Hertz Ireland car rental insurance: navigating the complexities of coverage options, comparing Hertz to competitors, and understanding your rights. This guide provides a comprehensive overview of Hertz Ireland car rental insurance, covering everything from basic policies to detailed claims procedures. From understanding the different types of coverage to comparing Hertz’s offerings with other rental companies, we’ll walk you through the process of choosing the right insurance and avoiding potential pitfalls.

This in-depth analysis examines Hertz Ireland’s insurance policies, highlighting their features, limitations, and potential benefits. We delve into the intricacies of insurance terms and conditions, providing clear explanations and examples. The information is presented in a user-friendly manner, making it easy for you to grasp the nuances of car rental insurance in Ireland.

Overview of Hertz Ireland Car Rental Insurance

Hertz Ireland car rental insurance provides a crucial safety net for travelers, safeguarding against unforeseen circumstances. Understanding the various options and their implications is vital for making informed decisions when booking your vehicle. This overview details the different insurance packages, their coverage, and the factors influencing costs, enabling you to select the most suitable protection for your needs.

Insurance Options Offered

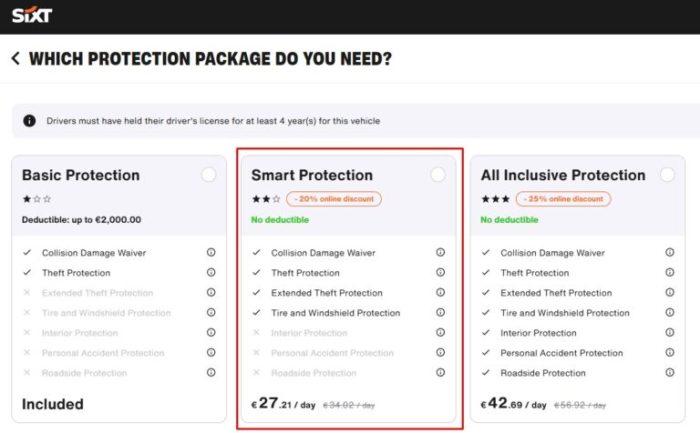

Hertz Ireland offers a range of insurance packages tailored to diverse needs. These packages generally include liability coverage, which protects against damages to other vehicles or individuals. Beyond liability, comprehensive coverage safeguards against damage to the rental vehicle itself, while collision coverage addresses incidents involving the vehicle. Each package typically varies in the extent of coverage and exclusions.

Factors Influencing Insurance Premiums

Several factors play a role in determining the cost of Hertz Ireland car rental insurance. These include the type of vehicle rented, the duration of the rental period, and the driver’s age and driving history. Furthermore, the specific insurance package chosen significantly impacts the premium. Locations and time of year can also affect pricing.

Common Exclusions and Limitations

Hertz Ireland insurance policies often include exclusions for certain types of damage. These may include pre-existing damage to the vehicle, damage caused by intentional acts, or damage resulting from specific circumstances like natural disasters. Reviewing the fine print is essential to understand the complete scope of coverage and any limitations. For instance, damage caused by reckless driving, such as speeding or aggressive maneuvers, may not be covered.

Additionally, specific activities like off-road driving are often excluded.

Comparison of Insurance Packages, Hertz ireland car rental insurance

| Insurance Package | Liability Coverage | Collision Coverage | Comprehensive Coverage | Estimated Premium (per day) |

|---|---|---|---|---|

| Basic | Yes (limited) | No | No | €10-€20 |

| Standard | Yes (moderate) | Yes (limited) | No | €20-€35 |

| Enhanced | Yes (full) | Yes (full) | Yes (full) | €35-€50 |

This table provides a general comparison. Actual premiums can vary based on the specific rental period, vehicle type, and other factors. Always confirm the exact details with Hertz Ireland directly.

