Allstate vs Progressive car insurance: Navigating the world of auto coverage can be tricky. This guide breaks down the key differences between these two major players, equipping you with the knowledge to make an informed decision. We’ll explore coverage options, pricing strategies, customer service, and more, ensuring you’re well-prepared to choose the right policy for your needs.

From liability to comprehensive, understanding the nuances of each coverage is crucial. We’ll dissect the fine print to help you understand the potential benefits and drawbacks of each company. This detailed comparison will help you determine which insurance provider aligns best with your individual circumstances and driving habits.

Comparing Coverage Options

So, you’re trying to figure out if Allstate or Progressive is the better bet for your car insurance? It’s a common dilemma, and the best choice really depends on your specific needs and driving habits. This section dives deep into the nitty-gritty of coverage options, comparing what each company offers.Understanding the various types of coverage is key to making an informed decision.

Liability, collision, comprehensive, and uninsured/underinsured motorist coverage all play a role in protecting you and your vehicle. Knowing the details of each type and how they work together will help you choose the right policy.

Liability Coverage

Liability coverage kicks in if you’re at fault in an accident and cause damage to another person’s vehicle or injury to them. This coverage pays for the other party’s damages, up to the policy limits. Both Allstate and Progressive offer various liability limits, allowing you to tailor the coverage to your budget and risk tolerance. A good example is if you cause a fender bender, your liability coverage will help pay for the repairs.

Collision Coverage

Collision coverage pays for damages to your vehicle if it’s involved in an accident, regardless of who is at fault. This is crucial for protecting your investment, especially in today’s car prices. If your car is totaled in a collision, collision coverage can help with the repair or replacement cost. Typical deductibles for collision coverage range from $250 to $1000, depending on the policy and your individual circumstances.

Deductibles are the amount you pay out-of-pocket before your insurance kicks in.

Comprehensive Coverage

Comprehensive coverage steps in to cover damage to your vehicle that’s not caused by a collision. Think things like vandalism, theft, or weather-related damage. This protection is vital for safeguarding your car from unforeseen events. Comprehensive coverage is typically offered with similar deductible options as collision. For example, if your car is stolen, comprehensive coverage would pay for a replacement or repair.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is essential for protecting you if you’re in an accident with someone who doesn’t have insurance or doesn’t have enough insurance to cover your damages. This coverage pays for your medical bills and vehicle repairs in these situations. Without this coverage, you could be financially responsible for significant costs if involved in such an accident.

Deductibles and Policy Limits

Deductibles and policy limits vary significantly between insurance companies and even within the same company depending on the state and the specific policy. It’s always best to compare these details directly with the companies themselves or with an independent insurance agent. Policy limits are the maximum amount the insurance company will pay out for a particular claim. For example, a $50,000 policy limit means the most the company will pay for any given accident is $50,000.

State-by-State Minimum Coverage Requirements

| State | Allstate Minimum Requirements | Progressive Minimum Requirements |

|---|---|---|

| California | $15,000 Bodily Injury per person, $30,000 Bodily Injury per accident, $5,000 Property Damage | $15,000 Bodily Injury per person, $30,000 Bodily Injury per accident, $5,000 Property Damage |

| New York | $25,000 Bodily Injury per person, $50,000 Bodily Injury per accident, $25,000 Property Damage | $25,000 Bodily Injury per person, $50,000 Bodily Injury per accident, $25,000 Property Damage |

| Florida | $10,000 Bodily Injury per person, $20,000 Bodily Injury per accident, $10,000 Property Damage | $10,000 Bodily Injury per person, $20,000 Bodily Injury per accident, $10,000 Property Damage |

Note: These areminimum* requirements. It’s highly recommended to get more coverage than the minimum to protect yourself fully. This table provides a quick snapshot of the basic coverage needed in various states, but it’s crucial to check the specifics with each insurance company.

