Can you get a refund on car insurance? It’s a common question, and the answer isn’t always straightforward. Sometimes, overpayments happen, policies have errors, or you might need to cancel early. This guide dives deep into the world of car insurance refunds, covering everything from the reasons behind requests to the procedures insurance companies follow and even the legal aspects.

Get ready to navigate the often-complex landscape of getting your money back!

This comprehensive guide breaks down the complexities of car insurance refunds, equipping you with the knowledge to understand your rights and maximize your chances of a successful claim. We’ll explore common scenarios, eligibility criteria, and the steps involved in initiating and pursuing a refund request. From policy terms and conditions to potential legal considerations, we cover it all. So, if you’re wondering about getting a refund, this is your ultimate resource.

Reasons for Seeking a Refund on Car Insurance

Getting a car insurance refund can feel like hitting the jackpot, especially when you’re feeling ripped off. But it’s not always a slam dunk. Knowing the ins and outs of refund policies can save you a ton of headache and potentially save you some serious cash. Understanding the reasons behind a legitimate refund request is key to navigating this process like a pro.Legitimate claims for car insurance refunds are based on specific circumstances, and understanding the fine print is crucial.

Policyholders should always carefully review their policy documents to ensure they understand the terms and conditions regarding refunds. This will help avoid frustration and ensure a smooth process.

Common Reasons for Refund Requests

Policyholders might request a refund for various reasons, often stemming from errors, misrepresentations, or policy changes. Understanding these reasons will help you decide if a refund is warranted.

- Misrepresentation: If you’ve provided inaccurate information during the application process, leading to an inflated premium, you may be eligible for a refund. This could include misrepresenting your driving history, vehicle details, or coverage needs.

- Incorrect Premiums: Errors in premium calculations are common. A refund might be possible if the insurance company made a mistake in calculating your premiums based on the information you provided. This could involve using incorrect rate tables or neglecting to account for discounts.

- Policy Errors: Insurance policies themselves can contain errors. If there’s a mistake in the policy wording, coverage details, or the premium amount, a refund might be possible. Policy errors could include wrongly applied endorsements or inaccuracies in the policy terms.

- Early Cancellation: Many policies allow for early cancellation with specific stipulations, often with a prorated refund for the unused portion of the policy term.

- Changes in Coverage Needs: If your circumstances change, reducing your need for coverage, a refund might be possible. Examples include moving to a safer neighborhood or upgrading your vehicle to one with better safety features, potentially reducing your insurance needs.

Specific Situations for Legitimate Refund Claims

Certain situations can lead to a legitimate claim for a car insurance refund. These situations should be carefully documented and presented to the insurance company.

- Policyholders provided false information: If a policyholder intentionally or unintentionally provided false information during the insurance application process, and this resulted in an inflated premium, they may be entitled to a refund. The policyholder needs to prove the misrepresentation was material and impacted the premium calculation.

- Billing Errors: Insurance companies occasionally make mistakes in billing. If there are errors in the amount charged or the billing cycle, a refund should be requested.

- Changes in Vehicle Specifications: If there’s a change in the vehicle’s specifications (e.g., upgrade to a safer model) after purchasing the policy, this could lead to a refund if it significantly alters the risk assessment.

- Policyholder cancels within a specific timeframe: If the policyholder cancels the policy within a certain timeframe as Artikeld in the policy terms, they are often entitled to a partial refund.

Types of Errors and Miscalculations

Different types of errors can lead to overpayments and potential refunds.

- Incorrect Rate Application: Insurance companies might use the wrong rate tables or fail to apply discounts correctly. This can result in overpaying for coverage.

- Duplicate Payments: If a policyholder is charged twice for a premium, a refund for the duplicate payment is warranted.

- Data Entry Errors: Mistakes in data entry during the policy application or renewal process can lead to inaccurate premium calculations.

Role of Policy Terms and Conditions

Policy terms and conditions are the bedrock of any insurance refund claim.

- Clear Guidelines: These terms specify the conditions under which refunds can be requested, including cancellation policies, billing procedures, and dispute resolution processes.

- Understanding the Fine Print: Carefully reviewing the policy terms and conditions before signing is critical to understand the refund policy, including specific clauses related to cancellation, billing errors, or misrepresentation.

- Legal Basis: Policy terms and conditions provide the legal framework for resolving disputes and determining eligibility for refunds.