Comparing Hertz Ireland Insurance with Competitors

Navigating the labyrinth of car rental insurance options can feel daunting, especially when comparing offerings from different companies. Understanding the specifics of coverage, pricing, and exclusions is crucial for making an informed decision. This analysis dives into the details of Hertz Ireland insurance, placing it alongside those of prominent competitors to illuminate the landscape of available choices.This comparative study examines the insurance packages provided by various major rental companies operating in Ireland.

By comparing coverage, pricing, and exclusions, a clearer picture of the strengths and weaknesses of each option emerges, allowing renters to make a more calculated and advantageous choice.

Coverage Comparison

Different rental companies tailor their insurance packages to cater to diverse needs. A crucial aspect of comparison involves scrutinizing the specific types of coverage included. This includes factors such as liability protection, collision damage waiver (CDW), and comprehensive coverage (including theft). Some companies might offer add-on options like roadside assistance or personal accident insurance. The scope of these coverages varies significantly between providers.

Analyzing these differences is paramount in determining the most appropriate protection for a given trip.

Pricing Analysis

Rental insurance pricing varies significantly across companies. Factors such as the type of vehicle, rental duration, and the specific coverage selected influence the cost. To effectively compare prices, it’s necessary to consider the full package, including any hidden fees or add-ons. Examining different pricing structures, including daily rates and overall costs, helps in understanding the financial implications of each option.

Exclusions and Limitations

Insurance policies often contain exclusions and limitations. Understanding these specifics is vital to avoid unpleasant surprises. Crucially, these exclusions often cover situations like pre-existing damage to the vehicle, misuse of the vehicle, or specific types of accidents. Thorough scrutiny of these clauses will help ensure a clear understanding of what is and isn’t covered.

Example Comparison Table

| Feature | Hertz Ireland | Enterprise Rent-A-Car | Avis Ireland |

|---|---|---|---|

| Collision Damage Waiver (CDW) | Included in standard package | Included in standard package | Included in standard package |

| Comprehensive Coverage (including theft) | Included in standard package | Included in standard package | Included in standard package |

| Liability Insurance | Included in standard package | Included in standard package | Included in standard package |

| Roadside Assistance | Optional add-on | Optional add-on | Optional add-on |

| Price (Example: 7-day compact car rental) | €15 per day | €12 per day | €13 per day |

| Exclusions (Example: Pre-existing damage) | Not covered | Not covered | Not covered |

Obtaining Quotes from Competitors

Obtaining quotes from competitor companies is straightforward. Websites dedicated to car rental comparison, or contacting the rental companies directly, are viable options. This process often involves providing details about the rental period, vehicle type, and desired level of insurance coverage. It’s recommended to compare quotes for similar packages from multiple companies to gain a comprehensive understanding of pricing variations.

Advantages of Choosing Hertz Ireland Insurance

Hertz Ireland insurance may offer competitive pricing for the included coverage. For instance, a comprehensive package with a competitive daily rate could be a notable advantage. Furthermore, familiarity with Hertz’s service and processes might offer a convenient experience.

Disadvantages of Choosing Hertz Ireland Insurance

While Hertz might offer a good deal, competitors might offer better value in specific situations. For example, a renter seeking a particularly extensive coverage package with roadside assistance might find better value elsewhere. This warrants a thorough comparison.

Understanding Insurance Terms and Conditions

Navigating the fine print of car rental insurance can feel daunting. However, a clear understanding of the terms and conditions can significantly reduce potential surprises and anxieties. This section delves into the specifics of Hertz Ireland car rental insurance, clarifying clauses, and outlining expectations in various scenarios.Understanding these terms empowers you to make informed decisions, protecting yourself and your financial interests during your rental period.

Specific Terms and Conditions of Hertz Ireland Car Rental Insurance

Hertz Ireland’s insurance policies typically include coverage for damage to the rental vehicle, theft, and liability in the event of an accident. The exact details, however, vary depending on the specific rental agreement. Crucially, examine the policy’s exclusions and limitations carefully. These often Artikel scenarios where coverage may not apply, such as pre-existing damage to the vehicle or use outside permitted areas.

