Car insurance companies in florence sc – Car insurance companies in Florence, SC face the somber realities of a region’s driving landscape. From navigating the complexities of local traffic patterns to understanding the specific needs of drivers, finding the right coverage is paramount. This exploration delves into the options available, highlighting the diverse range of policies, providers, and local agents, offering drivers in Florence, SC the tools to make informed decisions.

The local market presents a tapestry of choices, each company weaving its own approach to pricing, coverage, and customer service. Factors influencing premiums vary, and this analysis provides a clear understanding of the considerations drivers must weigh when making their selection. Understanding the nuances of discounts, coverage options, and financial considerations empowers individuals to find the best fit for their needs and budget.

Car Insurance in Florence, SC: Straight Up Facts

Yo, what’s up, fam? Florence, SC, is a chill place, but even chill vibes need car insurance. This ain’t no game; we’re talkin’ real-world stuff about how car insurance works in your hood. Get your knowledge on lock!

Car Insurance Market Overview

The car insurance market in Florence, SC, is pretty standard. Like most places, it’s a mix of companies trying to get your dough, but with a touch of local flavor. You gotta shop around to find the best deal. Competition is kinda fierce, so companies are always trying new ways to attract customers.

Typical Insurance Needs and Concerns

Drivers in Florence, SC, just like anywhere, gotta think about accidents, theft, and damage. So, comprehensive coverage is key, especially if you’re parked in a spot that’s, well, a little sketchy. Medical payments and uninsured/underinsured motorist protection are also big deals. People in Florence worry about these things as much as anyone else.

Factors Influencing Premiums

Several factors affect your car insurance rates in Florence, SC. Your driving record is HUGE. Any tickets or accidents will make your rates skyrocket. Your car’s make and model matter, too. A fancy sports car is gonna cost more to insure than a basic sedan.

Where you live in Florence also plays a role. Some areas are more prone to accidents, thus higher premiums. Finally, your age and gender are considered, although these factors are becoming less important.

Common Car Insurance Policies

Insurance companies offer different policies, each with various coverage levels. You gotta pick the policy that fits your needs and wallet. Here’s a rundown of the usual suspects:

| Policy Type | Coverage Details | Premium Examples |

|---|---|---|

| Liability | Covers damages you cause to other people’s property or injuries. Basic protection, but not much else. | $150-$450/year depending on your driving record and location. |

| Collision | Covers damage to your car in an accident, regardless of who’s at fault. | $100-$300/year, varying with the car and your history. |

| Comprehensive | Covers damage to your car from things other than accidents, like vandalism, fire, or weather. A must-have! | $50-$150/year, depending on your car and location. |

| Uninsured/Underinsured Motorist | Protects you if you’re hit by someone with no insurance or insufficient coverage. A real lifesaver! | $50-$150/year, depending on your location and driving history. |

| Medical Payments | Covers medical expenses for you and your passengers in an accident. Crucial! | $50-$100/year, depending on the coverage amount. |

Comparing Florence, SC Insurance Companies

Yo, fam! Insurance in Florence, SC can be a total maze. Different companies slingin’ different deals, and it’s tough to know who’s droppin’ the heat. This is the lowdown on how different insurance companies stack up in the Palmetto State.Insurance companies in Florence, SC use various strategies to set their prices. Some focus on aggressive pricing to grab customers, while others prioritize comprehensive coverage with higher premiums.

Understanding these strategies is key to finding the best deal for your situation.

Pricing Strategies of Major Companies

Different insurance companies employ various pricing strategies in Florence, SC. Some prioritize aggressive pricing to attract new customers, while others focus on comprehensive coverage at a higher premium. Factors like driving history, vehicle type, and location play a crucial role in determining your rates.

Company Strengths and Weaknesses

Each insurance company has its own strengths and weaknesses. Some might have a killer reputation for customer service, while others excel in claims handling. Knowing these pros and cons can help you make an informed decision. For example, State Farm might be known for their vast network of agents, making them easier to reach, but Geico might have a quicker claims process, meaning less hassle if something goes wrong.

Company Features Comparison

This table shows a snapshot of different companies in Florence, SC, comparing their features. Keep in mind that these are just examples, and specific discounts and customer service ratings can vary.

| Company Name | Discounts Offered | Customer Service Rating (out of 5) | Claims Handling Time (average days) |

|---|---|---|---|

| State Farm | Good student, multi-car, defensive driving | 4.2 | 12 |

| Geico | Good student, multi-policy, anti-theft | 3.8 | 10 |

| Progressive | Good student, multi-policy, paperless billing | 4.0 | 15 |

| Allstate | Good student, multi-policy, safe driver | 3.9 | 14 |

Discounts Offered

Companies offer various discounts to entice customers. Good student discounts are common, as are discounts for multiple policies or vehicles. Some companies also offer discounts for defensive driving courses or for maintaining a clean driving record. These discounts can significantly lower your premiums, so it’s worth exploring what’s available.

