Cheap car insurance Tyler TX is a hot topic, and finding the best deal can feel like a scavenger hunt. This guide breaks down everything you need to know, from understanding your local needs to negotiating lower premiums and filing claims.

We’ll explore typical insurance needs for Tyler, TX drivers, compare providers, and discuss strategies for getting lower premiums. We’ll also cover the claim process, offering real-world examples and case studies.

Understanding Car Insurance Needs in Tyler, TX

Navigating the world of car insurance can feel overwhelming, especially when considering the unique needs of your area. Understanding the typical insurance requirements in Tyler, TX, and the factors influencing costs, helps drivers make informed decisions about coverage. This empowers you to secure the right protection without overpaying.Tyler, TX, like other areas, presents a specific set of considerations for car insurance.

Demographic trends, driving habits, and even the types of vehicles on the road all play a role in shaping insurance premiums. This comprehensive overview provides insights into these crucial aspects, helping you tailor your coverage to your specific situation.

Typical Car Insurance Needs for Tyler, TX Drivers

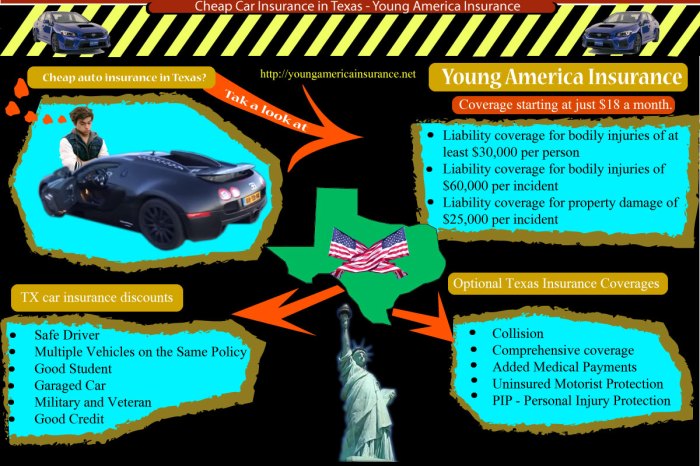

Drivers in Tyler, TX, like elsewhere, need insurance to protect themselves, their vehicles, and others involved in accidents. This includes liability coverage, which compensates others for injuries or damages resulting from an accident where you’re at fault. Collision coverage, in contrast, pays for damages to your vehicle regardless of who is at fault. Comprehensive coverage protects against incidents like vandalism, theft, or weather-related damage.

Factors Influencing Car Insurance Costs in Tyler, TX

Several factors affect the cost of car insurance in Tyler, TX. Demographics, such as age and driving history, play a significant role. Younger drivers often face higher premiums due to statistically higher accident rates. Similarly, a history of traffic violations or accidents will increase your premium. Driving habits, like the number of miles driven and the time of day, can also affect rates.

The type of vehicle you drive is another critical factor. High-performance sports cars, for instance, usually have higher premiums than more basic models.

Types of Car Insurance Coverage Available

Various types of coverage are available to meet different needs. Liability coverage, as mentioned earlier, protects you from financial responsibility in the event of an accident where you are at fault. Collision coverage protects your vehicle against damage from an accident, regardless of fault. Comprehensive coverage protects your vehicle from damage due to events like theft, vandalism, or weather-related damage.

Uninsured/Underinsured Motorist coverage safeguards you against accidents caused by drivers without adequate insurance. The choice of coverage depends on your budget and risk tolerance.

Comparing Costs of Different Coverage Options

Insurance costs vary widely depending on factors like age, driving record, and vehicle type. Younger drivers and those with poor driving records tend to pay more. Similarly, drivers of high-performance sports cars or luxury vehicles usually face higher premiums compared to drivers of more basic models. Comprehensive coverage often adds to the cost compared to liability-only policies.