Meaning of Different Clauses and Provisions

Insurance policies employ various clauses to define coverage. “Excess” is a common term referring to the amount you’ll be responsible for paying in the event of a claim. “Third-party liability” covers damages you cause to others. “Collision damage waiver” protects you from damage to the rental car due to collisions. It’s essential to carefully review these clauses to fully understand the scope of your coverage.

What to Expect in Case of an Accident or Damage

In the unfortunate event of an accident or damage to the rental vehicle, the process is typically standardized. Report the incident immediately to Hertz Ireland and the relevant authorities. Document the damage thoroughly, including photos and witness statements if available. Follow Hertz’s instructions on reporting procedures and obtain necessary documentation.

Common Misunderstandings Regarding Car Rental Insurance

A common misconception is that insurance automatically covers all potential damages. Often, there are exclusions and limitations. Another misunderstanding concerns the “excess” amount. Renters may not fully comprehend the financial responsibility they assume in the case of a claim.

Table of Common Insurance Terms

| Term | Definition |

|---|---|

| Excess | The amount you are responsible for paying in the event of a claim, after insurance has paid its share. |

| Third-party liability | Insurance coverage that protects you from financial responsibility for damages you cause to other people or their property. |

| Collision damage waiver | Insurance that protects you from paying for damage to the rental car resulting from a collision. |

| Comprehensive insurance | Insurance that covers damage to the rental car caused by events other than collisions, such as vandalism, theft, or weather damage. |

| Deductible | The amount you pay out-of-pocket before insurance coverage kicks in. |

Tips for Choosing the Right Insurance

Navigating the complexities of car rental insurance can feel like a minefield. Understanding your needs and carefully comparing options are crucial steps in securing the best possible coverage. This section will guide you through essential considerations to avoid costly surprises and ensure you’re adequately protected during your Irish road trip.Selecting the right car rental insurance is a proactive approach to securing your financial well-being and ensuring a smooth journey.

A comprehensive understanding of the various factors influencing insurance choices will empower you to make informed decisions.

Factors to Consider When Selecting Car Rental Insurance

Careful consideration of several key factors is essential in selecting the optimal insurance plan. These factors encompass the type of vehicle you’ll be renting, the duration of your rental, your driving experience, and any potential risks specific to your itinerary.Rental vehicle type and duration are crucial. A luxury car carries a higher risk of damage compared to an economical model, influencing the necessary insurance coverage.

Similarly, a longer rental period often necessitates more comprehensive coverage to account for potential incidents.

Importance of Reading the Fine Print

Insurance policies often contain fine print that can significantly alter your understanding of the coverage. Thoroughly reviewing the terms and conditions is paramount to avoid unpleasant surprises later. This includes understanding exclusions, limitations, and specific clauses. Scrutinizing these details is a proactive measure against unforeseen costs.

Checklist for Evaluating Different Insurance Options

A structured approach to evaluating different insurance options can simplify the decision-making process. This checklist provides a systematic way to compare coverage levels, deductibles, and any associated fees.

- Coverage details: Verify the extent of coverage offered, encompassing damage, theft, and liability. Look for specific exclusions to ensure the policy addresses your potential needs.

- Deductibles: Understand the financial implications of deductibles. Higher deductibles typically result in lower premiums, but you’ll bear a larger financial burden in the event of a claim.

- Exclusions: Identify any exclusions from the coverage. These can range from specific types of damage to certain geographical areas.

- Limitations: Review the limitations on coverage. Consider factors like the daily or total mileage allowance, as well as potential time restrictions.

- Additional fees: Examine any extra fees associated with the policy, such as excess charges, administration fees, or other hidden costs.

Questions to Ask Hertz Ireland Representatives Before Booking

Proactively seeking clarification from Hertz Ireland representatives can prevent misunderstandings and ensure you have the right insurance coverage.

- Coverage details: Inquire about the specific coverage options available for your rental period, ensuring clarity on the different tiers and their associated costs.