Insurance Provider Refund Policies

Different insurance providers have varying refund policies. Comparing these policies can help you make informed decisions.

| Provider | Refund Policy Summary | Example Situations for Refund |

|---|---|---|

| Example Provider 1 | Refunds issued for billing errors, or if the policyholder cancels early. | Billing error, early cancellation |

| Example Provider 2 | Refunds available for specific circumstances, but only if within the timeframe. | Policy errors, or policy cancellation within a set time |

Eligibility Criteria

Getting a car insurance refund ain’t always a slam dunk. It’s like trying to win a popularity contest – you gotta meet certain criteria. Understanding these rules will help you avoid getting bounced back like a bad TikTok trend.The key to a successful refund request lies in knowing your policy inside and out. Your policy document is your roadmap to a possible refund.

It’s not just a stack of legal jargon; it’s a treasure trove of information on procedures, deadlines, and what constitutes a valid reason for a refund.

Key Factors for a Valid Refund Request

A valid refund request isn’t just about wanting a refund. It hinges on specific factors that your insurance provider must acknowledge. These factors will determine whether your claim gets the green light. Policy terms and conditions will determine if you are eligible for a refund, so reading them carefully is essential. For example, a refund may be possible if you cancel your policy early, but if you cancel after a certain date, you might not qualify.

Importance of Reviewing the Insurance Policy Document

Your insurance policy is your bible, your instruction manual, and your secret weapon. It Artikels the specifics of your coverage, the fine print, and the rules for requesting a refund. This document will specify what’s covered, what’s excluded, and the exact procedures for requesting a refund. Carefully reviewing the refund procedures Artikeld in your policy document will save you a headache down the road.

Don’t just skim it; read it thoroughly. Understanding the terms and conditions is key to ensuring your request is valid and within the policy’s parameters.

Typical Timeframes for Refund Requests

Insurance companies have their own internal processes, like a well-oiled machine. The timeframe for processing a refund request is typically Artikeld in your policy. Be prepared for a reasonable turnaround time. Some companies might take a few weeks to process the refund, while others might have quicker turnaround times, similar to how fast your favorite streaming service can deliver a new season.

Be realistic and understand that a quick refund isn’t always possible. Knowing the timeframe will help you manage your expectations.

Documentation Required to Support a Refund Claim

Submitting a refund request without proper documentation is like trying to bake a cake without flour. You need the right ingredients to make it work. This usually includes your insurance policy details, proof of payment, and any other relevant supporting documents. For example, if you canceled your policy early, you’ll need to present the cancellation notice. Gathering these documents in advance will streamline the process and make it more likely your request will be approved.

Steps to Initiate a Refund Request

Understanding the steps involved in initiating a refund request is crucial. This ensures your request is handled smoothly and efficiently. This table Artikels the typical steps for initiating a refund request.

| Step | Description | Required Documents |

|---|---|---|

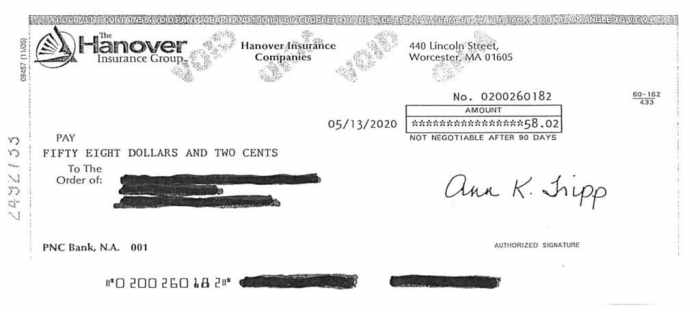

| Step 1 | Submit a written request detailing the reason for the refund and your policy number. | Insurance policy details, proof of payment (e.g., receipt, bank statement). |

| Step 2 | Provide any supporting evidence to substantiate your claim. This might include cancelled checks, bank statements, or other relevant documentation. | Billing statements, cancelled checks, or any other documents that support your claim. |

| Step 3 | Wait for the insurance company to review your request. Be patient; the review process takes time. | Confirmation of the request submission. |

Insurance Company Procedures

Insurance companies have established processes for handling refund requests, just like they have for handling claims. Understanding these procedures can help you navigate the process smoothly and increase your chances of a positive outcome. These procedures vary slightly between companies, but the general framework remains consistent.The typical car insurance refund process isn’t a magic trick, it’s a series of steps designed to ensure accuracy and fairness.

From initial contact to final resolution, there’s a predictable flow. Knowing the process can empower you to manage your expectations and potentially speed up the resolution.

Typical Steps in Processing a Refund Request

The process usually begins with a formal request. This could be a written communication, an online form submission, or a phone call. The insurance company will then review the request against your policy details and supporting documentation. This review ensures that the refund aligns with the terms and conditions you agreed to. A crucial part of this process is the careful verification of all the details.