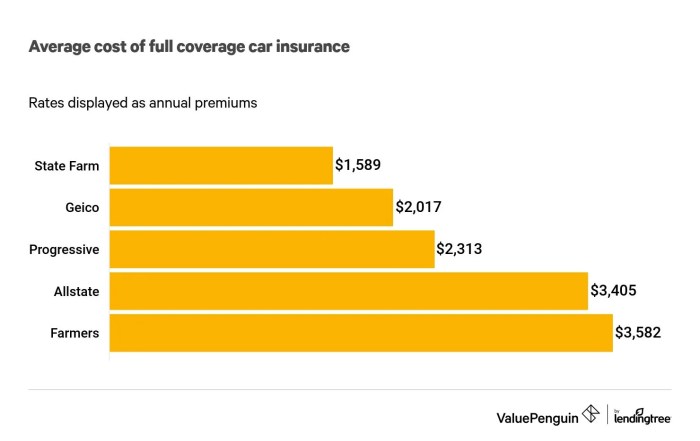

Pricing and Discounts

Figuring out car insurance costs can feel like deciphering a secret code. But it’s not as complicated as it seems. Understanding the factors that influence rates and the discounts available can help you save big. Both Allstate and Progressive use similar criteria, but their specific approaches and discounts differ.Insurance companies consider a variety of factors when setting premiums.

These factors influence the overall risk profile of the driver and vehicle, which ultimately affects the cost. These considerations are crucial for companies to assess risk and fairly price policies. A clean driving record, for example, indicates a lower risk compared to one with multiple accidents or traffic violations. Similarly, a newer, safer vehicle often comes with a lower premium.

Factors Influencing Car Insurance Premiums

Several factors significantly impact your car insurance premium, whether you’re with Allstate or Progressive. Your driving record, the type of vehicle you own, and your location are key elements. Other factors include your age and gender, and even your credit score, though the latter is less common. Insurers analyze all these data points to determine the likelihood of claims, and that, in turn, impacts your premium.

Vehicle Type

The type of car you drive plays a role in your insurance costs. High-performance vehicles, for example, might come with higher premiums due to the perceived risk of damage or theft compared to a standard sedan. Older vehicles might also be more expensive to insure due to the possibility of mechanical issues. Also, sports cars and luxury vehicles are generally more expensive to insure than basic models.

This reflects the greater potential for damage or theft.

Driving History

A clean driving record, free of accidents and violations, is essential for securing a lower premium. Insurance companies reward safe drivers. On the other hand, drivers with a history of accidents or violations face higher premiums because they represent a greater risk to the company.

Location

Location significantly impacts insurance costs. Areas with higher rates of accidents, theft, or natural disasters often have higher insurance premiums. This is because insurers factor in the increased risk of claims in those areas. Areas with a higher concentration of drivers and/or higher traffic density also have a higher risk profile, which directly influences insurance rates.

Other Relevant Factors

Your age and gender can also influence your premiums. Younger drivers are often considered higher risk and face higher premiums. Insurance companies base their decisions on historical claim data from different demographic groups. Credit scores, while less common, can sometimes play a part in determining rates in certain areas.

Discounts Offered by Allstate and Progressive

Both Allstate and Progressive offer a variety of discounts to incentivize safe driving and encourage customer loyalty. These discounts often help customers save money on their premiums. The discounts are a key part of the pricing strategy and vary by individual factors.

- Safe Driving Discounts: Both companies offer discounts for drivers with clean records, low mileage, or participation in defensive driving courses. These discounts recognize safe driving habits and reduce the risk profile for the company.

- Multi-Policy Discounts: Discounts are available for customers who insure multiple vehicles or policies with the same company. These discounts recognize the value of repeat business and reduce administrative costs for the company.

- Student Discounts: Both Allstate and Progressive often offer discounts for students who are good drivers. These discounts help make insurance more affordable for young drivers. The discounts often consider driving history and driving habits, like safe driving and low mileage.

Pricing Models

The pricing models of Allstate and Progressive might differ slightly. Allstate might place more emphasis on historical claim data and specific risk factors in certain locations, while Progressive might rely more on real-time data and predictive modeling. Different companies have different ways of assessing risk and calculating premiums, which may lead to variations in prices.

Discounts Comparison Table

| Discount Type | Allstate | Progressive | Eligibility Requirements |

|---|---|---|---|

| Safe Driving | Yes | Yes | Clean driving record, low mileage, completion of defensive driving courses. |

| Multi-Policy | Yes | Yes | Multiple vehicles or policies insured with the same company. |

| Student | Yes | Yes | Enrolled in a high school, college, or university. Clean driving record and sometimes low mileage. |

Customer Service and Claims Process

Figuring out which insurance company is right for you often comes down to more than just the price. Customer service and how claims are handled are major factors, especially when something unexpected happens. This section dives into the ways Allstate and Progressive handle customer interactions and claims.Handling your car insurance claim smoothly is key, so understanding the available channels and typical process is important.

This helps you know where to turn if you need assistance or have a claim.