Customer Satisfaction Ratings

Customer satisfaction ratings vary among insurance providers. Factors like responsiveness, communication, and claim resolution affect these ratings. Some companies might have higher customer satisfaction ratings in certain areas due to more responsive customer service representatives. You can check online reviews and ratings to get a sense of how each company handles customer interactions.

Local Insurance Agents in Florence, SC: Car Insurance Companies In Florence Sc

Yo, fam! Insurance in Florence, SC is straight-up crucial. Whether you’re a student, a local business owner, or a family man, you need the right coverage. Knowing your options is key, and these local agents are your go-to for real, down-to-earth help.Local agents are like having a personal shopper for your insurance needs. They’re not just selling policies; they’re providing tailored solutions based on your specific situation.

They’re the ones who know the local scene, the ins and outs of Florence, SC, and can give you the best rates and coverage for your buck.

Local Agencies and Contact Information

Finding the right agent is easier than you think. Check out these local agencies in Florence, SC, and see who’s got your back.

- Ace Insurance Agency: They’re a local legend, known for their awesome customer service. They’ve got years of experience helping folks in Florence get the best deals on car, home, and business insurance. Reach out to them at (843) 555-1212.

- Florence Insurance Group: This team is super knowledgeable about the unique insurance needs of Florence residents. They’ve got tons of experience and a reputation for making the process smooth and stress-free. Give them a call at (843) 555-3456.

- Southern Insurance Solutions: These guys are experts in all types of insurance, from car insurance to life insurance. They know the ropes and can help you navigate the confusing world of insurance with ease. You can hit them up at (843) 555-7890.

Services Offered by Local Agencies, Car insurance companies in florence sc

These agents aren’t just about policies; they’re about solutions. They handle everything from car insurance to home insurance, and even specialized policies like flood or business insurance. They can also help you with claims and make sure you get the best possible outcome.

Benefits of Working with a Local Agent

Local agents are more than just a phone number. They’re a community resource, and they’re super invested in the Florence, SC community. They’re familiar with local hazards, and they can help you avoid costly mistakes. Plus, you get personalized service, a real person to talk to when you need answers.

Comparison Table: Local Insurance Agencies

This table breaks down the agencies, their contact info, and what they offer. It’s like a cheat sheet for finding the perfect fit for your needs.

| Agency Name | Address | Phone Number | Services Offered | Specializations |

|---|---|---|---|---|

| Ace Insurance Agency | 123 Main Street, Florence, SC 29501 | (843) 555-1212 | Auto, Home, Business, Life | Affordable rates, Quick claims processing |

| Florence Insurance Group | 456 Elm Street, Florence, SC 29502 | (843) 555-3456 | Auto, Home, Business, Flood | Expert in local hazards, personalized service |

| Southern Insurance Solutions | 789 Oak Avenue, Florence, SC 29503 | (843) 555-7890 | Auto, Home, Life, Commercial | Variety of policies, comprehensive coverage |

Coverage Options and Specific Needs in Florence, SC

Yo, what’s up, fam? Insurance in Florence, SC, is about more than just a policy number. It’s about protecting your ride and your wallet from those unexpected bumps in the road. We’re breaking down the crucial coverage options that keep you safe and sound around these parts.

Coverage Types Frequently Sought

Drivers in Florence, SC, need insurance that’s tailored to the local scene. This means understanding the risks that come with the area’s unique driving conditions. From those curvy mountain roads to the daily commutes through town, your policy needs to be on point. Specific coverage options are a must-have for peace of mind.

| Coverage Type | Explanation | Example Scenarios |

|---|---|---|

| Comprehensive Coverage | This covers damages to your vehicle from things other than accidents, like weather, vandalism, or even falling objects. It’s like a safety net when the unexpected happens. | A tree branch falls on your car during a storm, or someone scratches your car parked on the street. |

| Collision Coverage | This pays for damages to your car if you’re involved in an accident, regardless of who’s at fault. It’s essential for keeping your ride on the road. | You rear-end another car, or you hit a deer while driving down the highway. |

| Liability Coverage | This covers the other party’s damages if you cause an accident. It’s crucial for protecting your assets and keeping your driving record clean. Think of it as a shield against legal issues. | You’re at fault in a fender bender, and the other driver needs repairs. |

| Uninsured/Underinsured Motorist Coverage | This protects you and your passengers if you’re hit by someone without insurance or with insufficient coverage. It’s like an extra layer of security for your well-being. | A driver without insurance crashes into your car, causing significant damage. Or, a driver with insufficient insurance causes a major accident. |

Importance of Comprehensive and Collision Coverage

Florence, SC, has its share of unpredictable weather and roadside hazards. Comprehensive and collision coverage are like having backup plans for those unforeseen events. Think of a sudden downpour or a misplaced tree branch. Comprehensive coverage steps in to protect your car. Collision coverage kicks in if you’re involved in a wreck, no matter the circumstances.

