Do I need gap insurance for leased car? Understanding the potential financial pitfalls of a leased vehicle is crucial. A lease agreement typically protects you from damage up to a certain point, but what happens if the car’s value drops below what you owe? This comprehensive guide explores the complexities of gap insurance, examining how it safeguards your interests and clarifies your responsibilities when leasing a vehicle.

This guide delves into the nuances of car leasing and insurance, comparing the risks and rewards of leasing versus buying a car. We’ll illuminate the different types of car damage, the coverage provided by standard auto insurance, and the critical role gap insurance plays in protecting your financial investment in a leased vehicle. The information presented is intended to empower you with the knowledge to make informed decisions about your insurance needs.

Understanding Lease Agreements

Leasing a car differs significantly from buying it, impacting how you handle insurance. A lease agreement essentially gives you the right to use a car for a set period, typically a few years. You’re responsible for maintaining the vehicle and paying a fixed monthly fee. Crucially, you don’t own the car; ownership remains with the leasing company.

This fundamental difference is key to understanding your insurance needs.Leasing a car involves a contract outlining specific terms and conditions. Understanding these terms, especially those related to damage and liability, is vital for making informed insurance decisions. These agreements often include stipulations on mileage limits, maintenance requirements, and specific conditions for returning the car.

Typical Lease Terms and Conditions

Lease agreements typically Artikel the vehicle’s condition upon pickup, detailing any pre-existing damage. They often include a clause defining “reasonable wear and tear,” which clarifies what the leasing company considers acceptable use-related damage. Liability clauses specify who’s responsible for damage beyond wear and tear. These clauses are critical for understanding your potential financial obligations. For example, if you cause significant damage, the lease agreement might Artikel the amount you are liable for.

Lease vs. Buy: Repair Costs

When considering repair costs, leasing often provides a degree of protection. Typically, the lease agreement covers the cost of repairs up to a certain threshold or value. However, the extent of coverage varies widely. In contrast, if you buy a car, you’re solely responsible for all repair costs. This responsibility includes both routine maintenance and unexpected damage.

Examples of Lease Agreements with Different Coverage Levels

A lease agreement might stipulate that the lessee is responsible for damage exceeding $500, or that the leasing company will cover the repair costs up to a certain percentage of the car’s value. Other leases may cover repairs for all types of damage, regardless of the cause. The key takeaway is that the level of coverage varies considerably between different lease agreements.

A thorough review of the lease agreement is essential to understanding your responsibilities and potential liabilities.

Comparison of Lease Provisions

| Lease Provision | Description | Impact on Insurance Needs |

|---|---|---|

| Mileage Limits | Specifies the maximum number of miles allowed during the lease period. | Exceeding the limit might trigger penalties. Consider insurance coverage if you anticipate driving significantly more. |

| Maintenance Requirements | Artikels the lessee’s responsibility for maintaining the vehicle. | Insurance coverage is essential if a lease violation occurs, like neglecting maintenance and causing a significant problem. |

| Damage beyond Reasonable Wear and Tear | Details the lessee’s responsibility for damages exceeding normal use. | Comprehensive insurance coverage is crucial to address damages not covered by the lease agreement. |

| Liability for Accidents | Artikels who is responsible for damages in an accident. | Insurance coverage is crucial to handle any liability beyond what is covered by the lease agreement. |

| Return Condition Clause | Specifies the condition in which the vehicle must be returned. | Thorough understanding of the return condition clause is important for determining your liability and potential coverage needs. |

Defining Car Damage

Understanding what constitutes car damage under your lease agreement is crucial for avoiding financial surprises. Knowing the different types of damage and their coverage is key to managing your lease obligations responsibly. This section will delve into the specifics of car damage, differentiating between covered and non-covered incidents, and illustrating how depreciation and market value impact the situation.

Types of Car Damage

Car damage falls into several categories. Accidental damage, often stemming from collisions, is a common concern. Vandalism, such as scratches or damage from intentional acts, also poses a risk. Comprehensive damage, encompassing perils beyond collisions and vandalism, like hail, fire, or flood, is another important consideration. These categories help clarify what’s typically covered under a lease agreement’s insurance.