- Deductible amounts: Understand the different deductible options and their impact on the premium.

- Exclusions: Ask about specific exclusions, like damage caused by specific events or circumstances.

- Limitations: Clarify any mileage restrictions, time constraints, or geographical limitations on the insurance coverage.

- Claim process: Understand the steps involved in filing a claim, including necessary documentation and the expected timeframe for resolution.

Avoiding Costly Surprises with Insurance Claims

A proactive approach to managing insurance claims can minimize potential financial burdens. This involves careful documentation, accurate reporting, and timely communication.

- Documentation: Thoroughly document any incidents, including photos and detailed descriptions of the damage.

- Accurate reporting: Ensure that the claim is reported accurately and completely to avoid delays or complications.

- Communication: Maintain open communication with the rental company and insurance provider throughout the claim process.

Claims and Dispute Resolution Procedures

Navigating the process of filing a claim or resolving a dispute with a car rental company like Hertz Ireland can be intricate. Understanding the steps involved and your rights as a renter can ease the process and ensure a fair outcome. This section details the procedures for filing claims, resolving disputes, and common issues.

Claim Filing Process with Hertz Ireland

Filing a claim with Hertz Ireland requires a structured approach. Documentation is crucial. Renters should meticulously retain all relevant paperwork, including the rental agreement, insurance documents, and any supporting evidence like accident reports or witness statements. This organized approach ensures the claim is processed efficiently.

- Contact Hertz Ireland Customer Support: The first step involves contacting Hertz Ireland customer support. This should be done promptly after the incident.

- Provide Necessary Information: Provide all requested details, including the rental agreement number, date of rental, and a clear description of the incident. Detailed documentation significantly aids in processing the claim.

- Documentation Submission: Submit all necessary documentation. This may include photos of damages, police reports, and witness statements. Complete and accurate documentation expedites the claim process.

- Claim Evaluation: Hertz Ireland will evaluate the claim based on the provided information and supporting documents.

- Settlement: Following the evaluation, Hertz Ireland will communicate the outcome of the claim. This may involve compensation for damages or a denial, with clear justification.

Dispute Resolution Steps

Disputes regarding insurance claims can arise, necessitating a structured resolution process. A well-defined approach to dispute resolution can resolve conflicts amicably.

- Contact Hertz Ireland Customer Support: Initially, contact Hertz Ireland’s customer support team for clarification and potential resolution. This provides an initial opportunity for addressing concerns directly.

- Review Insurance Policy Terms: Carefully review the insurance policy terms and conditions. This helps determine the scope of coverage and potential limitations.

- Documentation Review: Review all provided documentation, verifying accuracy and completeness. Ensure all necessary documents are available and correctly presented.

- Mediation (if applicable): Hertz Ireland may offer mediation to facilitate a mutually agreeable resolution. This involves a neutral third party to guide the conversation.

- Legal Action (as a last resort): If mediation fails, renters may consider legal action, though this should be a last resort. Consult with legal professionals for advice.

Common Insurance Claim Issues and Resolutions

Several common issues arise during insurance claims. Addressing these proactively can prevent delays and facilitate a smooth resolution.

- Incorrect Documentation: Errors in documentation can lead to claim rejection. Accuracy in reporting and providing necessary documents is crucial.

- Lack of Supporting Evidence: Insufficient evidence for the claim can result in rejection. Gather all relevant documentation to support the claim.

- Policy Exclusions: Understanding policy exclusions is vital. Claims falling outside the coverage scope will be rejected.

- Misunderstanding Policy Terms: Misinterpreting policy terms can lead to disputes. Reviewing the policy terms with clarity helps avoid misunderstandings.

- Delayed Responses: Delayed responses from Hertz Ireland can prolong the claim process. Proactive follow-up is essential.

Contacting Hertz Ireland Customer Support

Effective communication is key to resolving issues promptly. Hertz Ireland provides multiple channels for customer support.