Typical Insurance Needs for Different Vehicle Types

| Vehicle Type | Typical Insurance Needs |

|---|---|

| Sports Cars | Higher premiums due to higher risk of accidents and potential for more extensive repairs. Typically require higher liability and collision coverage. |

| Trucks | Higher premiums for collision coverage due to potential for damage in accidents. May require increased coverage limits for liability, depending on the size and payload. |

| SUVs | Usually have moderate premiums, with collision coverage costs often dependent on the size and features of the vehicle. Liability limits should be sufficient for the vehicle’s potential for damage. |

| Sedans | Typically have lower premiums compared to sports cars or trucks. Standard liability coverage and basic collision coverage might be sufficient. |

Identifying Affordable Insurance Providers in Tyler, TX

Finding the right car insurance in Tyler, TX, can feel like navigating a maze. With so many options, knowing where to start and which providers offer the best value for your needs is crucial. This guide will help you compare different insurance companies, analyze their reputations, and pinpoint the most affordable options tailored to your specific driving history and car type.Understanding the landscape of insurance providers in your area is essential for securing the best possible rates.

Factors like your driving record, vehicle type, and coverage choices all play a role in determining your premium. This analysis dives into how these factors impact affordability and introduces strategies to find the most suitable insurance provider for your financial situation.

Frequently Used Insurance Providers in Tyler, TX

Tyler, TX, residents often rely on a variety of insurance providers. Some of the most common choices include State Farm, Geico, Allstate, Progressive, and Nationwide. These companies have established presence in the area, offering various insurance packages.

Reputation and Reliability of Local Providers

Customer reviews and industry rankings can offer valuable insights into the reputation and reliability of insurance providers. State Farm, for instance, often receives high marks for its customer service and claims handling, particularly regarding the speed and efficiency of processing claims. Geico is known for its competitive pricing, but customer satisfaction ratings may vary depending on individual experiences.

Allstate maintains a strong local presence and generally provides reliable service. Progressive has a reputation for being customer-focused and easy to work with, though specific experiences can differ. Nationwide has a solid reputation for handling claims effectively, and their customer service is often praised.

Pricing Strategies of Different Insurance Providers

Pricing strategies vary widely among insurance providers. State Farm often employs a comprehensive approach, considering factors like your driving history and vehicle type. Geico is frequently associated with more competitive pricing, but may have less comprehensive coverage options. Allstate typically offers a balanced approach between pricing and coverage. Progressive often emphasizes discounts for safe drivers, and Nationwide frequently provides competitive pricing for various coverage levels.

Factors Influencing Insurance Affordability

Several factors influence the affordability of insurance from different providers. Discounts for good driving records, usage of safety features like anti-theft devices or airbags, and low-risk driving behaviors are often offered by insurance companies. The type of car you drive and its value also affect the premium. Your driving history, including any accidents or traffic violations, significantly impacts insurance costs.

Comparison of Insurance Providers in Tyler, TX

| Insurance Provider | Pricing Model | Customer Reviews |

|---|---|---|

| State Farm | Comprehensive, considering driving history and vehicle type | Generally positive, praised for customer service and claims handling |

| Geico | Competitive pricing, potentially less comprehensive coverage | Mixed reviews, some positive experiences regarding pricing, others regarding coverage |

| Allstate | Balanced approach between pricing and coverage | Generally reliable, with a strong local presence |

| Progressive | Emphasis on discounts for safe drivers | Often praised for customer focus and ease of working with the company |

| Nationwide | Competitive pricing for various coverage levels | Solid reputation for handling claims effectively, with positive customer service reviews |

Strategies for Obtaining Lower Car Insurance Premiums

Finding affordable car insurance in Tyler, TX, is achievable with smart strategies. Understanding how various factors influence your premium can empower you to make informed choices and potentially save money. By implementing these strategies, you can navigate the complexities of the insurance market and secure the coverage you need at a price that fits your budget.Knowing the factors that impact your car insurance rates in Tyler, TX, is key to finding the best deals.

From your driving record to the safety features of your vehicle, numerous elements influence the cost of your policy. Smart choices can significantly reduce your premiums.