Covered vs. Non-Covered Damage

Lease agreements explicitly Artikel covered and non-covered damages. Covered damages usually include incidents like collisions, vandalism, and certain comprehensive events (depending on the policy). Non-covered damages might involve misuse, neglect, or wear and tear. It’s essential to review your specific lease agreement for a detailed understanding of these categories. For instance, normal wear and tear on tires, or interior fading due to sun exposure, typically falls outside the scope of coverage.

Depreciation and Market Value

Depreciation and market value are significant factors in determining financial implications. Depreciation reduces a car’s value over time. If your lease agreement has a higher-than-market-value return, you’re responsible for the difference. For example, if a car depreciates significantly during your lease, a minor accident could result in a higher financial responsibility for you, even if the damage is covered.

The market value of the car at the time of damage is crucial for calculating the financial impact of repairs or replacements.

Typical Damage Scenarios During a Lease Period

Various scenarios can occur during a lease period. A fender bender might involve a minor collision, while a hail storm could cause widespread damage. Intentional damage, like vandalism, can result in extensive repairs. Accidents with other vehicles could lead to significant damage and associated costs. Each situation necessitates careful consideration of the lease agreement’s terms and conditions.

Damage Scenarios and Potential Impact

| Damage Scenario | Description | Impact on Insurance |

|---|---|---|

| Minor Collision (fender bender) | A slight impact with another vehicle, resulting in minor damage to the front or rear bumper. | Likely covered if the incident is reported promptly and the damage meets the criteria in the lease agreement. |

| Major Collision (total loss) | A severe accident involving significant damage to the vehicle, potentially rendering it a total loss. | Likely covered, but the financial responsibility depends on the terms of the lease agreement, including the market value at the time of the incident. |

| Vandalism (scratches/dents) | Damage to the vehicle caused by intentional acts of vandalism. | Potentially covered depending on the specific lease agreement, and it may depend on the severity of the damage. |

| Comprehensive Damage (hail storm) | Damage caused by a severe weather event like hail, which could lead to significant damage to the vehicle’s exterior. | Likely covered if the incident is reported promptly and the damage meets the criteria in the lease agreement. |

| Wear and Tear (interior fading) | Normal deterioration of the vehicle’s interior due to usage over time. | Generally not covered, as it’s considered normal wear and tear. |

Exploring Insurance Options

Standard auto insurance policies typically cover damages to your car from accidents or other events. However, they often have limitations when it comes to leased vehicles. Understanding these limitations is key to deciding if gap insurance is necessary.

Standard Auto Insurance Coverage

Standard auto insurance policies usually cover the actual cash value of your vehicle. This means if your car is damaged, the insurance payout will reflect the car’s depreciated value, not its original price. This can be a significant difference, especially for newer leased vehicles.

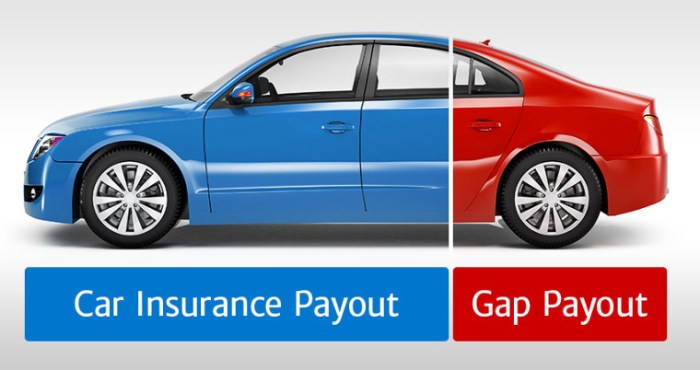

Gap Insurance Coverage

Gap insurance specifically addresses the difference between the vehicle’s actual cash value and its outstanding lease balance. If your car is totaled or significantly damaged, your standard insurance might not cover the full lease amount. Gap insurance steps in to pay the difference, ensuring you’re not left responsible for the remaining lease payments.