- Phone: Hertz Ireland’s customer service number is a primary contact point.

- Online Portal: An online portal might facilitate communication and allow tracking of claims.

- Email: Hertz Ireland likely has an email address for customer support inquiries.

Rights of Renters in Insurance Disputes

Renters possess specific rights during insurance disputes. Understanding these rights empowers renters to navigate the process effectively.

- Right to Information: Renters have the right to clear and concise information regarding their claim status and the resolution process.

- Right to Representation: Renters can seek legal representation if needed. Consulting with a legal professional is advisable.

- Right to Fair Treatment: Renters deserve fair and transparent treatment throughout the dispute resolution process.

Case Studies of Insurance Claims

Insurance claims, whether successful or not, offer valuable insights into the intricacies of car rental insurance. Understanding how claims are handled, and the factors that influence outcomes, empowers customers to make informed decisions and navigate the process effectively. By examining case studies, we can gain a deeper appreciation for the importance of accuracy and documentation in the claims process.Analyzing successful claims at Hertz Ireland provides a blueprint for effective claims handling.

The outcomes of these claims, along with their underlying causes, illuminate the practical application of insurance policies. This allows customers to anticipate potential scenarios and prepare for a smoother experience should a claim arise.

Hypothetical Successful Claims

Successful claims at Hertz Ireland often hinge on meticulous documentation and the provision of accurate information. Below are a few hypothetical examples:

- Case 1: Damage from a Third Party: A Hertz Ireland customer rented a car and was involved in an accident where the other driver was at fault. The customer immediately contacted Hertz Ireland, documented the incident with police report, photos of the damage, and statements from witnesses. This comprehensive documentation facilitated a swift and successful claim settlement, covering repair costs and associated expenses.

The successful outcome highlights the significance of promptly reporting incidents and collecting all relevant evidence.

- Case 2: Theft of Rental Car: A customer rented a vehicle and parked it in a designated parking lot. Upon returning to the car, the customer noticed it was missing. Following procedures, the customer reported the theft to Hertz Ireland, submitting a police report, and providing proof of insurance coverage. Hertz Ireland, after verifying the information and the claim’s validity, successfully reimbursed the customer for the value of the vehicle.

- Case 3: Damage Due to a Natural Disaster: During a severe storm, a customer’s rental car sustained damage due to falling debris. The customer immediately contacted Hertz Ireland and provided pictures of the damage, a police report if available, and details of the incident. Hertz Ireland’s insurance provider assessed the situation and covered the repair costs. This exemplifies how natural disasters can be covered under certain circumstances, as long as accurate documentation is provided.

Factors Contributing to Successful Claims

The successful outcome of an insurance claim at Hertz Ireland often depends on several crucial factors:

- Accuracy of Information: Providing precise details about the incident, including dates, times, locations, and involved parties, is paramount. Inaccurate information can significantly hinder the claim process.

- Prompt Reporting: Reporting the incident as soon as possible after it occurs is essential. This helps preserve evidence and ensure that Hertz Ireland can initiate the claim process without delay.

- Comprehensive Documentation: Thorough documentation, such as photographs, police reports, witness statements, and repair estimates, is vital. These documents provide concrete evidence to support the claim.

Importance of Documentation

“Accurate documentation is the cornerstone of a successful insurance claim.”

The role of documentation in claims processing cannot be overstated. Comprehensive documentation not only supports the claim but also streamlines the claims process. This includes:

- Photos and Videos: Documenting the damage or incident with clear photos and videos is crucial. This provides a visual record of the situation and aids in assessing the extent of the damage.

- Police Reports: In cases of accidents or theft, obtaining a police report is essential for verifying the incident’s details. This is especially important for establishing liability.

- Witness Statements: If witnesses were present during the incident, their statements can provide valuable information to support the claim.

