Cheap car insurance in Ocala is a beacon of financial freedom, guiding you toward a future of secure driving. This journey unveils the secrets to securing the best rates, revealing the hidden factors that influence premiums. Unlocking affordable car insurance in Ocala is within your reach; we’ll navigate the complexities, illuminating the path to financial peace of mind.

Ocala’s car insurance market presents a diverse landscape, influenced by various factors. Understanding these elements is key to finding the right coverage at the right price. This exploration will equip you with the knowledge to confidently compare quotes and choose the policy that perfectly suits your needs and budget.

Introduction to Cheap Car Insurance in Ocala

Unlocking the secrets to affordable car insurance in Ocala, Florida is easier than you think! The Ocala area, like any other region, has a dynamic car insurance market. Understanding the factors driving prices and common misconceptions will empower you to find the best deals. This guide provides a clear overview of the Ocala insurance landscape, helping you navigate the process and secure the coverage you need at a price you can afford.

Factors Influencing Car Insurance Costs in Ocala

Several factors significantly impact the cost of car insurance in Ocala. Driving record, vehicle type, and location all play a crucial role. A clean driving record, with no accidents or traffic violations, is often associated with lower premiums. Similarly, newer, safer vehicles typically attract lower rates. The specific location within Ocala also affects rates, as some areas might have a higher frequency of accidents or claims.

Furthermore, your age and gender can influence your premium. These elements combine to create a personalized insurance cost.

Common Misconceptions About Cheap Car Insurance

Several common myths surround cheap car insurance. One misconception is that you need to sacrifice coverage to save money. In reality, comprehensive and collision coverage is vital for protecting your vehicle and financial well-being. Another misconception is that the cheapest option is always the best. It’s crucial to prioritize reputable insurance companies and comprehensive coverage, not just the lowest price.

A thorough comparison of different policies is essential to ensure you get the best value for your money. Choosing a company with a solid financial rating is also crucial for the long-term reliability of your coverage.

Importance of Comparing Quotes for Car Insurance in Ocala

Comparing quotes is paramount when seeking cheap car insurance in Ocala. Different insurance providers offer varying rates based on your profile and coverage needs. By comparing quotes from multiple companies, you can identify the most affordable option without compromising on essential coverage. This process allows you to shop effectively and save money. Don’t limit yourself to just a few quotes; the more quotes you compare, the greater your chance of finding a truly exceptional deal.

Types of Car Insurance Coverage Available in Ocala

| Coverage Type | Description | Importance |

|---|---|---|

| Liability Coverage | Protects you financially if you cause an accident and are held legally responsible for damages to another person or their property. | A fundamental coverage that protects your assets. |

| Collision Coverage | Pays for damages to your vehicle, regardless of who caused the accident. | Essential for repairing or replacing your vehicle after an accident, even if you are at fault. |

| Comprehensive Coverage | Covers damages to your vehicle caused by events other than collisions, such as vandalism, theft, fire, or natural disasters. | Crucial for protecting your vehicle from unforeseen events that can lead to substantial repair costs or even total loss. |

| Uninsured/Underinsured Motorist Coverage | Provides protection if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. | Protects you and your vehicle if you’re involved in an accident with an uninsured or underinsured driver. |

| Personal Injury Protection (PIP) | Pays for medical expenses and lost wages for you and your passengers in the event of an accident, regardless of fault. | A crucial coverage for your well-being, covering medical costs and lost income, and protects your family. |

Comparing various coverage options is essential for identifying the optimal package that meets your specific needs and financial situation.

Identifying Factors Affecting Insurance Premiums in Ocala

Unveiling the secrets to securing affordable car insurance in Ocala involves understanding the key factors that influence premiums. These factors aren’t arbitrary; they’re calculated risk assessments based on statistical data and past claims. Knowing these factors empowers you to make informed decisions about your coverage and potentially save money.