Scenarios Requiring Gap Insurance

Gap insurance becomes critical in situations where your car’s value depreciates rapidly, such as accidents involving severe damage or total loss. For example, a leased car that’s totaled in a collision might have an insurance payout significantly less than the remaining lease balance. Another scenario involves an incident where the vehicle is stolen or vandalized beyond repair, leaving you with a hefty outstanding lease obligation.

Comparison of Insurance Options

Different insurance options provide varying degrees of coverage and protection. It’s crucial to evaluate the terms and conditions of each policy to ensure it meets your needs and the specific terms of your lease agreement. Some insurance companies offer comprehensive packages that include both standard auto coverage and gap insurance. This can simplify the process and ensure a holistic approach to your vehicle protection.

Factors Influencing Gap Insurance Need

The need for gap insurance often depends on the vehicle’s value, the outstanding lease balance, and the likelihood of an accident or total loss. A newer vehicle with a high lease payment is more likely to require gap insurance, as the gap between the vehicle’s value and the lease balance is greater. In addition, drivers who live in high-risk areas or drive frequently may want to consider gap insurance for added protection.

| Insurance Type | Coverage | Pros | Cons |

|---|---|---|---|

| Standard Auto Insurance | Covers damage to the vehicle up to its depreciated value. | Relatively affordable. | May not cover the full lease balance if the vehicle is totaled or significantly damaged. |

| Gap Insurance | Covers the difference between the vehicle’s actual cash value and the outstanding lease balance. | Protects against financial loss in case of total loss or significant damage. | Adds to the overall insurance cost. |

| Comprehensive Insurance Packages | Combines standard auto coverage and gap insurance in one policy. | Convenience and potentially cost-effectiveness. | May not be the most tailored option for all situations. |

Determining Gap Insurance Need

Figuring out if you need gap insurance for your leased car can be tricky. It boils down to understanding the difference between what you owe on the lease and what the car is worth. This section will help you determine if gap insurance is a worthwhile investment for your specific situation.

Situations Where Gap Insurance is Essential

Gap insurance becomes crucial when the value of your leased vehicle significantly drops below what you owe on the lease. This often happens due to depreciation, accidents, or damage. Without gap insurance, you’d be responsible for the difference between the car’s value and the remaining lease balance if the car is totaled.

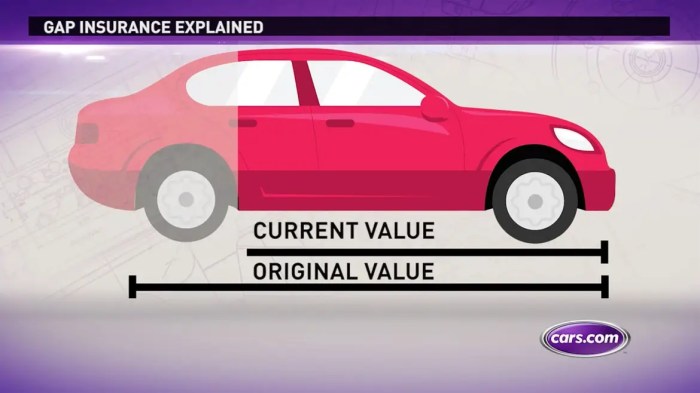

Calculating the Gap Amount

The gap amount is the difference between the outstanding lease balance and the vehicle’s actual cash value (ACV). This ACV is determined by an independent appraisal or a valuation method from the insurance company. Lease agreements typically Artikel the total lease payments and any down payment, providing a starting point for calculating the outstanding balance.

Gap Amount = Outstanding Lease Balance – Actual Cash Value (ACV)

For example, if your lease balance is $25,000 and the car’s ACV is $18,000 after an accident, the gap amount would be $7,000.

Factors Influencing Gap Insurance Necessity

Several factors influence whether you need gap insurance. The most significant is the car’s depreciation rate. Luxury cars, or those in high-demand models, tend to depreciate more quickly, potentially increasing the likelihood of a gap. The length of your lease and the market value of similar vehicles at the time of the lease also play a crucial role.

Finally, the possibility of an accident or other damage event that might impact the vehicle’s value is a key consideration.

Questions to Determine Gap Insurance Need

- What is the current market value of similar vehicles? Knowing the current market value of comparable vehicles helps gauge the depreciation rate and potential for a gap.

