage from falling objects or certain types of animal collisions. This coverage is comparable to the comprehensive coverage in car insurance, but may have different exclusions and limitations based on the specific policy.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage safeguards the insured and their passengers against drivers lacking adequate insurance or being uninsured. This coverage becomes vital if another driver is at fault and lacks sufficient insurance to cover the full extent of damages. This coverage is a crucial safeguard in both motorcycle and car insurance.

Deductibles and Policy Limits

Deductibles are the amounts the insured must pay out-of-pocket before the insurer begins to pay claims. Policy limits define the maximum amount the insurer will pay for a claim. Both deductibles and policy limits vary depending on the specific policy and the level of coverage selected. Higher limits typically correspond with higher premiums.

Exclusions and Limitations, Motorcycle insurance vs car insurance

Motorcycle insurance policies often contain exclusions for specific types of damages or situations. For instance, some policies may not cover damage resulting from racing or stunt riding. Understanding these exclusions is crucial to avoid potential disputes or misunderstandings.

Motorcycle vs. Car Insurance Coverage Comparison

Factors Affecting Motorcycle Insurance Premiums

Motorcycle insurance premiums, like those for car insurance, are influenced by a complex interplay of factors. Understanding these factors is crucial for riders to make informed decisions about their coverage and budget. A comprehensive analysis of these elements allows for a clearer understanding of the pricing structures and the rationale behind varying insurance costs.A significant distinction between motorcycle and car insurance lies in the inherent risks associated with each mode of transportation.

Motorcycles, due to their smaller size and lack of the protective cage of a car, are more vulnerable to accidents and often incur higher repair costs. This inherent risk is a primary driver in the premium calculation for motorcycle insurance.

Rider Experience

Rider experience is a key determinant in motorcycle insurance premiums. Insurers assess a rider’s driving history, including any prior accidents or violations. Experienced riders with a clean record often qualify for lower premiums, reflecting their reduced risk profile. Conversely, newer riders or those with a history of traffic violations face higher premiums. This reflects the established relationship between driving experience and accident likelihood.

Rider Age

Rider age significantly impacts insurance premiums. Younger riders are often considered higher-risk due to their perceived inexperience and potentially higher propensity for risky behaviors. Older riders, while potentially exhibiting different types of risk factors, may have established driving histories that provide a more predictable risk assessment. These factors are considered in setting the premium for each age bracket.

Location

Geographic location significantly influences motorcycle insurance rates. Areas with higher accident rates, poor road conditions, or increased traffic density tend to have higher premiums. This is a direct consequence of the risk associated with driving in those specific areas. The local factors associated with higher risk, such as weather patterns or traffic congestion, influence insurance rates accordingly.

Type of Motorcycle

The type of motorcycle also plays a crucial role in premium calculation. Larger, more powerful motorcycles are generally associated with higher premiums. This is often due to the increased potential for damage in an accident and the higher cost of repairs. Insurers consider the specific features and specifications of the motorcycle model to determine the appropriate premium.

Motorcycle Usage Patterns

Motorcycle usage patterns, such as commuting versus leisure riding, influence premiums. Commuting riders, typically covering shorter distances and in familiar locations, may face lower premiums than those engaged in extensive leisure riding. The increased risk associated with longer distances and potentially unfamiliar routes contributes to higher premiums. This factor considers the inherent risks associated with each type of riding.

Rider Behaviors

Specific rider behaviors directly impact premiums. Behaviors like speeding, aggressive driving, and disregarding traffic laws are all indicators of higher risk. Insurers often penalize riders with such behaviors through increased premiums. Conversely, riders who prioritize safe practices and demonstrate responsible riding habits are often rewarded with lower premiums. This is based on the principle that safe driving behaviors reduce the probability of accidents.

Comparison with Car Insurance Factors

While some factors, such as location, affect both motorcycle and car insurance, significant differences exist. Motorcycle insurance rates are often more sensitive to rider experience and the type of motorcycle. Car insurance, on the other hand, may be more sensitive to factors such as the car’s make and model and the driver’s vehicle usage patterns.

Illustrative Example

A young rider with a history of speeding tickets and a powerful sport bike in a high-accident area would likely face a significantly higher motorcycle insurance premium than an experienced rider with a clean record, an older, less powerful motorcycle, and a history of commuting in a lower-risk area.