Safe Driving Habits and Insurance Costs

Safe driving habits are directly correlated with lower insurance premiums. A clean driving record, demonstrating responsible and cautious behavior on the road, is highly valued by insurance companies. Accidents and violations, such as speeding tickets or at-fault accidents, increase your risk profile, leading to higher premiums. Maintaining a safe driving record, free from traffic violations and accidents, is a significant step toward securing lower car insurance rates.

This demonstrates a commitment to responsible driving, reducing your risk profile in the eyes of insurance providers.

The Role of Discounts

Discounts play a crucial role in lowering car insurance premiums. Various discounts are available, tailored to different circumstances and behaviors. These discounts can significantly reduce your overall premium cost, offering substantial savings.

- Multi-Policy Discounts: Bundling your car insurance with other insurance policies, like homeowners or renters insurance, often qualifies you for a multi-policy discount. This can significantly reduce your overall insurance costs, as insurance companies reward customers who demonstrate a commitment to their services.

- Good Student Discounts: If you’re a student, insurance companies frequently offer discounts for good students, recognizing responsible behavior and commitment to academic success. This can provide a tangible benefit to young drivers seeking to manage their expenses. The discounts often apply to drivers with a clean driving record.

Vehicle Safety Features and Insurance Rates

Vehicles equipped with advanced safety features, such as airbags, anti-lock brakes (ABS), and electronic stability control (ESC), often attract lower insurance premiums. These features demonstrate a commitment to vehicle safety, reducing the risk of accidents and injuries. This, in turn, translates into lower premiums for the policyholder.

Summary of Discounts and Potential Impact

| Discount Type | Description | Potential Premium Impact |

|---|---|---|

| Multi-Policy | Bundling multiple policies (e.g., auto, homeowners) | Significant savings, often 10-15% or more |

| Good Student | For students with a clean driving record | Potential savings of 5-10% |

| Defensive Driving Courses | Completion of a defensive driving course | Potential savings of 5-15%, depending on the course and insurance provider |

| Vehicle Safety Features | Cars equipped with advanced safety features | Potential savings of 5-15%, depending on the features and insurance provider |

Comparing Insurance Quotes for Tyler, TX

Finding the best car insurance deal in Tyler, TX, involves more than just browsing websites. It’s a smart move to compare quotes from various providers to ensure you’re getting the most competitive rate for the coverage you need. Understanding the nuances of different policies and deductibles will help you make an informed decision.Comparing insurance quotes is crucial for securing the most affordable coverage.

By comparing various options, you can identify policies that align with your budget and driving needs. It’s like shopping for groceries; you wouldn’t buy the first item you see without checking prices and quality.

Comparing Coverage Options and Pricing

Comparing insurance quotes involves scrutinizing the coverage levels and associated premiums. This allows you to tailor your policy to your individual circumstances and financial constraints. A comprehensive comparison considers not only the price but also the breadth and depth of the coverage. Different insurance providers offer varying policy structures.

Utilizing Online Tools for Quote Comparison

Numerous online tools can simplify the process of comparing car insurance quotes. These tools often provide an interface to input your vehicle details, driving history, and desired coverage, instantly generating quotes from multiple providers. This streamlined approach can save you significant time and effort. Examples include comparison websites dedicated to insurance or dedicated insurance company websites.

Obtaining Quotes from Insurance Agents in Tyler, TX

Insurance agents in Tyler, TX, can offer personalized advice and guidance throughout the quote comparison process. They can explain the details of different policies and help you understand the fine print. This hands-on approach can be invaluable, especially if you’re unsure about specific coverage options. Meeting with an agent involves discussing your needs, understanding various coverage options, and ultimately receiving customized quotes tailored to your circumstances.

They can also provide recommendations based on your particular driving record and vehicle type.

Example Quote Comparison Table

| Insurance Provider | Coverage Level (Liability) | Deductible (Collision) | Monthly Premium |

|---|---|---|---|

| Progressive | $300,000/$300,000 | $500 | $150 |

| State Farm | $250,000/$50,000 | $1,000 | $175 |

| Allstate | $100,000/$100,000 | $250 | $125 |

Note: This table is for illustrative purposes only and actual quotes may vary. Factors like your driving record, vehicle type, and location significantly impact premium costs.