- What is the remaining lease balance? Understanding the outstanding lease payments is critical to calculating the gap amount.

- What is the potential for damage or accidents during the lease term? Evaluating the likelihood of an accident or damage helps assess the risk of a gap situation.

- What is the vehicle’s depreciation rate? High depreciation rates for the specific vehicle model can increase the likelihood of needing gap insurance.

- Are there any specific lease terms that affect the vehicle’s value? Understanding any special clauses in the lease agreement is essential for accurately assessing the vehicle’s value and the need for gap insurance.

Determining the Gap Amount for a Leased Car

To determine the gap amount, you need the current market value of the leased vehicle. This value is typically established by an independent appraisal or the insurance company’s valuation method.

- Obtain an appraisal or valuation: An independent appraisal provides a precise estimate of the car’s current worth. Insurance companies often use their own valuation methods, which might be less favorable. It’s wise to compare both.

- Calculate the outstanding lease balance: Review your lease agreement for the remaining lease payments, including any down payments.

- Subtract the actual cash value from the lease balance: Subtracting the actual cash value (ACV) from the outstanding lease balance yields the gap amount.

Potential Financial Implications

So, you’ve learned about lease agreements, car damage, and insurance options. Now, let’s dive into thereal* money matters – what could happen if something goes wrong with your leased car and you don’t have gap insurance? Knowing the potential financial implications is crucial for making an informed decision.Understanding the financial landscape surrounding your leased vehicle is vital. Unforeseen circumstances can significantly impact your wallet.

Gap insurance acts as a safety net, protecting you from unexpected costs.

Financial Implications of Not Having Gap Insurance

Without gap insurance, you’re on the hook for the difference between the actual cash value of your car (after depreciation) and what you still owe on the lease. This is often a substantial amount, especially if the car is damaged beyond repair or totaled. If your car is damaged or totaled in an accident, and the insurance payout doesn’t cover the remaining lease balance, you’ll be responsible for the shortfall.

Potential Costs Exceeding Coverage Limits

Let’s say your car is totaled in an accident. Standard insurance likely covers the repair or replacement costs up to the car’s current market value. However, if the accident is severe, the payout might not fully cover the remaining lease balance. This is where the gap appears – the difference between the insurance payout and what you owe on the lease.

Financial Benefits of Gap Insurance

Gap insurance protects you from the gap between the car’s value and what you owe on the lease. If the car is totaled or damaged beyond repair, your gap insurance policy kicks in to cover the remaining balance, shielding you from potentially significant financial burdens. It’s essentially an insurance policy for the gap in your car’s value.

Examples of Gap Insurance Protection

Imagine a scenario where a leased car is severely damaged and deemed a total loss. Without gap insurance, you’d be responsible for the difference between the insurance payout and the outstanding lease balance. With gap insurance, the insurer pays the remaining balance, freeing you from this financial strain.

Comparison of Costs with and without Gap Insurance

| Scenario | Cost Without Gap | Cost With Gap |

|---|---|---|

| Car totaled in accident; insurance payout below lease balance | Full amount of the shortfall (difference between the insurance payout and the lease balance) | $0 |

| Car damaged beyond repair; insurance payout below lease balance | Full amount of the shortfall (difference between the insurance payout and the lease balance) | $0 |

| Car involved in an accident with minor damage, within insurance limits; lease balance is high | No direct cost related to gap insurance | No direct cost related to gap insurance |

| Car involved in an accident with major damage; insurance payout covers the lease balance | No direct cost related to gap insurance | No direct cost related to gap insurance |

Lease vs. Buy Analysis

Choosing between leasing and buying a car is a significant financial decision. Both options have distinct advantages and disadvantages, and the best choice depends heavily on individual circumstances and financial goals. Understanding these differences is crucial to making an informed decision.A critical factor in this choice is the financial implications. Lease payments are typically lower than monthly car payments for a purchase, but this lower payment may not always translate to overall lower costs.

Analyzing all potential costs, including taxes, insurance, maintenance, and potential depreciation, is essential for accurate comparison.