Driving Record Impact on Insurance Rates

Driving records are a significant determinant of insurance premiums in Ocala. A clean driving record, devoid of accidents or traffic violations, typically translates to lower premiums. Conversely, drivers with a history of accidents or violations face higher premiums. Insurance companies use this data to assess the likelihood of future claims. For instance, a driver with multiple speeding tickets or at-fault accidents will likely pay more for insurance compared to a driver with no violations.

This reflects the risk associated with their driving behavior.

Vehicle Type and Value Impact on Insurance Costs

The type and value of your vehicle directly influence your insurance premiums. High-performance sports cars, luxury vehicles, and vehicles with unique or expensive features tend to have higher premiums. This is because these vehicles are often more expensive to repair or replace in case of an accident. Similarly, the value of the vehicle plays a significant role.

A high-value vehicle will attract a higher premium than a lower-value vehicle. This reflects the potential financial loss to the insurance company in the event of damage or theft.

Location and Demographics Influence on Car Insurance Prices

Location and demographics in Ocala can also affect insurance costs. Areas with higher crime rates or higher accident frequencies often have higher insurance premiums. This is because the insurance company needs to account for a greater risk of claims in those areas. Demographic factors, such as age and marital status, may also contribute to premium differences. Insurance companies often use statistical data to correlate demographic characteristics with claim frequencies, which ultimately influences the premium.

Insurance Costs for Different Age Groups

Insurance premiums vary significantly between different age groups. Younger drivers are often assigned higher premiums due to their statistically higher claim frequency. This is primarily attributed to inexperience and risk-taking behavior. As drivers gain experience and age, their premiums typically decrease. This trend reflects the reduced risk associated with mature drivers.

Impact of Claims History on Insurance Premiums

A driver’s claims history is a crucial factor in determining insurance premiums. Drivers with a history of making claims, whether for accidents, theft, or other damages, will generally face higher premiums. Insurance companies use this information to assess the likelihood of future claims, reflecting the increased risk associated with such drivers.

Discounts Available for Car Insurance

Numerous discounts can help reduce car insurance premiums in Ocala. These discounts often depend on factors like the driver’s profile, the vehicle type, or the insurance company’s specific program.

| Discount Type | Description |

|---|---|

| Safe Driving Discounts | Drivers with a clean driving record may qualify for discounts. |

| Defensive Driving Courses | Completing defensive driving courses can earn discounts. |

| Multi-Policy Discounts | Owning multiple policies with the same insurance company may lead to discounts. |

| Anti-theft Devices | Installing anti-theft devices on your vehicle may qualify for discounts. |

| Good Student Discounts | Students with good academic records might qualify for discounts. |

Effect of Credit History on Car Insurance Rates

Insurance companies may consider a driver’s credit history when setting premiums. A poor credit history may lead to higher premiums. This reflects a correlation between financial responsibility and accident or claim frequency. This is a crucial aspect for insurance companies in evaluating risk. A good credit history often translates to lower premiums.

Strategies for Finding Affordable Car Insurance in Ocala

Unlocking the secrets to affordable car insurance in Ocala is easier than you think! By employing smart strategies and utilizing the right tools, you can significantly reduce your insurance premiums without sacrificing essential coverage. This guide will equip you with the knowledge and methods to find the best deals tailored to your specific needs.Finding the best car insurance deal in Ocala involves a proactive approach, moving beyond simply accepting the first quote.

Understanding the factors influencing premiums and employing effective comparison methods are key to securing the most competitive rates.

Comparing Car Insurance Quotes in Ocala

Comparing quotes is the cornerstone of finding affordable car insurance. Thorough comparisons allow you to identify the best value and tailor coverage to your unique circumstances. This involves evaluating not only the premium amount but also the scope of coverage offered.

Reliable Online Car Insurance Comparison Websites in Ocala

Several reputable online platforms specialize in comparing car insurance quotes, providing a convenient and efficient way to find competitive rates. These platforms collect data from multiple insurers, allowing you to see a comprehensive overview of available options in Ocala.