If any information is missing or incorrect, the company might request further clarification. After the review, the company will either approve or deny the request, explaining their decision.

Timeline for Processing Refund Requests

The timeline for processing a refund request varies greatly depending on factors like the complexity of the request, the volume of requests the company is handling, and whether any additional documentation is needed. Some companies may process simple refund requests within a few weeks, while more complex ones might take several months. It’s essential to check your policy documents for specific timeframes, and keep in mind that contacting the company about the status of your request is perfectly acceptable.

Methods for Contacting the Insurance Company

Insurance companies offer various avenues for communication regarding refund requests. You can often reach them via phone, email, or online portals. Each method has its own advantages and disadvantages. For instance, phone calls might provide quicker responses, while emails allow for a documented record of your interaction. Online portals often offer self-service options and allow you to track the status of your request.

Choose the method that best suits your needs and communication preferences.

Common Reasons for Refund Denials and Appeals Process

| Reason for Denial | Explanation | Appeals Process |

|---|---|---|

| Incomplete Documentation | Insufficient supporting materials or missing required forms. | Resubmit the request with all the necessary documentation. Be thorough and precise. |

| Policy Terms | The refund request is not covered under the terms of your policy. For example, a policy may exclude certain circumstances. | Clearly articulate why the policy terms should be reconsidered. Highlight any unusual circumstances that might justify a review. Provide any supporting evidence. |

| Time Limits | The request is submitted after the specified timeframe for claiming a refund as Artikeld in your policy. | Explain the extenuating circumstances that caused the delay. For instance, a sudden illness or an unforeseen event might warrant an exception. Be prepared to provide evidence supporting your case. |

Legal Considerations

Navigating the world of car insurance refunds can feel like a wild ride. You’ve paid your dues, and now you want your money back. But sometimes, the insurance companies, well, they don’t exactly roll over and play dead. Understanding your legal rights is key to getting what you deserve.

Legal Rights of Policyholders

Policyholders have specific rights regarding refunds, stemming from the contracts they’ve signed. These rights are not just theoretical; they’re legally enforceable. These rights generally revolve around the terms and conditions of the insurance policy, including any clauses pertaining to refunds. Understanding these clauses is crucial. If the insurance company fails to uphold its side of the agreement, a policyholder might have grounds for legal action.

Potential Legal Recourse

If your refund request is unjustly denied, don’t just shrug it off. You might have legal recourse. The specifics of the legal process vary by state, but generally, you need to demonstrate that the denial was not justified. This could involve proving the insurance company violated the policy terms, misrepresented facts, or made errors in their calculations.

Gathering documentation, like correspondence, policy details, and any supporting evidence, is critical. This evidence will be instrumental in your case.

State Regulations

State regulations play a significant role in car insurance refund policies. Different states have varying laws and requirements regarding the procedures and grounds for granting or denying refunds. These regulations often stipulate specific timeframes for responding to refund requests and the reasons for denial. Keeping track of these regulations can significantly impact the success of your claim.

Relevant Laws and Regulations

Many states have laws that dictate the rules for car insurance companies regarding refunds. These laws typically Artikel the circumstances under which a refund may be warranted, the process for requesting a refund, and the timeframes for processing the request. Understanding these specific state laws is paramount. Failing to adhere to these laws can expose insurance companies to penalties.

Examples of Cases

While specific case details are often confidential, general patterns emerge. Cases where refunds were granted often involved demonstrable errors on the insurance company’s part, such as miscalculations or a failure to fulfill the terms of the contract. Conversely, denials often resulted from a lack of sufficient documentation or a clear misinterpretation of policy terms by the policyholder.

Common Legal Issues in Car Insurance Refunds

| Legal Issue | Description | Resolution |

|---|---|---|

| Misrepresentation | False information given by the insurance company. | Providing evidence to support the claim, such as contradictory statements or documentation. |

| Contract Breach | Violation of policy terms, e.g., failure to honor agreed-upon conditions. | Proof of the violation, such as missed deadlines or broken promises. |

| Policy Errors | Mistakes made by the insurance company in calculating the refund amount or processing the request. | Evidence of the error, such as incorrect calculations or documentation discrepancies. |

Tips and Best Practices: Can You Get A Refund On Car Insurance

Getting a car insurance refund can feel like navigating a maze, but with the right strategies, you can increase your chances of success. Think of it like a reality TV show where you’re the contestant, and the insurance company is the judge. You need a solid game plan to win that refund.Knowing the ins and outs of your policy and the company’s procedures is key.

