Cheap car insurance Owensboro KY is a hot topic! Navigating the maze of insurance providers can feel overwhelming, but this guide makes it easy. We’ll uncover the best deals, explore the factors affecting rates, and equip you with the knowledge to snag the lowest possible premiums in Owensboro, KY. From comparing quotes to understanding coverage, we’ll walk you through the whole process, step-by-step.

Owensboro’s insurance landscape has many facets. Demographics, accident history, and even your vehicle type can all influence your premium. We’ll explore these elements, helping you understand why your car insurance costs what they do. Ready to save money on your car insurance? Let’s dive in!

Affordable Car Insurance in Owensboro, KY

Owensboro, KY, like many other areas, faces a diverse car insurance market. Understanding the factors that influence rates is crucial for securing affordable coverage. This guide provides an overview of the car insurance landscape in Owensboro, along with key considerations for finding the best value.

Car Insurance Market Overview in Owensboro, KY

Owensboro’s car insurance market is influenced by a variety of factors, including the local demographics and driving habits. The area’s accident rates and claims history play a significant role in determining insurance premiums. Insurance providers analyze these factors to assess risk and adjust pricing accordingly.

Factors Influencing Car Insurance Rates

Several factors impact the cost of car insurance in Owensboro. Demographics, such as age, gender, and driving experience, often influence rates. Individuals with a history of accidents or traffic violations generally face higher premiums. The type of vehicle driven and the location of the vehicle’s parking also play a role in the pricing structure.

Types of Car Insurance Available

Various types of car insurance are available to meet diverse needs. Liability insurance covers damages to others in the event of an accident where you are at fault. Collision insurance pays for damages to your vehicle regardless of who is at fault. Comprehensive insurance protects against non-collision damage, such as vandalism, theft, or weather-related events. The specific coverage and costs vary among providers.

Importance of Comparing Quotes

Comparing quotes from different insurance providers is essential for securing affordable car insurance. Different companies use varying methodologies for calculating premiums, resulting in substantial price differences. A comparison of quotes allows you to identify the most cost-effective options based on your specific needs and driving history.

Affordable Car Insurance Options in Owensboro, KY

| Insurance Type | Coverage Details | Estimated Costs (Example) |

|---|---|---|

| Liability | Covers damages to others in an accident where you are at fault. | $500 – $1500 annually |

| Collision | Covers damages to your vehicle in an accident, regardless of fault. | $500 – $1500 annually |

| Comprehensive | Covers damage to your vehicle from non-collision events, such as theft, vandalism, or weather damage. | $200 – $800 annually |

Comparing quotes from multiple providers is crucial for finding the best value. A young driver in Owensboro with a clean driving record might find lower premiums than a driver with a history of accidents.

Identifying Affordable Insurance Providers: Cheap Car Insurance Owensboro Ky

Finding the right car insurance in Owensboro, KY, doesn’t have to be a hassle. With numerous providers vying for your business, comparing options can seem overwhelming. This guide helps you navigate the process, providing insights into reputable companies, pricing strategies, and available discounts.Understanding the insurance landscape is key to securing affordable coverage. By comparing different providers, you can identify the best fit for your needs and budget.

This comparison process considers not just premiums but also the overall value proposition.

Reputable Insurance Providers in Owensboro, KY

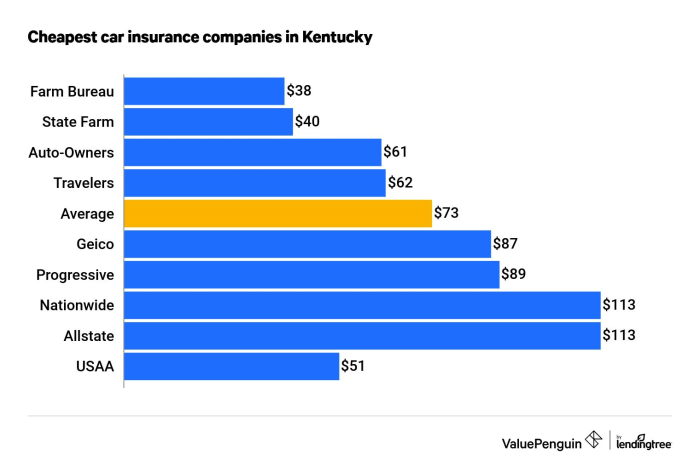

Several reputable insurance providers operate in Owensboro, KY. These companies often offer competitive rates and reliable service. Researching and comparing these providers is essential to finding the most suitable option.