Illustrative Table of Successful Claims

The following table illustrates the details of some successful insurance claims at Hertz Ireland:

| Case Study | Incident | Documentation | Outcome |

|---|---|---|---|

| Case 1 | Third-party accident | Police report, photos, witness statement | Repair costs covered |

| Case 2 | Theft | Police report, proof of insurance | Vehicle value reimbursed |

| Case 3 | Storm damage | Photos, police report, repair estimate | Repair costs covered |

Recent Developments and Trends in Car Rental Insurance: Hertz Ireland Car Rental Insurance

The Irish car rental insurance landscape is constantly evolving, mirroring broader market trends and adapting to changing renter needs. This dynamic environment necessitates a keen understanding of recent developments for informed decision-making. Renters must stay abreast of evolving policies to secure appropriate coverage and avoid financial surprises.Recent shifts in the car rental insurance market in Ireland demonstrate a focus on both enhancing coverage and streamlining the claims process.

Technological advancements are significantly impacting how insurance is managed, offering more convenient and transparent options for customers. Understanding these shifts allows renters to select insurance packages that align with their specific needs and budget.

Policy Additions and Modifications

Recent years have seen a growing emphasis on comprehensive coverage options. Hertz, in particular, has introduced or modified policies to better cater to diverse customer needs. These adjustments might include increased coverage for specific incidents (e.g., damage from severe weather events) or modifications to excess liability limits. Furthermore, some insurance providers are now offering flexible payment options, allowing renters to spread the cost of insurance over time.

New Coverage Options for Renters

Several new coverage options for renters have emerged, reflecting a broader understanding of the potential risks associated with car rentals. These might include added coverage for personal belongings stored within the vehicle or roadside assistance beyond the usual mechanical breakdowns. The rise of “all-inclusive” packages encompassing various protection options is another significant trend. Some policies now also include coverage for accidents caused by uninsured or hit-and-run drivers, offering renters enhanced peace of mind.

Impact of Technological Advancements

Technological advancements are profoundly impacting insurance processes, making them more efficient and transparent. Digital platforms enable renters to easily access policy details, manage claims, and track the status of their insurance in real-time. Hertz’s online portal, for instance, might allow renters to digitally file claims or request policy modifications. The implementation of digital tools also helps to prevent fraud and expedite the claims process.

Role of Online Tools for Managing Insurance

Online tools are playing an increasingly significant role in managing car rental insurance. Renters can now access policy documents, view their coverage details, and manage their insurance online through Hertz’s website or app. These online tools provide real-time information on claims status and the ability to submit claims electronically. This digitization simplifies the process, allowing for more convenient and faster claim settlements.

Alternatives to Hertz Ireland Car Rental Insurance

Navigating the world of car rental insurance can feel like navigating a complex maze. Understanding your options beyond the rental company’s offerings is crucial for making informed decisions. This section explores alternative insurance avenues, empowering you to choose the best fit for your needs.Beyond the Hertz Ireland package, various options exist to supplement or replace their coverage. Careful consideration of these alternatives can save money and potentially offer broader protection.

Alternative Car Rental Insurance Providers in Ireland

Several companies offer comprehensive car rental insurance in Ireland, often with competitive pricing and varying coverage. These alternatives frequently cater to specific needs, whether it’s enhanced accident protection or additional liability coverage. A thorough comparison of policies is vital for identifying the most suitable option.

- Independent Insurance Brokers: These brokers act as intermediaries, offering a wide range of insurance products from multiple providers. They can assist in comparing policies, tailoring coverage to individual needs, and securing the most advantageous terms. This approach allows for tailored coverage, potentially surpassing the standard options provided by rental companies.

- Direct Insurance Companies: Many direct insurance providers offer car rental insurance packages, often with flexible options and potentially more competitive premiums than those through rental agencies. Direct companies might offer customized packages and tailored exclusions.

- Travel Insurance Providers: Travel insurance policies sometimes include car rental insurance as an add-on. These policies are particularly useful for travelers who require comprehensive coverage for various aspects of their trip, including vehicle damage or liability issues. Travel insurance can provide a one-stop shop for various trip contingencies.