Comparing Policy Costs and Benefits

Motorcycle insurance policies, while often perceived as more expensive than car insurance, can offer substantial cost savings in specific circumstances. The comparative costs and benefits are heavily influenced by regional factors, rider experience, and the chosen coverage levels. This section explores the nuanced cost structures and advantages of motorcycle insurance, highlighting situations where it might be more economical than car insurance.The average cost of motorcycle insurance varies significantly across different regions due to factors such as local traffic laws, accident rates, and the cost of living.

A comprehensive comparison necessitates considering both the base premiums and the optional add-ons, which can dramatically alter the overall policy cost.

Average Policy Costs Across Regions

Average motorcycle insurance premiums are generally lower than car insurance premiums in rural areas with fewer traffic incidents and lower accident rates. Conversely, urban areas with high traffic density and higher accident risks tend to have higher premiums for both motorcycle and car insurance. Data from insurance comparison websites and industry reports show a considerable discrepancy in premium costs between urban and rural regions.

Comparison of Coverage Amounts

Motorcycle insurance policies typically offer lower coverage amounts compared to car insurance policies, reflecting the inherent risks associated with motorcycles. Motorcycle policies often have lower liability limits and may not include comprehensive coverage options such as collision or comprehensive damages as standard. However, riders can often add comprehensive coverage as an optional rider, increasing the overall cost.

Rider Experience and its Impact on Premiums

A rider’s experience and driving history significantly affect motorcycle insurance premiums. New riders with limited experience face higher premiums due to the increased risk of accidents. Insurers typically assess factors like age, years of experience, and previous accident history. Experienced riders with a clean driving record are often eligible for lower premiums.

Pros and Cons of Motorcycle Insurance Coverage

Motorcycle insurance coverage often focuses on liability, offering protection against damages caused to other vehicles or individuals. This often includes minimal coverage for the motorcycle itself, emphasizing the need for riders to consider additional riders. Conversely, car insurance frequently provides comprehensive coverage for the vehicle and its occupants, encompassing collision, comprehensive, and personal injury protection. The specific coverage options offered vary significantly between policies and regions.

Scenarios Where Motorcycle Insurance Might Be More Cost-Effective

Motorcycle insurance can be more cost-effective than car insurance for riders in areas with low accident rates and a focus on liability coverage. For instance, a rider with limited mileage and residing in a rural area might find motorcycle insurance significantly cheaper than car insurance. Similarly, riders primarily using their motorcycles for commuting or leisure activities may find motorcycle insurance more economical than car insurance.

Benefits of Additional Add-ons or Riders

Adding riders, such as comprehensive coverage, or personal injury protection, significantly enhances the protection offered by motorcycle insurance policies. These riders provide protection against damage to the motorcycle in case of accidents, vandalism, or theft. They also extend coverage to the rider, providing financial support in case of injuries or medical expenses. Adding such add-ons will naturally increase the overall cost of the insurance policy.

Table of Potential Savings/Increased Costs

| Feature | Motorcycle Insurance | Car Insurance |

|---|---|---|

| Premium Cost | Potentially lower in rural areas, higher in urban areas | Generally higher in urban areas, potentially lower in rural areas |

| Coverage Amount | Lower liability limits, often minimal comprehensive coverage | Higher liability limits, often includes collision, comprehensive, and personal injury protection |

| Rider Experience | Premiums increase with limited experience | Premiums increase with limited experience |

| Comprehensive Coverage | Often an add-on, increasing cost | Standard coverage, lower cost |

Claims Process and Settlements

The claims process for motorcycle accidents differs significantly from that of car accidents, primarily due to the inherent vulnerabilities of motorcycles. Understanding these differences is crucial for both policyholders and insurance companies to ensure a fair and efficient resolution. The process involves a series of steps, from initial reporting to final settlement, each with specific requirements and potential pitfalls.

Motorcycle Accident Reporting Procedures

Proper reporting is the first critical step in the claims process. Immediate notification to the insurance company is essential, following specific procedures Artikeld in the policy. This often involves contacting the insurer directly, providing details of the accident, and requesting a claim number. Documentation of the incident, including witness statements, is also vital.

Documentation Requirements for Motorcycle Claims

Thorough documentation is paramount for a successful claim. This includes the police report, if filed, photographs of the accident scene and damage to the motorcycle, medical records, and witness statements. The clarity and completeness of this documentation significantly influence the claim’s outcome. Failure to provide complete and accurate documentation can lead to delays or rejection of the claim.

For instance, a missing police report might necessitate further investigation, potentially delaying the entire process.