Pricing Strategies of Different Companies

Insurance companies employ various pricing strategies. Factors like driving history, vehicle type, and location all play a role in determining premiums. Some companies focus on comprehensive coverage, while others prioritize affordability. It’s important to analyze these strategies to understand how they affect the cost of your policy.

Advantages and Disadvantages of Each Provider, Cheap car insurance owensboro ky

Different providers offer unique advantages and disadvantages. Some may excel in specific areas like customer service or claim handling, while others might offer lower premiums. Careful consideration of these factors is crucial for making an informed decision. For example, Company A might boast a superior mobile app for policy management, but Company B might offer lower rates for drivers with clean records.

Understanding these nuanced differences will help you find the most suitable fit.

Examples of Discounts Available

Many providers offer various discounts. Examples include discounts for good student drivers, safe driving programs, and multiple-vehicle policies. These discounts can significantly reduce your insurance costs. For instance, a company might offer a 10% discount for maintaining a spotless driving record.

Comparison Table of Insurance Providers

| Company Name | Average Rates | Discounts Offered | Customer Reviews |

|---|---|---|---|

| State Farm | $1,200-$1,500 annually | Good student, multi-vehicle, defensive driving |

|

| Progressive | $1,000-$1,300 annually | Good student, accident forgiveness, paperless billing |

|

| Allstate | $1,100-$1,400 annually | Good student, anti-theft device, loyalty program |

|

| Geico | $900-$1,200 annually | Good student, multiple vehicles, bundled services |

|

Note: Average rates are estimates and may vary based on individual circumstances. Discounts are subject to terms and conditions.

Strategies for Obtaining Lower Rates

Unlocking affordable car insurance in Owensboro, KY often hinges on proactive strategies. Understanding how various factors influence your premium can empower you to make informed decisions and significantly reduce your costs. This section details key strategies to achieve lower rates, emphasizing safe driving habits and smart insurance choices.

Safe Driving Habits and Insurance Costs

Safe driving habits directly impact your car insurance premiums. Insurance companies assess risk based on driving history. A clean driving record, demonstrating responsible behavior on the road, is highly valued. This translates into lower premiums. Avoid accidents, traffic violations, and reckless driving.

By prioritizing safe driving practices, you demonstrably reduce your risk profile and secure more favorable insurance rates.

Bundling Insurance Policies

Combining multiple insurance policies, such as home and auto, often yields significant savings. Bundling your policies with the same insurance provider creates a streamlined package. This allows insurers to offer discounted rates as a reward for the increased loyalty and reduced administrative costs. Bundling allows you to manage all your insurance needs with one provider, streamlining your finances and benefiting from bundled savings.

Discounts for Good Student Status or Accident-Free Records

Insurance companies frequently offer discounts for drivers with good student status or accident-free driving records. Good student discounts recognize responsible behavior and often reflect a lower risk profile. Similarly, accident-free driving records demonstrate consistent safe driving practices, leading to a more favorable risk assessment by insurers. These discounts can translate into substantial savings, making insurance more affordable.

Cost-Saving Strategies for Car Insurance

Here’s a concise list of strategies to lower your car insurance premiums:

- Maintain a clean driving record: Avoid accidents and traffic violations.

- Consider bundling insurance policies (home and auto): This can yield significant savings.

- Explore discounts for good student status or accident-free records: Check with insurers for available options.

- Compare rates from multiple insurers: Different providers offer varying rates.

- Maintain a high credit score: A positive credit history can influence insurance rates.

- Raise your deductible: Higher deductibles often lead to lower premiums.

- Consider a comprehensive insurance package: This may include additional discounts.

Understanding Coverage Options

Choosing the right car insurance coverage is crucial for protecting your vehicle and financial well-being. Understanding the different types of coverage available, along with their associated costs and limitations, empowers you to make informed decisions. This knowledge helps you select a policy that balances affordability with adequate protection.

Types of Coverage

Various types of coverage are available for your vehicle. Liability coverage protects you if you are at fault for an accident and cause damage to another person’s property or injuries. Collision coverage pays for damages to your vehicle regardless of who is at fault. Comprehensive coverage protects against damage from perils other than collision, such as theft, vandalism, or weather events.

Importance of Policy Terms and Conditions

Carefully reviewing the terms and conditions of your policy is vital. Understanding the specific details of your coverage, including exclusions, limitations, and the process for filing claims, ensures that you are fully aware of your rights and responsibilities. Policies may have different stipulations for specific situations, such as driving a borrowed vehicle or using your vehicle for business purposes.