Understanding Insurance Claims Process in Tyler, TX

Navigating the insurance claims process can feel daunting, especially when you’re dealing with a car accident or unexpected damage. Understanding the steps involved, the potential impact on your premiums, and the role of adjusters can make the experience smoother and less stressful. This guide will provide a clear overview of the claims process in Tyler, TX.The insurance claim process is a structured series of steps designed to fairly and efficiently resolve covered losses.

Understanding these procedures can help you avoid delays and ensure your claim is processed promptly and accurately. A clear understanding of the process is essential to ensuring a positive outcome.

Steps Involved in Filing a Claim, Cheap car insurance tyler tx

Filing an insurance claim involves several key steps, starting with the initial report and culminating in the final settlement. Proper documentation and communication are crucial for a smooth process. Each step contributes to a thorough investigation and a fair resolution.

- Reporting the Claim: Immediately after an accident or damage, contact your insurance company and report the incident. Provide as much detail as possible, including the date, time, location, and nature of the incident. A detailed account, including witness information, is vital for accurate assessment.

- Gathering Documentation: Collect all relevant documentation, such as police reports, medical records (if applicable), repair estimates, and photos of the damage. These documents will support your claim and help expedite the claims process.

- Contacting the Adjuster: Your insurance company will assign an adjuster to investigate the claim. The adjuster will contact you to discuss the incident and gather further information.

- Assessment of the Damage: The adjuster will assess the damage to your vehicle and determine the extent of coverage. This often involves an inspection of the vehicle and the scene of the incident.

- Negotiating a Settlement: If the damage is covered, the adjuster will negotiate a settlement amount with you. This amount will usually cover the repair costs, but may also include other expenses.

- Claim Settlement: Once the settlement is agreed upon, the insurance company will arrange for repairs to your vehicle. They will also process the payment for the agreed amount.

Common Reasons for Claims and Their Impact

Several incidents can trigger insurance claims. Accidents, vandalism, and weather-related damage are frequent causes. The nature and severity of the claim directly impact your premiums.

- Accidents: Car accidents are a leading cause of insurance claims. The severity of the accident, including injuries and property damage, can significantly affect the claim amount and your future premiums.

- Vandalism: Damage caused by vandalism, such as scratches or broken windows, may also trigger a claim. The extent of the damage and the cost of repair will influence the settlement amount.

- Weather-related Damage: Severe weather events, such as hailstorms or floods, can lead to significant vehicle damage, triggering insurance claims. The cost of repairs for weather-related damage can vary greatly depending on the intensity and duration of the event.

Role of Insurance Adjusters in Tyler, TX

Insurance adjusters play a crucial role in the claims process. They investigate claims, assess damages, and negotiate settlements. Their expertise and impartiality are vital for a fair outcome.Adjusters are trained professionals who work for insurance companies to investigate claims and determine the appropriate compensation. They are responsible for verifying the facts of the incident, evaluating the extent of the damage, and negotiating a fair settlement.

Examples of Claims Affecting Premiums

The frequency and severity of claims directly affect your insurance premiums. A history of frequent claims may result in higher premiums.

- Multiple Accidents: A series of accidents within a short period may signal a need for a higher premium, reflecting an increased risk. Insurance companies assess risk factors to determine appropriate premium rates.

- High-Value Repairs: Claims requiring extensive repairs or high-value parts replacements can impact your premiums. The total repair cost is a crucial factor in determining the appropriate settlement.

- Recurring Claims for the Same Issue: If you repeatedly file claims for the same type of damage, like fender benders, your premiums may increase. Insurance companies use this data to assess risk and adjust premiums accordingly.