Having both ensures your vehicle is protected in almost any scenario.

Importance of Liability Coverage

Liability coverage is the cornerstone of any good insurance policy in Florence, SC. It’s a must-have for navigating the local driving landscape. You never know when a fender bender or a more serious accident could happen. Liability coverage helps protect your assets and keeps your driving record clean. It’s a smart move for peace of mind.

Relevance of Uninsured/Underinsured Motorist Coverage

Unfortunately, accidents involving uninsured or underinsured drivers happen. Uninsured/underinsured motorist coverage is vital for safeguarding you and your passengers in these situations. In Florence, SC, this coverage is a critical component to have in place. It protects your financial well-being if a driver without proper insurance causes an accident.

Discounts and Financial Considerations

Yo, fam! Insurance ain’t cheap, but there are ways to score some serious deals and keep your wallet happy. We’re breakin’ down the common discounts, the factors that jack up your premium, and how to budget for this essential expense. Let’s get into it!Insurance premiums aren’t just about your driving record; a bunch of other factors play a role.

Things like your location, age, and even the type of car you drive can all affect how much you pay. Knowing these factors can help you understand your costs and find ways to save. Smart budgeting is key, and we’ll show you how to make car insurance a manageable part of your financial plan.

Common Car Insurance Discounts in Florence, SC

Savvy moves can lead to major savings. Discounts can seriously lower your monthly payments, and we’re talkin’ about legit savings, not some scam. Take advantage of these discounts to save big on your car insurance.

- Safe Driver Discounts: Maintain a clean driving record, and you could score a discount. This is a no-brainer; avoid accidents and tickets to save money. Insurance companies reward responsible drivers with lower premiums.

- Multi-Policy Discounts: If you have other insurance policies with the same company, you might get a discount. Bundling policies with the same provider is often a solid financial move.

- Student Discounts: If you’re a student, you could be eligible for a discount. Insurance companies often reward students who are responsible and cautious behind the wheel.

- Anti-theft Device Discounts: Installing an anti-theft device can reduce your premium. This is a great way to show you care about your vehicle’s safety.

- Good Student Discounts: Maintaining good grades can get you a discount. This shows the insurance company that you’re a responsible individual.

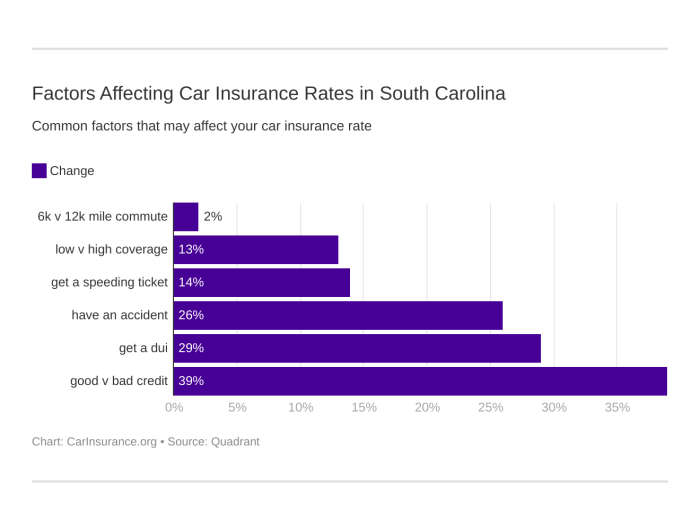

Factors Impacting Insurance Premiums

Your insurance rate isn’t just random; it’s based on several factors. Understanding these factors can help you make smart choices to save money.

- Driving Record: Accidents and traffic violations directly affect your premium. A clean record is crucial for getting a good rate.

- Vehicle Type: The make, model, and value of your car influence your premium. More expensive vehicles usually mean higher premiums.

- Location: Your location in Florence, SC, can affect your rates. Areas with higher crime rates or accident frequency often have higher premiums.

- Age and Gender: Age and gender are considered in premium calculations. Younger drivers and male drivers often have higher rates.

- Credit History: Insurance companies may use your credit score to assess your risk. A good credit score can help lower your premium.

Budgeting for Car Insurance

Treat your car insurance like any other bill—plan for it! Budgeting for insurance is just like budgeting for rent or groceries; you need a strategy to keep your finances in check.