Comparing Gap Insurance Needs

Gap insurance is designed to cover the difference between the outstanding loan amount and the car’s market value if it’s totaled or stolen. Leasing, by its nature, differs from buying a car. Leasing typically involves a set repayment plan and a specific return date, whereas a purchase is often tied to a loan with a final payment. If a leased car is totaled, the lease company is typically responsible for the difference between the residual value of the vehicle and the current value.

In contrast, a buyer with a loan faces the risk of a gap, as the outstanding loan amount might exceed the car’s value in a total loss. This significantly impacts the need for gap insurance.

Advantages and Disadvantages of Leasing

Leasing offers several benefits. Lower monthly payments are often a key attraction, making a car more affordable in the short term. Leasing typically involves less responsibility for maintenance and repairs, as these are usually handled by the lease company. You also have the flexibility of swapping vehicles after a set term. The disadvantage of leasing is the potential for higher overall costs.

The total cost of a lease, including the down payment, and all additional fees, might exceed the cost of a purchase over the long term, particularly if the vehicle’s value depreciates significantly. The residual value, the estimated value of the car at the end of the lease term, is crucial in calculating the total cost. The lease agreement is often structured to favor the lease company over the lessee.

Advantages and Disadvantages of Purchasing

Buying a car often means higher monthly payments initially. However, you own the vehicle outright after the loan is paid off, leading to potential long-term cost savings. With ownership, you can make modifications to the vehicle, and you can sell the car at any time. The disadvantage of purchasing is the potential for significant upfront costs, including a down payment and loan interest.

You’re responsible for all maintenance and repairs, which can add to the overall cost. Unexpected mechanical issues can cause significant financial strain.

Financial Implications of Decision-Making

Careful evaluation of all financial implications is crucial in choosing between leasing and buying. Factor in not just monthly payments, but also insurance costs, maintenance expenses, potential depreciation, and any potential for unexpected repairs. Consider the financial implications of a total loss or theft, which is covered differently under lease vs. purchase scenarios. Compare the costs of gap insurance under both options.

Example Scenarios

Scenario 1: A young professional with limited savings might find leasing advantageous due to lower monthly payments. However, they need to be mindful of the potential for higher total costs over the life of the lease.Scenario 2: A seasoned professional with substantial savings might find purchasing more attractive due to the long-term ownership benefits. They must weigh the higher initial cost against the flexibility of owning the vehicle.

Lease vs. Buy Comparison Table, Do i need gap insurance for leased car

| Factor | Lease | Buy |

|---|---|---|

| Initial Costs | Potentially lower down payment | Higher upfront costs (down payment, loan fees) |

| Monthly Payments | Typically lower | Typically higher |

| Maintenance | Usually handled by the lease company | Responsibility of the owner |

| Ownership | No ownership after the lease term | Full ownership after loan repayment |

| Flexibility | Relatively easy to switch vehicles | More flexibility in modifying/selling the vehicle |

| Residual Value | Crucial factor in lease cost calculation | No direct impact on the final cost (except if reselling) |

| Total Cost (Long Term) | Potentially higher due to fees and depreciation | Potentially lower if the vehicle is maintained well |

Outcome Summary

In conclusion, determining if gap insurance is necessary for a leased car involves careful consideration of several factors. Understanding your lease agreement, the potential for damage, and the limitations of standard insurance is paramount. This guide provides a roadmap for evaluating your specific situation and making an informed decision about protecting yourself financially. By weighing the potential costs against the benefits of gap insurance, you can confidently navigate the complexities of leasing and ensure your financial well-being.

Query Resolution: Do I Need Gap Insurance For Leased Car

Is gap insurance mandatory for all leased vehicles?

No, gap insurance is not mandatory. Whether or not you need it depends on your individual circumstances and lease agreement.

What if my car is totaled in an accident?

Standard insurance will cover the car’s value up to the policy limits. Gap insurance covers the difference between the vehicle’s depreciated value and the outstanding lease amount.

How do I calculate the gap amount?

The gap amount is calculated by subtracting the vehicle’s current market value from the outstanding lease balance.

What are the potential financial implications of not having gap insurance?

Without gap insurance, you may be responsible for the difference between the vehicle’s depreciated value and the outstanding lease balance, which could result in a substantial financial loss.