Understanding your rights and responsibilities is your superpower in this process. Arm yourself with knowledge, and you’ll be ready to tackle any roadblock.

Maximizing Refund Chances

A well-structured approach significantly boosts your chances of securing a refund. Thorough preparation is crucial, from collecting necessary documents to understanding your policy terms. This proactive approach can make the difference between a successful and an unsuccessful outcome.

- Review Your Policy Carefully: Don’t just skim it. Dive deep into the fine print. Understanding the terms and conditions surrounding refunds is vital. Look for clauses about cancellation fees, premium adjustments, and specific circumstances where refunds might be possible. If you’re unsure about any part, contact the insurance company for clarification.

This step prevents surprises later on. For example, if your policy states that refunds are only granted for cancellations made within a certain timeframe, you need to ensure your request falls within that period.

- Document Everything: Keep meticulous records of all communications with the insurance company. This includes emails, phone calls, and any correspondence you send. Save copies of all relevant documents, such as your policy, receipts, and any supporting evidence you’re providing. This is your proof and your best defense if the situation goes sideways. Consider using a dedicated folder or digital file system to store these documents.

- Communicate Clearly and Professionally: Use clear and concise language when contacting the insurance company. Avoid using aggressive or accusatory language. Focus on the facts and present your case logically. A calm and professional tone can significantly influence the outcome. For instance, instead of saying “You owe me a refund,” try “Based on the terms of my policy and the circumstances, I believe I am entitled to a refund.” This demonstrates respect and strengthens your position.

Successful and Unsuccessful Refund Examples

Real-world examples can illuminate the strategies involved. Some examples highlight common mistakes to avoid.

- Successful Refund Example: A customer canceled their policy early due to a job change, ensuring their request aligned with the policy’s cancellation clause. They documented every communication and provided all necessary supporting documents, like proof of employment. Their clear and concise communication was a significant factor in the successful outcome.

- Unsuccessful Refund Example: A customer requested a refund for a policy they had only been paying for a few weeks. They failed to consult their policy for refund conditions. The lack of thorough preparation and clear communication led to the denial of the refund request.

- Another Unsuccessful Refund Example: A customer didn’t keep detailed records of their communication with the insurance company. They had a vague memory of their conversation, which made it hard for them to present a strong case. This lack of documentation hindered their ability to prove their claim.

Negotiating with the Insurance Company, Can you get a refund on car insurance

Negotiation is a skill that can lead to positive outcomes in these situations. It involves understanding the company’s position and articulating your needs effectively.

- Identify Your Goals: Clearly define the desired outcome of the negotiation. What amount of refund are you seeking? What are your specific reasons for requesting the refund? Knowing your goals is the first step to achieving them. For example, if you want a partial refund, clearly state the amount you’re requesting and the reason for it.

- Be Prepared to Compromise: Negotiation often involves compromise. Be willing to consider alternative solutions or options that address your needs. Sometimes a partial refund is better than no refund at all. This can be an alternative solution in situations where the company doesn’t fully agree with the refund request.

Importance of Clear Communication

Clear communication is paramount in any refund request. It’s the key to presenting your case effectively.

- Precisely Explain Your Situation: Clearly and concisely explain the circumstances surrounding your request for a refund. Present supporting evidence to back up your claims. Use factual details, avoid emotional language, and focus on the specifics of your situation.

Wrap-Up

In conclusion, getting a car insurance refund can be a complex process, but understanding the reasons, eligibility criteria, company procedures, and legal considerations can significantly improve your chances of success. This guide has provided a comprehensive overview of the entire process, equipping you with the necessary information to confidently navigate the world of car insurance refunds. Remember, thorough documentation and clear communication are key to a smooth process.

FAQ Resource

Can I get a refund if I cancel my policy after a few months?

It depends on the specific terms of your policy. Check your policy document for clauses regarding early cancellation and potential refund amounts. Some policies might have penalties or restrictions.

What if the insurance company made a mistake in calculating my premium?

If you find an error in your premium calculation, promptly contact the insurance company. Provide supporting documentation, like your payment records, and follow their procedures for correcting the billing error.

How long does it usually take to get a refund?

The timeframe for processing a refund request varies greatly depending on the insurance company and the complexity of the claim. Most companies will have a timeframe Artikeld in their policy documents.

What if my refund request is denied?

If your request is denied, carefully review the reason for denial. If the reason is due to incomplete documentation, resubmit with the missing information. If you believe the denial is unjustified, explore the appeals process Artikeld in your policy.