- Insurify: A user-friendly platform that aggregates quotes from various insurers. Insurify allows you to compare policies based on specific factors, helping you find the best fit.

- Policygenius: This platform provides comprehensive comparisons, enabling you to customize your search based on desired coverage and deductibles. It’s known for its ease of use and clear presentation of options.

- NerdWallet: A widely recognized financial resource, NerdWallet’s car insurance comparison tool facilitates easy navigation and allows for fine-tuning searches to align with specific needs.

- QuoteWizard: Known for its user-friendly interface and broad network of insurance providers, QuoteWizard offers a detailed comparison of policies, allowing you to assess options from different companies.

Negotiating Lower Premiums with Insurance Providers in Ocala

Insurance companies often offer flexible options and negotiation opportunities. Researching these options before engaging in discussions can empower you to secure more favorable terms. Being well-prepared can lead to substantial savings.

Obtaining Multiple Quotes from Different Insurance Companies in Ocala

Securing quotes from various insurance providers is crucial for obtaining a comprehensive comparison. This involves inputting your specific information into multiple platforms to generate diverse quotes. A diverse set of quotes provides a solid foundation for selecting the best option.

Using Online Tools to Compare Car Insurance Rates in Ocala

Utilizing online comparison tools simplifies the process of finding competitive car insurance rates. These tools often allow for detailed comparisons based on various factors like driving history, vehicle type, and location.

Comparing Different Insurance Company Offerings in Ocala, Cheap car insurance in ocala

A well-structured comparison table allows for a clear and concise overview of different insurance company offerings. This visual representation makes it easier to identify the most suitable option for your needs.

| Insurance Company | Premium (Estimated) | Coverage Options | Customer Service Rating |

|---|---|---|---|

| Company A | $1,200 | Comprehensive, Collision, Liability | 4.5 Stars |

| Company B | $1,050 | Comprehensive, Collision, Liability, Uninsured Motorist | 4.2 Stars |

| Company C | $1,150 | Comprehensive, Collision, Liability, Personal Injury Protection | 4.7 Stars |

Advantages and Disadvantages of Different Car Insurance Policies in Ocala

Understanding the nuances of different car insurance policies is essential for making informed decisions. Policies vary significantly in their coverage and terms, affecting your overall cost and protection.

- Liability Coverage: Offers basic protection against claims for damages caused to others, but provides minimal coverage for your vehicle.

- Collision Coverage: Covers damages to your vehicle regardless of who is at fault. It’s crucial for protecting your investment.

- Comprehensive Coverage: Covers damages to your vehicle from events other than collisions, such as vandalism or weather damage. It is a crucial safeguard against unforeseen incidents.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

Understanding Insurance Coverage Options in Ocala

Unlocking the secrets to affordable car insurance in Ocala involves more than just price comparisons. It’s crucial to understand the various coverage options available to ensure you’re adequately protected on the road. This comprehensive guide delves into the different types of car insurance coverage, illuminating their importance and benefits.

Liability Coverage in Ocala

Liability coverage is the cornerstone of car insurance, protecting you financially if you’re at fault in an accident. It covers damages you cause to other people’s property or injuries to others. This coverage is typically required by law in Ocala and many other areas. A minimum liability coverage amount is usually mandated, but it’s strongly recommended to consider higher limits to better protect your assets.

For example, a low liability limit might not cover extensive medical bills or property damage in a serious accident.

Comprehensive Coverage in Ocala

Comprehensive coverage safeguards your vehicle against perils beyond accidents, like vandalism, theft, fire, hail, or weather damage. This coverage is vital because it protects your investment, covering repairs or replacement costs for unexpected events. Without comprehensive coverage, you’d be responsible for significant out-of-pocket expenses if your car were damaged by something other than a collision. For instance, a sudden hail storm could severely damage your car, and without comprehensive coverage, you’d have to bear the cost of repairs or replacement.