Claim Filing Procedures

A clear understanding of the steps involved in filing a claim will make the process more efficient.

| Step | Procedure |

|---|---|

| Reporting | Contact your insurance company and provide details about the incident. |

| Documentation | Gather all relevant documents, including police reports and repair estimates. |

| Adjuster Contact | The insurance company will assign an adjuster to investigate. |

| Damage Assessment | The adjuster will assess the damage and determine the extent of coverage. |

| Settlement Negotiation | Negotiate a settlement amount with the adjuster. |

| Settlement Payment | Receive the agreed-upon settlement payment. |

Illustrative Case Studies of Insurance in Tyler, TX

Navigating the world of car insurance can feel overwhelming, especially in a bustling city like Tyler, TX. Understanding how various factors influence premiums and claims processes can empower you to make informed decisions and secure the best possible coverage. This section explores real-life scenarios to demonstrate how drivers in Tyler, TX have successfully managed their insurance needs.

Successful Premium Negotiation

A Tyler resident, Sarah, found her car insurance premiums unexpectedly high. Realizing she held a clean driving record and had a comprehensive safety system installed in her vehicle, Sarah decided to contact her insurance provider to explore options for a lower rate. By emphasizing her safety-conscious driving habits and highlighting the safety features of her car, she successfully negotiated a 15% reduction in her premium.

This showcases the importance of proactive communication and highlighting positive driving attributes to secure favorable insurance rates.

Leveraging Discounts to Reduce Premiums

Drivers in Tyler, TX can significantly reduce their insurance premiums by taking advantage of available discounts. John, a Tyler resident, took advantage of multiple discounts, including those for being a safe driver and for maintaining a good credit score. By combining these discounts, John saw a 20% reduction in his monthly car insurance payment. These discounts demonstrate how responsible driving habits and good financial standing can lead to substantial savings.

Claim Settlement Process for a Car Accident

A typical claim settlement process for a car accident in Tyler, TX involves several steps. First, the driver must report the accident to the police and their insurance company. Next, the insurance companies will assess the damages and liability. Once the claim is evaluated, the insurance company will offer a settlement amount. This process can be complex and potentially time-consuming, often involving negotiations and documentation to determine liability and compensation.

Evaluating Damages in a Tyler, TX Accident

Assessing the damages to a vehicle in a Tyler, TX accident is crucial for determining insurance claim settlements. An independent professional, often a certified appraiser, will inspect the damaged vehicle to determine the extent of the damage and its repair costs. This involves examining the body damage, assessing the impact on the interior and mechanics, and providing an accurate estimate of the repair cost.

This detailed evaluation forms the basis of the insurance claim settlement, ensuring fair compensation for the damages.

Impact of Local Driving Conditions on Insurance Claims

Tyler, TX, with its mix of city and rural driving conditions, has specific driving challenges. Drivers in Tyler, TX who frequently encounter heavy traffic, intersections, or inclement weather conditions might see their insurance premiums potentially affected. Drivers navigating the specific challenges of Tyler’s roadways might consider these factors when reviewing and comparing insurance options. Insurance companies often consider local driving conditions and accident rates when determining premiums.

Ending Remarks: Cheap Car Insurance Tyler Tx

Navigating the world of cheap car insurance in Tyler, TX doesn’t have to be daunting. By understanding your needs, comparing providers, and implementing smart strategies, you can find a policy that fits your budget and offers the protection you deserve. This guide provides a comprehensive roadmap to securing affordable car insurance in Tyler, empowering you to make informed decisions.

Top FAQs

What are the typical factors that affect car insurance rates in Tyler, TX?

Demographics (age, driving history), driving habits (accidents, tickets), vehicle type (sports car vs. SUV), and coverage options all influence rates. Even local factors like traffic patterns can play a role.

How can I compare quotes from different insurance providers in Tyler, TX?

Use online comparison tools, contact insurance agents directly, and gather quotes from various providers. Compare coverage options, deductibles, and premiums to find the best fit.

What are some common discounts available for car insurance in Tyler, TX?

Multi-policy discounts, good student discounts, safe driving discounts, and discounts for anti-theft devices are frequently available. Check with your potential provider to see what options are available.

How do I file an insurance claim in Tyler, TX?

Report the claim to your provider, gather necessary documentation (police report, medical records), and follow their instructions. Understanding the steps beforehand can make the process smoother.