Customer Service Channels

Choosing the right contact method is crucial. Both companies offer various ways to reach their customer service teams. Understanding these options helps you select the method that works best for you.

- Phone: Both Allstate and Progressive have 24/7 phone support, a vital resource for immediate assistance.

- Online Portal: Digital platforms allow for online claim filing, policy management, and chat support. This provides flexibility and convenience for many.

- In-Person Assistance: Some locations offer in-person assistance for more complex situations. This can be handy for those who prefer face-to-face interaction.

Claim Process Overview

Navigating the claim process can be stressful, so knowing the steps involved beforehand is helpful. Both companies have established procedures for filing and resolving claims.

- Filing a Claim: The initial step involves reporting the incident. This typically involves filling out forms and providing supporting documentation. Progressive and Allstate both generally require photos, police reports, and medical records when needed.

- Claim Evaluation: Insurance companies evaluate the validity and scope of the claim. This process can involve investigations and appraisals.

- Settlement and Resolution: Once the claim is evaluated, the company will work toward a settlement. This could involve repairs, payment, or other compensation as agreed upon.

Customer Feedback

Customer reviews offer valuable insights into the quality of service and claim handling. Public feedback provides a real-world perspective.

- Allstate: Some customers praise Allstate’s online portal and 24/7 phone support, while others report frustration with the claim process, particularly regarding delays or lack of communication. Anecdotal accounts suggest that issues can arise when dealing with complex or disputed claims.

- Progressive: Customer feedback on Progressive often highlights the ease of online claim filing and the speed of initial responses. However, some customers have mentioned challenges with getting their claim fully resolved, potentially due to complicated negotiations or paperwork.

Contact Information and Service Options, Allstate vs progressive car insurance

A table summarizing contact information and service options can help you compare options quickly.

| Company | Phone Support | Online Portal | In-Person Assistance |

|---|---|---|---|

| Allstate | 1-800-ALLSTATE (1-800-255-7828) | Yes, comprehensive online portal | Limited in-person assistance at select locations |

| Progressive | 1-800-PROGRESSIVE (1-800-776-4737) | Yes, user-friendly online portal | Limited in-person assistance at select locations |

Policy Features and Add-ons

So, you’ve got your coverage basics down, but what about those extra perks? Choosing between Allstate and Progressive often boils down to the specific add-ons that best suit your needs and budget. This section dives into the various extras each company offers, helping you make an informed decision.

Additional Coverages Offered

Allstate and Progressive both offer a range of add-on coverages beyond the standard policy. These extras can significantly impact your total cost and the level of protection you have. Common add-ons include roadside assistance, rental car reimbursement, and accident forgiveness. Understanding how these differ between the two companies is key to finding the best fit.

Roadside Assistance

Roadside assistance is a crucial add-on for any driver. It provides help when you’re stranded, offering services like jump-starting your car, tire changes, and fuel delivery. The specifics of this service, like the hours of coverage and the types of assistance offered, can vary considerably between providers. For instance, one company might cover flat tire changes only during daylight hours, while another might cover 24/7.

Rental Car Reimbursement

Rental car reimbursement is another helpful add-on. If you’re involved in an accident covered by your policy, this feature will help cover the cost of a rental car while yours is being repaired. This coverage can save you money and inconvenience, especially if your car is out of commission for an extended period. Different policies may have different daily rental allowances.

Accident Forgiveness

Accident forgiveness is a valuable perk that protects your premium from increasing after an accident. This is particularly helpful if you’re a young driver or have a history of minor accidents. If you have accident forgiveness, your rates won’t skyrocket after a minor fender-bender, making it a cost-effective option for many drivers.

Cost Implications

The cost of these add-on coverages varies greatly depending on the specific coverage level, your vehicle, and your driving history. Be prepared to factor in the additional expense when comparing policies. For example, a more comprehensive roadside assistance package will likely cost more than a basic one. It’s also important to note that these add-ons often stack up with each other, leading to an even higher overall cost.