Collision Coverage in Ocala

Collision coverage kicks in when your vehicle collides with another object, regardless of who’s at fault. It pays for the repair or replacement of your vehicle. This is crucial, as it ensures you’re financially protected even if you’re involved in a collision where you’re not at fault. For example, if you’re hit by a negligent driver, collision coverage would cover your vehicle’s repair or replacement, ensuring you aren’t left with significant financial burdens.

Uninsured/Underinsured Motorist Coverage in Ocala

Uninsured/underinsured motorist coverage steps in if you’re involved in an accident with a driver lacking sufficient insurance or no insurance at all. It compensates you for medical expenses and property damage. This coverage is critical in Ocala, where accidents can involve drivers with insufficient or no insurance. This coverage is particularly important because it protects you from the financial fallout of an accident with a driver who isn’t adequately insured.

Essential Coverages for Car Insurance in Ocala

| Coverage Type | Description |

|---|---|

| Liability Bodily Injury | Covers injuries to others in an accident you cause. |

| Liability Property Damage | Covers damage to other people’s property in an accident you cause. |

| Comprehensive | Covers damage to your vehicle from non-collision events. |

| Collision | Covers damage to your vehicle in a collision, regardless of fault. |

| Uninsured/Underinsured Motorist | Covers you if you’re involved in an accident with an uninsured or underinsured driver. |

Additional Options in Ocala

Beyond the core coverages, additional options like roadside assistance and rental car coverage can significantly enhance your protection. Roadside assistance provides help with flat tires, jump starts, and lockouts. Rental car coverage offers temporary transportation if your vehicle is damaged or involved in an accident, reducing inconvenience and stress.

Tips for Maintaining a Low Car Insurance Premium in Ocala

Unlocking the secrets to affordable car insurance in Ocala starts with proactive steps to maintain a positive driving record and a financially sound approach. By focusing on responsible driving, credit management, and vehicle upkeep, you can significantly influence your insurance premiums. These strategies will not only save you money but also contribute to a safer driving environment for everyone on the roads.

Maintaining a Pristine Driving Record

A spotless driving record is paramount for securing favorable insurance rates. Consistent adherence to traffic laws and safe driving practices is crucial. Avoiding accidents and traffic violations directly impacts your insurance premiums. Insurance companies use driving history to assess risk and assign premium levels. A clean record translates to lower premiums, demonstrating your responsible behavior on the road.

Safe Driving Habits in Ocala

Implementing safe driving habits is not only essential for your safety but also for keeping your insurance premiums low. Always follow speed limits, maintain a safe following distance, and avoid distractions such as cell phone use. Driving under the influence of alcohol or drugs is strictly prohibited and can lead to significant increases in insurance premiums and potential legal consequences.

By proactively avoiding risky driving behaviors, you minimize the likelihood of accidents, reducing your insurance costs.

Managing Your Credit History

Your credit score plays a significant role in determining your car insurance rates. Maintaining a healthy credit score demonstrates financial responsibility to insurance providers. High credit scores often translate to lower insurance premiums. Lenders use credit scores to assess the risk of lending, and insurers use a similar approach when evaluating risk. Paying bills on time and managing debt responsibly contributes to a positive credit score, impacting your insurance rates positively.

Vehicle Maintenance for Lower Premiums

Regular vehicle maintenance is not just about keeping your car running smoothly; it can also help lower your insurance premiums. Properly maintained vehicles are less prone to mechanical failures and accidents, which can reduce the risk for insurance providers. Ensuring your vehicle is properly inspected and maintained can lead to lower premiums. Investing in preventative maintenance can save you money in the long run.

Comparing Insurance Policies with Different Deductibles

Understanding deductibles is crucial when comparing insurance policies. A higher deductible means a lower premium, but you’ll need to pay more out-of-pocket in the event of a claim. Lower deductibles result in higher premiums but offer greater financial protection. Carefully evaluate your financial situation and risk tolerance when choosing a deductible amount. Consider the likelihood of needing to make a claim and your ability to pay a higher deductible to lower your premium.