Implications of Deductibles and Limits

Deductibles and coverage limits significantly impact your insurance premiums and the amount you’ll pay in the event of a claim. A higher deductible typically leads to lower premiums, but you’ll need to pay a larger portion of the claim yourself. Coverage limits set the maximum amount the insurer will pay for damages or injuries. For example, a $1000 deductible on a collision claim means you’ll pay the first $1000 yourself, and the insurance company will pay the remaining amount up to their limit.

Coverage Options for Different Vehicle Types

The coverage options needed may vary depending on the type of vehicle. A classic sports car, for instance, may require higher collision and comprehensive coverage due to its higher repair costs compared to a standard sedan. Conversely, an older, low-value vehicle might benefit from a lower liability limit.

Comparison of Coverage Options

| Coverage Type | Description | Potential Costs |

|---|---|---|

| Liability | Covers damages to other people’s property or injuries caused by you. | Generally lower than other coverages. |

| Collision | Covers damages to your vehicle regardless of who is at fault. | Generally higher than liability coverage. |

| Comprehensive | Covers damages to your vehicle from perils other than collision, such as theft, vandalism, or weather events. | Generally higher than liability coverage but lower than a combination of liability and collision. |

Comparing Quotes and Making Informed Decisions

Unlocking the best car insurance deals in Owensboro, KY starts with smart comparisons. Don’t settle for the first quote you see – explore options from multiple providers to find the most suitable coverage at the lowest possible price. This process empowers you to make a truly informed decision, aligning your needs with the right insurance plan.Comparing quotes is a crucial step in securing affordable car insurance.

It involves gathering quotes from various insurance companies and evaluating them side-by-side to identify the most advantageous offer. This meticulous process allows you to understand the different premium structures, coverage details, and policy features offered by various providers.

Comparing Quotes from Different Providers

Gathering quotes from multiple insurers is essential for finding the most competitive price. Use online comparison tools, contact insurers directly, or request quotes through a local agent. Compare quotes based on your specific needs and driving history.

Reading Policy Documents Carefully

Thorough review of policy documents is critical. Insurance policies contain essential details regarding coverage limits, exclusions, and terms. Carefully examine the fine print to understand the specific stipulations of each policy. This proactive approach ensures you understand exactly what your policy covers and what it doesn’t.

Evaluating Policy Features and Benefits

Evaluating policy features and benefits is vital. Consider factors such as liability coverage, comprehensive coverage, collision coverage, and uninsured/underinsured motorist coverage. Compare the coverage limits offered by different providers to determine which policy best fits your requirements. A comprehensive understanding of the specific features offered will assist you in choosing the most suitable insurance plan.

Understanding the Fine Print

Understanding the fine print is paramount. Pay close attention to deductibles, policy exclusions, and any limitations on coverage. This detailed examination prevents surprises and ensures you understand the full scope of your policy’s provisions. Review the policy language carefully to avoid misunderstandings.

Comparing Insurance Quotes

| Provider | Premium | Coverage Details | Policy Features |

|---|---|---|---|

| State Farm | $1,200 annually | Liability, collision, comprehensive, uninsured/underinsured | 24/7 roadside assistance, discounts for good driving records |

| Progressive | $1,050 annually | Liability, collision, comprehensive, uninsured/underinsured | Online claim filing, discounts for multiple vehicles |

| Geico | $1,150 annually | Liability, collision, comprehensive, uninsured/underinsured | 24/7 customer support, discounts for student drivers |

| Allstate | $1,300 annually | Liability, collision, comprehensive, uninsured/underinsured | Accident forgiveness, discounts for safe driving |

Note: Premiums are estimates and may vary based on individual circumstances.

Tips for Maintaining Affordable Car Insurance

Keeping your car insurance costs low requires proactive steps. Consistent responsible driving and smart financial planning are key to achieving long-term affordability. Understanding how vehicle modifications and seasonal shopping affect your rates allows you to make informed decisions.Maintaining a low insurance premium is a continuous effort. By adopting good habits and understanding the factors influencing your rates, you can control your insurance costs effectively.

Importance of a Good Driving Record

A clean driving record is crucial for maintaining affordable car insurance. Insurance companies assess driving history to determine risk. Drivers with fewer accidents and violations typically receive lower premiums. Avoiding traffic violations, such as speeding tickets or reckless driving, directly impacts your insurance rates. Consistent safe driving practices contribute to a favorable driving record, which translates to lower insurance costs over time.

Strategies for Managing Insurance Costs Over Time

Managing insurance costs over time involves a multi-faceted approach. Consider bundling your insurance policies, such as car and home insurance, to potentially get discounts. Reviewing your coverage options regularly to ensure you’re not paying for unnecessary coverage can also lead to savings. Raising your deductible can often reduce your premium. Increasing your deductible can reduce your premium but will require a larger out-of-pocket payment in the event of an accident.