- Include it in your monthly budget: Treat car insurance like a monthly expense, just like rent or utilities. Set aside a specific amount each month to cover it.

- Look for discounts: Check for available discounts to lower your premium. Many discounts can save you a significant amount each month.

- Consider different payment options: See if you can pay monthly, or if a lump sum is a better option for you. Many providers offer payment plans to fit your needs.

- Set up automatic payments: Setting up automatic payments helps you avoid late fees and keeps your insurance current.

Example Budget Strategies

Here’s a breakdown of how you can plan your car insurance payments:

- The ‘Fixed Percentage’ Method: Allocate a fixed percentage of your income each month for insurance. For example, if you earn $2000 a month, allocate 5% for insurance.

- The ‘Envelope Method’: Create a dedicated envelope for car insurance and put a set amount in it each month. This way, you don’t use those funds for other things.

Common Car Insurance Discounts

| Discount Type | Description | Requirements |

|---|---|---|

| Safe Driver | Reduced premium for a clean driving record | No accidents or violations within a specified period |

| Multi-Policy | Discount for having multiple policies with the same company | Must have multiple policies with the same insurance provider |

| Student | Reduced premium for students | Must be enrolled in a high school or college program |

| Anti-theft Device | Discount for installing an anti-theft device | Must install an approved anti-theft device |

| Good Student | Reduced premium for maintaining good grades | Must maintain a certain GPA |

Tips for Choosing the Right Insurance

Yo, future drivers, lemme break down how to choose the right car insurance like a pro. It’s not rocket science, but you gotta know the game to score the best deal. This ain’t no drill, this is your guide to getting the best coverage for your ride.Choosing the right car insurance is crucial for peace of mind and financial security.

Understanding the process and key factors will help you make informed decisions that fit your budget and needs. Don’t get caught in a bind with a policy that doesn’t cover you properly.

Comparing Car Insurance Quotes

Insurance quotes are like shopping for clothes; you gotta compare ’em to find the best fit. Different companies offer different rates, so don’t just settle for the first one you see. Use online comparison tools or ask local agents to get multiple quotes. This lets you see the different prices and coverage options available, allowing you to make an educated choice.

Think of it like a shopping spree—compare prices and features before buying.

Understanding Policy Terms and Conditions

Policy terms and conditions are the fine print, but they’re super important. They Artikel what’s covered and what’s not. Don’t just skim through ’em; read carefully. If something’s unclear, ask the agent to explain it in simple terms. This will prevent surprises later.

It’s like reading the rules of a game; knowing the rules is key to winning.

Factors to Consider When Selecting a Provider

Several factors influence your insurance choice. Think about your driving record, the type of car you own, and your location. A clean driving record will get you better rates, a fancy sports car might cost more to insure, and living in a high-crime area could bump up your premiums. These are the real-world factors that affect your policy.

It’s like picking a team based on their stats and strengths.

Importance of Reading Policy Documents Thoroughly

Reading your policy thoroughly is like signing a contract. You need to understand what you’re agreeing to. Pay close attention to coverage limits, deductibles, and exclusions. Don’t be a dummy; understand what you’re getting into. Knowing the terms prevents misunderstandings and potential issues down the road.

This is like getting the complete blueprint of your insurance coverage.

Key Questions to Ask When Comparing Insurance Companies

Asking the right questions is key to getting the best deal. Here’s a quick rundown:

- What coverage options are available?

- What are the premium rates for various coverage levels?

- What discounts are offered?

- What is the claims process like?

- What is the company’s financial stability?

- What is the customer service like?

- What are the terms and conditions of the policy?

These questions are like a checklist to make sure you get the best deal.

End of Discussion

In conclusion, navigating the world of car insurance in Florence, SC, requires careful consideration of individual needs and financial constraints. The interplay between local companies, agents, and coverage options offers a multifaceted approach to securing the best possible protection. This guide provides the framework for drivers to make informed decisions and find the right balance between coverage and cost, ensuring peace of mind on the roads of Florence, SC.

Quick FAQs

What are the most common discounts offered by car insurance companies in Florence, SC?

Common discounts include those for safe driving records, multiple vehicles, anti-theft devices, and student status. Specific discounts may vary by company.

How do I compare car insurance quotes in Florence, SC effectively?

Utilize online comparison tools and request quotes from multiple companies. Compare coverage options, premiums, and discounts carefully.

What are the typical concerns of drivers in Florence, SC regarding car insurance?

Concerns often include the cost of insurance, coverage adequacy for specific needs, and the efficiency of claims handling.

What is the significance of liability coverage in Florence, SC?

Liability coverage protects drivers from financial responsibility in the event of an accident where they are at fault. It’s a crucial component of any insurance policy in Florence, SC.