Factors Influencing Car Insurance Costs in Ocala

| Factor | Description |

|---|---|

| Driving Record | Accidents, violations, and claims affect premiums. |

| Credit Score | Financial responsibility is reflected in insurance rates. |

| Vehicle Type | High-performance or luxury cars often have higher premiums. |

| Location | Traffic density and accident rates influence premiums in specific areas. |

| Age and Gender | Statistics show that certain age and gender groups have higher or lower accident rates. |

| Coverage Options | Higher levels of coverage translate to higher premiums. |

Common Mistakes to Avoid in Car Insurance Selection

Ignoring your credit score, failing to compare quotes from multiple providers, and neglecting to understand coverage options are common pitfalls. Reviewing insurance policy details carefully and seeking advice from financial experts can help you avoid these mistakes. Inaccurate or incomplete information can lead to unsuitable insurance coverage and potentially higher costs.

Resources for Further Information on Car Insurance in Ocala

Navigating the world of car insurance can feel overwhelming, especially when you’re looking for the best deals in a specific area like Ocala. This section provides essential resources to help you make informed decisions and find the right coverage for your needs. Armed with this knowledge, you can confidently compare policies and choose the best option for your driving situation.Understanding the available resources empowers you to proactively manage your insurance needs, leading to greater peace of mind and potentially significant savings.

By exploring these avenues, you’ll gain a comprehensive perspective on car insurance in Ocala and confidently select the most suitable coverage.

Local Insurance Agents in Ocala

Finding a local insurance agent can be incredibly beneficial. They possess in-depth knowledge of the Ocala market, offering personalized advice and potentially identifying exclusive deals tailored to your circumstances. Local agents understand the specific traffic patterns, accident rates, and other factors unique to the area, which can impact your insurance premiums.

- Local insurance agencies often have a deep understanding of the local market, which can be advantageous when looking for competitive rates. They can provide personalized advice and cater to specific needs, ensuring you get the best possible coverage.

- Many local agencies offer the ability to meet in person, allowing for detailed discussion and questions about your particular situation. They can help you understand complex policies and provide insights on options not readily apparent online.

State Insurance Departments in Ocala

State insurance departments provide crucial resources for consumers. They maintain records of licensed insurance companies, ensure compliance with regulations, and handle consumer complaints. Understanding these resources empowers you to effectively address concerns and advocate for your interests.

- The Florida Department of Financial Services (DFS) is the primary regulatory body for insurance in Florida. You can find valuable information about licensed insurers, insurance-related laws, and consumer protection measures on their website.

- Contacting the DFS directly can provide you with insights into specific insurance policies and their compliance with state regulations. They also offer guidance on resolving insurance-related disputes.

Consumer Protection and Insurance Complaints in Ocala

Navigating insurance disputes can be challenging. Knowing how to file a complaint and seek recourse is crucial for consumers. Understanding these processes ensures your rights are protected and your concerns are addressed appropriately.

- The Florida Department of Financial Services (DFS) handles consumer complaints and investigations related to insurance policies. Filing a complaint with the DFS provides a formal avenue for addressing dissatisfaction with an insurance company.

- The DFS maintains detailed guidelines for filing insurance complaints. Understanding these guidelines ensures the complaint is submitted correctly, maximizing its effectiveness.

Researching Insurance Policies Specific to Ocala

Researching policies tailored to Ocala’s specific conditions is essential for finding the best possible rate. Understanding local factors can significantly impact your insurance costs.

- Online comparison tools can be a great starting point for exploring various insurance policies. These tools often provide personalized quotes based on your driving history, vehicle type, and location.

- Reviewing policy details thoroughly is essential. Understanding the coverage, exclusions, and specific clauses relevant to Ocala can save you money and prevent future disputes.

Frequently Asked Questions (FAQ) About Car Insurance in Ocala

Understanding common questions about car insurance in Ocala can prevent confusion and provide valuable insights.