Role of Adjusters in Motorcycle Claims

Insurance adjusters play a key role in evaluating the claim. Their responsibility includes investigating the accident, assessing the damages, and determining the appropriate settlement amount. This process often involves contacting witnesses, reviewing the documentation, and potentially inspecting the motorcycle. A thorough investigation ensures that the settlement accurately reflects the loss. A thorough investigation is crucial for a fair and equitable settlement, as it prevents over or under compensation.

Differences in Motorcycle and Car Insurance Claims Processes

The claims process for motorcycles differs from that of cars in several key aspects. Motorcycle accidents often result in more severe injuries and higher repair costs for the motorcycle. The lack of passenger compartment protection in motorcycles contributes to this difference. Insurance companies often have different procedures for evaluating damage to motorcycles compared to cars, taking into account the unique construction and vulnerability of motorcycles.

Common Issues and Disputes in Motorcycle Insurance Claims

Several issues can arise during the claims process. One common dispute involves determining fault. Ambiguity in the police report or conflicting witness statements can complicate this aspect. Another significant issue is the evaluation of the motorcycle’s repair costs. Differences in repair estimates from various mechanics can lead to disputes.

Furthermore, disagreements over the extent of injuries sustained by the motorcycle rider can complicate the settlement process. It is critical for both parties to understand and address these issues transparently and effectively to avoid disputes.

Step-by-Step Procedure for Filing a Motorcycle Insurance Claim

- Immediately notify your insurance company of the accident, providing all necessary details, including the date, time, location, and involved parties. Contacting the insurance company immediately is essential for timely processing.

- Collect all relevant documentation, including the police report, medical records, repair estimates, and witness statements. Thorough documentation is key to a smooth and efficient claims process.

- Cooperate fully with the insurance adjuster during the investigation. This includes providing access to the motorcycle and cooperating with requests for information.

- Review the settlement offer carefully. Compare the offer with repair estimates and medical bills to ensure it adequately covers the damages incurred. A careful review ensures a fair settlement.

- If you disagree with the settlement offer, communicate your concerns to the insurance company. A clear communication of concerns is crucial for further negotiation.

Motorcycle Insurance Discounts and Options

Motorcycle insurance premiums can vary significantly depending on various factors, including the rider’s experience, the type of motorcycle, and the geographic location. Discounts can significantly reduce these costs, making insurance more accessible and affordable for motorcyclists. Understanding available discounts is crucial for optimizing insurance coverage and financial planning.

Available Discounts

Discounts for motorcycle insurance often mirror those in car insurance, but unique considerations for motorcycle operation are factored in. A wide array of discounts is available, potentially lowering premiums substantially. These discounts can often lead to substantial savings for riders who meet the criteria.

Safe Driving Programs

Participation in safe driving programs, such as defensive driving courses, frequently leads to discounts. These programs equip riders with essential skills and knowledge to navigate challenging situations, minimizing the risk of accidents. Successful completion of such courses demonstrably lowers accident rates and promotes safer riding habits, which insurers recognize and reward.

Anti-theft Devices

Installation of anti-theft devices, such as alarms or security systems, can qualify riders for discounts. These devices act as deterrents against theft, safeguarding the investment in the motorcycle. The presence of these devices directly correlates with a reduced risk of theft, a factor insurers consider when assessing risk profiles and offering premium reductions.

Good Student Discounts

Insurers often offer discounts for students with a clean driving record. These discounts acknowledge the reduced driving experience and potential for accidents among novice riders, and are a reflection of the lower risk profile associated with younger drivers with fewer years on the road.

Motorcycle-Specific Discounts

Some discounts are tailored exclusively to motorcycle insurance. For example, certain discounts might be offered for motorcycle maintenance records, such as scheduled servicing and upkeep. These discounts recognize the proactive approach to motorcycle maintenance, indicating responsible ownership and contributing to a reduced accident risk.

Comparison of Discounts in Motorcycle and Car Insurance

While some discounts overlap between motorcycle and car insurance (e.g., safe driving courses), others are unique to motorcycles. Motorcycle-specific discounts often address the unique challenges and considerations of motorcycle operation, such as the types of anti-theft measures available, and the specific maintenance schedules. Car insurance discounts might focus more on factors like vehicle type and safety features. Comparing these discounts allows riders to maximize their savings and ensure they are receiving the best possible coverage.