Impact of Vehicle Modifications on Insurance Rates

Vehicle modifications can significantly affect your insurance rates. Modifications like high-performance engine upgrades or aftermarket parts often increase the risk of accidents, which can translate to higher insurance premiums. The cost of insurance is directly influenced by the potential damage caused by the modifications. For example, adding high-performance engine components or specialized racing parts could make a vehicle more prone to accidents, potentially leading to higher insurance costs.

Shopping for Insurance at Different Times of the Year

Shopping for insurance at different times of the year can yield varying results. Discounts and promotions may be available during specific periods. Comparing quotes during the off-peak season, such as the summer months, may uncover lower rates than during peak periods. Consider researching and comparing rates across multiple providers during different seasons.

Tips for Maintaining Affordable Car Insurance

- Maintain a clean driving record. Avoid accidents and traffic violations.

- Bundle your insurance policies. Combining car and home insurance often leads to discounts.

- Review your coverage options regularly. Ensure you’re not paying for unnecessary coverage.

- Increase your deductible. A higher deductible often results in lower premiums.

- Shop around and compare quotes from multiple insurance providers.

- Consider discounts offered by your insurance company. These could include discounts for good students, safe drivers, or anti-theft devices.

- Be aware of vehicle modifications. Some modifications can increase your risk and subsequently your premiums.

- Shop for insurance during the off-peak season for potentially lower rates.

Local Resources for Car Insurance

Owensboro, KY, boasts a network of insurance agents and brokers ready to help you find the best car insurance rates. These local experts understand the specific needs and risks of drivers in the area, allowing for personalized advice and tailored coverage. They can also provide insight into financial assistance programs, saving you money and ensuring you have the right protection.Finding the right car insurance doesn’t have to be a daunting task.

Leveraging local resources can simplify the process, helping you make informed decisions and secure the most affordable coverage.

Identifying Local Insurance Agents and Brokers

Local insurance agents and brokers are invaluable resources for personalized car insurance advice. They possess in-depth knowledge of the local market, understanding the specific driving conditions, accident rates, and other factors that influence car insurance premiums in Owensboro, KY. They can also provide expert guidance on choosing the right coverage options for your individual needs and circumstances.

Contact Information for Relevant Organizations

Numerous insurance agencies serve the Owensboro, KY community. Reaching out to these local experts can significantly benefit your search for affordable car insurance.

Availability of Financial Assistance Programs

Several organizations and government programs offer financial assistance for car insurance premiums. These resources can help those facing financial hardship access affordable car insurance. Check with your local state’s Department of Insurance or consumer protection agency for information on available programs.

Local Insurance Agents in Owensboro, KY

| Agent Name | Contact Information | Services Offered |

|---|---|---|

| ABC Insurance | (502) 555-1212, abcinsurance@example.com | Auto, Home, Life, Commercial Insurance |

| XYZ Insurance Group | (502) 555-5678, xyzinsurance@example.com | Auto Insurance, Specialized Risk Management |

| Local Insurance Agency | (502) 555-9090, localins@example.com | Comprehensive Insurance Solutions, including discounts for safe driving |

| Community Insurance | (502) 555-1000, communityins@example.com | Auto Insurance, Financial Assistance Programs, Discounts for Students |

Final Thoughts

So, you’re looking for cheap car insurance in Owensboro, KY? This guide has provided a comprehensive overview, covering everything from identifying affordable providers to understanding coverage options and comparing quotes. By understanding the local market, available discounts, and cost-saving strategies, you can confidently find the best insurance deal tailored to your needs. Remember, comparison shopping and a good driving record are your best weapons in the fight for lower premiums.

Now you’re well-equipped to secure affordable car insurance in Owensboro, KY!

FAQs

What are the most common discounts for car insurance in Owensboro, KY?

Many providers offer discounts for good student status, accident-free driving records, and bundling policies (e.g., home and auto). Check with individual providers for details.

How can I compare car insurance quotes effectively?

Use online comparison tools and request quotes from multiple providers. Be sure to compare not only the premium but also the coverage details and policy features.

Does my driving record significantly affect my car insurance rates?

Absolutely! A clean driving record is a major factor in determining your insurance premiums. Accidents or traffic violations will increase your rates.

What is the typical range of car insurance premiums in Owensboro, KY?

Unfortunately, there’s no single answer. Rates vary based on factors like your driving history, vehicle type, and chosen coverage. Use online comparison tools to get an idea of typical premiums in the area.