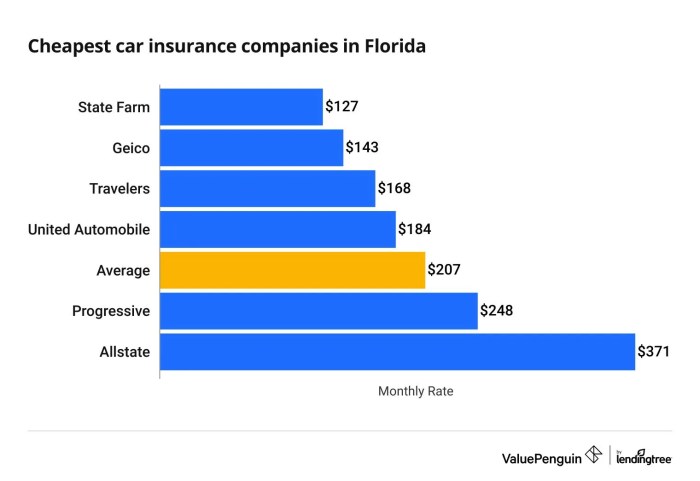

- Question: What are the typical car insurance rates in Ocala?

Answer: Car insurance rates in Ocala, like in any area, vary based on factors like your driving history, vehicle type, and chosen coverage. Comparing quotes from multiple providers is essential to determine the most affordable option. - Question: How can I lower my car insurance rates in Ocala?

Answer: Maintaining a clean driving record, increasing your deductible, and considering comprehensive coverage with a high deductible can often lead to lower premiums. Insurance providers in Ocala, as elsewhere, often reward responsible driving behavior.

Key Contact Information for Insurance Related Services in Ocala

Accessing relevant contact information streamlines the process of seeking assistance. This table provides essential details for your convenience.

| Service | Contact Information |

|---|---|

| Florida Department of Financial Services (DFS) | (Information about the Florida DFS’s website and contact number) |

| Ocala Chamber of Commerce | (Information about the Ocala Chamber of Commerce’s website and contact number) |

| National Insurance Consumer Helpline | (Information about the National Insurance Consumer Helpline’s website and contact number) |

Choosing the Right Car Insurance Provider in Ocala

Selecting the right insurance provider involves careful consideration of various factors. Understanding these elements is crucial to making an informed decision.

- Reviewing financial stability reports for insurance companies is crucial. Companies with strong financial ratings often provide greater stability and security for your policy.

- Customer reviews and testimonials can offer insights into a company’s reputation and service quality. Positive reviews and feedback often point to a provider committed to customer satisfaction.

Conclusive Thoughts

In conclusion, securing cheap car insurance in Ocala is achievable with a well-informed approach. By understanding the influencing factors, comparing quotes strategically, and choosing the right coverage, you can navigate the complexities and find the perfect balance between affordability and protection. Embrace this knowledge as a tool for financial empowerment, allowing you to drive confidently and with peace of mind.

General Inquiries: Cheap Car Insurance In Ocala

What is the average cost of car insurance in Ocala?

Average costs vary greatly depending on factors like driving record, vehicle type, and coverage choices. It’s best to get personalized quotes to determine your specific rate.

Can I get a discount on my car insurance in Ocala?

Yes, numerous discounts are available, such as discounts for safe drivers, good students, and for bundling insurance products. Be sure to inquire about all available discounts.

What are the most common misconceptions about cheap car insurance?

A common misconception is that sacrificing coverage will automatically yield lower premiums. However, inadequate coverage can leave you vulnerable to financial hardship. Comprehensive and thorough coverage is essential, and affordable options are available to fit any budget.

How can I compare car insurance quotes effectively?

Utilize online comparison websites specifically tailored for Ocala. Compare multiple quotes from different insurers to identify the best deal for your needs. This thorough comparison will empower you to make the most informed decision.