Comparison Table

| Feature | Allstate | Progressive | Pricing Notes |

|---|---|---|---|

| Roadside Assistance | 24/7 towing, jump-starts, fuel delivery, lockout service | 24/7 towing, jump-starts, flat tire changes, lockout service | Allstate’s coverage tends to be more extensive, but Progressive’s pricing is often competitive. |

| Rental Car Reimbursement | Up to $35 per day for rental cars | Up to $40 per day for rental cars | The amount reimbursed can vary, so compare daily allowances. |

| Accident Forgiveness | Available for eligible drivers | Available for eligible drivers | Look into specific terms and conditions for the accident forgiveness policy. Availability and terms vary. |

Company Reputation and Financial Stability

Picking a car insurance company is a big deal. You want to know that they’re not just promising you the world, but are actually financially sound and have a good track record. This section dives into the financial health and reputation of Allstate and Progressive, looking at their ratings, recent news, and customer feedback.

Financial Strength Ratings

Insurance companies need to be financially stable to pay out claims. These ratings, from independent agencies, show the companies’ ability to meet their obligations. These ratings are important because they indicate the company’s likelihood of being able to pay out claims in the future. A higher rating typically means a lower risk for policyholders.

| Company | Rating Agency | Rating |

|---|---|---|

| Allstate | A.M. Best | A+ (Excellent) |

| Allstate | Standard & Poor’s | A+ (Excellent) |

| Progressive | A.M. Best | A+ (Excellent) |

| Progressive | Standard & Poor’s | A+ (Excellent) |

These ratings show both Allstate and Progressive have excellent financial strength, putting them in a solid position to handle claims. This is important to know when choosing a policy.

Recent News and Reports

Staying informed about recent news is crucial when considering insurance companies. Reports about their financial performance, customer service, and any legal issues can affect their reliability. Recent reports on both companies haven’t indicated any major problems or concerns.

Customer Reviews and Ratings

Customer feedback is a valuable way to get a sense of a company’s performance. Websites like the Better Business Bureau and online review platforms are valuable resources for gathering insights from various customer experiences. It’s worth noting that reviews can vary greatly depending on the individual customer’s experience.

“Allstate has been great for me, and their customer service is excellent. They have a lot of discounts that I’ve used and have always been prompt in processing my claims.”

John Smith, Allstate Customer

“Progressive’s claims process was a little slow, but the overall experience was decent. Their customer service is average and the pricing was pretty good.”

Jane Doe, Progressive Customer

These examples show the wide range of experiences customers have had with both companies. Customer satisfaction varies, and it’s important to consider this variability alongside the financial strength ratings.

Specific Coverage Scenarios

Figuring out which car insurance policy best fits your needs can feel like navigating a maze. Understanding how different companies handle specific situations, like hit-and-runs or classic car damage, is key to making the right choice. This section dives into the specifics, comparing Allstate and Progressive’s approaches.Comparing policies isn’t just about numbers; it’s about understanding how coverage applies in real-world scenarios.

Different states have different laws and regulations, and these factors can influence the specific coverages offered by insurers. This is where knowing the details of both companies’ policies becomes critical.

Hit-and-Run Accidents

Hit-and-run accidents can be tricky, as often the at-fault driver is unknown. Both Allstate and Progressive typically offer coverage to help with repairs if you’re the victim. However, the specifics can vary. For example, Allstate might have slightly different stipulations on how quickly you need to report the incident to receive compensation, while Progressive might prioritize the ease of reporting the claim online.

Location also plays a role. In some areas, there might be additional requirements for police reports or witness statements to initiate a claim.

Damage to Classic Vehicles

Classic cars often require specialized repairs and parts. Insurance coverage for these vehicles can be a complex issue. Allstate and Progressive both typically have options for classic car coverage, but the details, including the specific limits of liability, can vary considerably. For example, Allstate might have a higher deductible for classic car coverage compared to a standard vehicle, and the coverage limits for replacement value might be different.

Progressive’s policy might offer a more flexible approach to determining the fair market value of a classic vehicle in case of total loss. Keep in mind that the insurer might require proof of the vehicle’s historical value or condition.

Location-Based Differences

Insurance policies aren’t one-size-fits-all. The specific coverages offered by Allstate and Progressive can vary based on your location. This is due to state-specific laws and regulations that influence how insurers operate within those jurisdictions. For example, in states with high rates of hail damage, Allstate might offer specific add-ons or discounts for hail damage coverage, while Progressive might have a different approach based on local claims data.

The cost of repair for the same type of damage can also vary significantly depending on the area.

Vehicle-Specific Coverage

The type of vehicle you own can significantly impact your insurance coverage. For example, a high-performance sports car might attract a higher premium than a standard sedan. The level of coverage and the associated cost will likely differ. Allstate might offer additional coverage options for high-value vehicles, while Progressive might emphasize their competitive rates for standard cars.