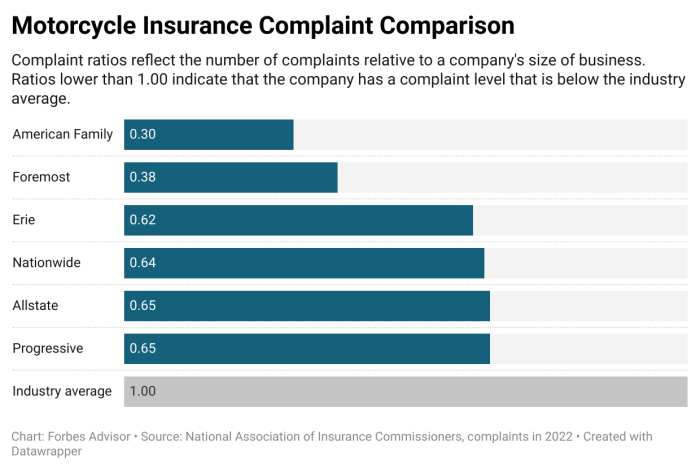

List of Insurance Companies Offering Motorcycle Insurance

This is not an exhaustive list, and availability may vary by region and individual circumstances. It’s recommended to research directly with the companies to confirm current offerings and eligibility criteria.

- Progressive

- State Farm

- Geico

- Allstate

- Nationwide

- Liberty Mutual

- Farmers Insurance

- Mercury Insurance

- AAA

- USAA

Motorcycle Insurance vs. Car Insurance – Illustration

Motorcycle insurance and car insurance, while both designed to protect policyholders, differ significantly in coverage requirements and premium structures. Understanding these distinctions is crucial for making informed decisions about personal financial security. This comparison highlights the unique risks and responsibilities associated with each type of vehicle, informing choices based on individual circumstances and needs.

Coverage Comparison

The core difference lies in the inherent risk profiles. Motorcycles are more vulnerable to accidents due to factors like lower visibility and less structural protection. Consequently, motorcycle insurance often emphasizes comprehensive coverage, including medical payments for injuries sustained by the rider and others involved. Conversely, car insurance typically focuses on liability coverage, which protects against damage to other vehicles or injuries to others.

However, comprehensive coverage for cars, including damage to the insured vehicle, is also available and frequently included.

Premium Factors Illustration

| Factor | Motorcycle Insurance | Car Insurance |

|---|---|---|

| Vehicle Type | Higher premiums due to greater risk of damage and injury. | Premiums vary based on factors such as make, model, and year. |

| Rider Experience | New riders or those with a poor driving record often face higher premiums. | Drivers with a history of accidents or traffic violations will have higher premiums. |

| Location | Premiums can fluctuate based on accident rates and local traffic conditions. | Premiums vary across states and cities due to factors like traffic congestion and accident rates. |

| Usage | Frequency and distance of motorcycle use can influence premium costs. | Frequency and distance of car use can affect insurance costs. |

| Coverage Options | Comprehensive coverage often includes medical payments, uninsured/underinsured motorist coverage, and collision coverage. | Liability coverage is standard, but comprehensive, collision, and uninsured/underinsured motorist coverage are also available. |

This table illustrates the key factors driving premium differences. A hypothetical example: a young, inexperienced motorcycle rider in an accident-prone area might pay significantly more for motorcycle insurance than a seasoned driver of a newer, less accident-prone car in a low-accident zone.

Decision-Making Flowchart

This visual flowchart represents the decision-making process for choosing between motorcycle and car insurance. It Artikels the key questions to consider, including vehicle type, riding experience, and location, to arrive at the most suitable policy. The decision is based on the comparative analysis of coverage and premium factors for both types of insurance.

Ending Remarks

In conclusion, the choice between motorcycle and car insurance rests on a careful evaluation of individual circumstances. While both provide essential safety nets, understanding the specific features of each policy is crucial. The factors that impact premiums, the coverage details, and the claims procedures are key elements in making an informed choice. Ultimately, this comparison aims to provide a roadmap for riders to confidently select the insurance that best protects their investment and lifestyle.

FAQ Guide

What are the typical exclusions in motorcycle insurance policies?

Exclusions often include damage caused by racing, reckless operation, or use of the motorcycle for illegal activities. Policy specifics vary by insurer.

How do usage patterns (e.g., commuting vs. leisure riding) affect motorcycle insurance premiums?

Commuting often results in lower premiums compared to leisure riding, as it suggests a more predictable and less risky usage pattern.

What are some common issues or disputes that arise during motorcycle insurance claims?

Disagreements can arise regarding the extent of damage, the validity of the claim, or the responsibility for the accident.

Are there specific discounts tailored to motorcycle insurance?

Yes, some insurers offer discounts for safety courses, anti-theft devices, or for riders with clean driving records.