Securing Supplemental Insurance

Purchasing supplemental insurance alongside the rental company’s base policy can provide enhanced coverage. This can include adding specific protections against damages or liability situations not covered by the standard Hertz offering. Many policies allow customization of coverage limits and exclusions.

- Adding Collision Damage Waiver (CDW): This supplementary coverage often protects against damage to the rented vehicle, regardless of who is at fault. A significant advantage of CDW is its ability to safeguard against unforeseen circumstances.

- Third-Party Liability Insurance: This coverage addresses liability for damages or injuries to others during an accident involving the rental vehicle. A separate liability policy can provide comprehensive protection beyond the rental company’s standard offering. It protects against potential financial burdens.

Third-Party Insurance Providers: Pros and Cons

Employing a third-party insurance provider for car rental coverage has both advantages and disadvantages. The key is to weigh these factors against your specific needs and preferences.

| Factor | Pros | Cons |

|---|---|---|

| Cost | Potentially lower premiums compared to rental company insurance. | May require careful comparison shopping and understanding of policy nuances. |

| Coverage | Potentially broader coverage options, including tailored add-ons. | Policy exclusions and limitations must be thoroughly reviewed. |

| Convenience | Insurance purchase often separate from the rental process, allowing for greater flexibility. | Potential complexity in navigating multiple providers and policies. |

Purchasing Insurance Separately

Purchasing car rental insurance independently involves several steps. This approach offers the flexibility to choose specific coverages and adjust limits to suit personal needs. Transparency is key to ensure that the policy effectively addresses potential risks.

- Research and Comparison: Thorough investigation of various providers and policies is essential to identify the most suitable coverage and price. Understanding policy details is crucial.

- Policy Review: Careful scrutiny of policy terms and conditions, including coverage limits, exclusions, and claim procedures, is vital. This helps avoid unexpected costs and clarifies the extent of protection.

- Purchase and Documentation: Completing the purchase process and retaining copies of the insurance documents are essential for future reference. Accurate record-keeping is crucial for any claims.

Coverage Limits of Supplemental Insurance

Understanding the coverage limits of supplemental insurance is crucial for making informed decisions. This encompasses the maximum amount the insurance will cover for various situations, such as damage to the vehicle or liability for injuries to others. The limits often vary depending on the specific policy and provider.

- Specific Limits: Different policies may have varying limits for damages, personal injury, or liability. It is vital to understand these specifics to ascertain sufficient coverage.

- Reviewing Exclusions: Careful review of exclusions is critical to avoid misunderstandings. Knowing what is not covered can help avoid potential surprises during a claim.

- Policy Limitations: Policies may have limitations on the number of claims or the duration of coverage. This information should be carefully reviewed to understand the limitations.

Final Summary

In conclusion, understanding Hertz Ireland car rental insurance is crucial for any traveler renting a car in Ireland. This guide has provided a thorough overview of the available options, helping you compare Hertz’s offerings to competitors, understand the terms and conditions, and prepare for potential claims. By taking the time to research and understand your insurance, you can protect yourself from unexpected expenses and enjoy your trip with peace of mind.

Remember to carefully review all policy details before making a decision.

Question & Answer Hub

What are the common exclusions in Hertz Ireland insurance policies?

Common exclusions often include pre-existing damage, wear and tear, damage caused by negligence, and damage resulting from specific activities like off-road driving or using the vehicle for commercial purposes. Always review the specific policy documents for complete details.

How do I file a claim with Hertz Ireland?

The process usually involves reporting the incident to Hertz immediately, documenting the damage with photos, and providing necessary information like your rental agreement details and contact information. Hertz will provide specific instructions depending on the nature of the claim.

What are the key differences between Hertz Ireland and other major rental companies’ insurance options?

Differences can lie in the specific coverage levels (e.g., liability, collision, comprehensive), pricing structures, and exclusions. Comparing quotes from different companies is essential to make an informed decision.