Specific coverages like comprehensive and collision can have different limits depending on the vehicle type.

Illustrative Case Studies: Allstate Vs Progressive Car Insurance

Figuring out which car insurance is right for you can be tricky. Looking at real-world examples of how different companies handle claims can help you make a more informed decision. These case studies highlight how Allstate and Progressive handle various scenarios, from simple accidents to complex policy disputes.Claims resolution processes vary significantly between insurers. Understanding these differences is crucial when choosing a policy.

The following sections delve into specific examples to illustrate these variations.

Comparative Claim Resolution Processes

Allstate and Progressive have different approaches to claim resolution, impacting the time it takes to settle a claim and the overall customer experience. A fender bender, for instance, might be handled differently by each company. Allstate might prioritize speed, while Progressive might favor thoroughness, leading to different timelines for payout.

Coverage for Specific Vehicle Types

Different vehicle types come with unique insurance needs. Let’s say you own a classic car, a hot rod, or a high-performance sports car. Coverage specifics and pricing often vary based on these characteristics. Allstate and Progressive have different ways of handling the unique needs of these vehicles.

Case Studies of Policy Disputes

Policy disputes can arise due to misunderstandings or disagreements on coverage. For instance, a policyholder might feel that their claim wasn’t handled fairly or that their coverage didn’t adequately protect them. Both companies have mechanisms for resolving disputes. Progressive’s approach might be more focused on negotiation, while Allstate might lean toward a more formal dispute resolution process.

Policy Terms and Conditions in a Specific Scenario

Consider a scenario involving a young driver with a limited driving record. The policy terms and conditions regarding accident forgiveness or increased premiums might differ substantially between Allstate and Progressive. For example, Progressive might offer more favorable terms for young drivers with a clean record compared to Allstate. This illustrates how policy specifics vary based on the driver’s profile.

Example Claim Resolution: Minor Collision

- Allstate: A customer reports a minor fender bender. Allstate’s process might involve a quick assessment of the damage, a prompt estimate, and a relatively speedy payout. The claim resolution process might involve minimal paperwork and a direct payment to the customer.

- Progressive: A customer reports a minor fender bender. Progressive might have a slightly longer process, potentially involving an independent adjuster for a more detailed evaluation of the damage. They might have a thorough investigation process that takes more time, but could result in a more precise repair cost and a fair settlement.

Example Claim Resolution: Hail Damage to a Classic Car

- Allstate: A policyholder’s classic car experiences significant hail damage. Allstate’s process might involve a thorough inspection of the damage, potentially consulting with experts in classic car restoration to determine the appropriate repair costs. The claim process might involve a detailed appraisal and a negotiation process based on the restoration costs.

- Progressive: A policyholder’s classic car experiences significant hail damage. Progressive’s process might focus on a certified repair shop network to get a fair estimate. They might also involve a specialized appraiser who understands the nuances of classic car restoration, ensuring accurate cost calculations for the restoration.

Policy Dispute: Uncovered Damage

- Allstate: A policyholder claims their car was damaged in a storm, but Allstate denies coverage, citing exclusions in the policy. Allstate’s dispute resolution might involve a detailed review of the policy terms, evidence from the policyholder, and potentially an independent investigation.

- Progressive: A policyholder claims their car was damaged in a storm, but Progressive denies coverage, citing exclusions in the policy. Progressive’s dispute resolution might involve a more direct communication process, a review of the policy terms, and potential negotiation to reach a settlement.

Last Point

Choosing between Allstate and Progressive car insurance ultimately depends on your individual needs and preferences. Consider factors like coverage types, pricing, and customer service. This comparison provides a comprehensive overview, empowering you to make a smart decision. Remember to thoroughly research and compare to find the best fit for your budget and driving profile.

FAQ Insights

What are the typical deductibles offered by Allstate and Progressive?

Deductibles vary based on the coverage type and your specific policy. It’s recommended to check the policy details for exact figures.

How do I file a claim with Allstate or Progressive?

Both companies offer multiple claim filing methods, including online portals, phone calls, and in-person assistance. Refer to your policy documents for specific instructions.

Do Allstate and Progressive offer discounts for safe driving?

Yes, both companies typically offer safe-driving discounts. The eligibility requirements and the specifics of the discounts may differ.

What are the minimum required car insurance coverages in my state?

Minimum coverage requirements vary by state. You can find this information on your state’s Department of Motor Vehicles website.