Hertz Ireland car rental insurance provides a crucial layer of protection for travelers. This comprehensive guide delves into the specifics of Hertz’s insurance offerings, comparing them to competitor options in the Irish market. It details the various coverage types, excess amounts, and associated costs, enabling informed decisions regarding rental insurance selection. The document also addresses essential Irish driving regulations, the claims process, and additional coverage options, ensuring a complete understanding of the insurance landscape.

Understanding the different insurance tiers and their associated coverages is crucial. A comparative analysis of Hertz’s policies against those of other major rental companies is presented, offering valuable insight into the market landscape. Factors like excess amounts and pricing strategies are examined, aiding in the selection of the most suitable insurance option. This analysis also addresses the implications of inadequate insurance and potential penalties under Irish law.

Overview of Car Rental Insurance in Ireland

Hiring a car in Ireland can be a breeze, but understanding the insurance options is key to a smooth trip. Different companies offer various levels of protection, ensuring you’re covered for different eventualities. Knowing what’s included in each package helps you choose the right level of insurance for your needs and budget.

Common Car Rental Insurance Options

Car rental insurance in Ireland typically includes options ranging from basic coverage to comprehensive protection. These options vary significantly in the types of incidents they cover and the level of financial responsibility they transfer. This means you need to carefully consider what kind of protection you need.

Types of Coverages

Common coverages include collision damage waiver (CDW), theft protection, and liability insurance. CDW protects you from damage to the rental car, regardless of who is at fault. Theft protection covers the loss of the vehicle. Liability insurance covers any damage you cause to other people’s property or injury to others. Understanding the specifics of these coverages is crucial to selecting the right plan.

Insurance Tiers and Protection Levels

Insurance tiers often differentiate by the level of excess (the amount you’re responsible for paying in the event of an accident or damage) and the breadth of protection. A basic policy might have a higher excess and fewer coverages than a premium package. Higher tiers typically offer greater protection and a lower excess, although this comes at a higher cost.

Consider the potential risks you face when renting a car and choose the appropriate level of protection.

Insurance Option Comparison Table

| Insurance Type | Coverage | Excess | Cost |

|---|---|---|---|

| Basic | Collision damage, theft, third-party liability. This is a bare minimum coverage, and the excess is often significant. | €1,000 – €2,000 (or more). This can vary greatly depending on the rental company and the vehicle type. | Generally the most affordable option. |

| Premium/Comprehensive | Collision damage, theft, third-party liability, and often additional coverages like windscreen damage, accidental damage, and personal accident cover. | €0 – €500 (or less). The excess is often significantly lower than basic options. | Higher than basic, but often worth the cost for added protection. |

Hertz Car Rental Insurance Specifics

Hertz offers various insurance packages to suit different needs and budgets for car rentals in Ireland. Understanding these options is crucial for ensuring your trip goes smoothly and you’re protected against unexpected expenses. This section dives deep into the details of Hertz’s insurance offerings, highlighting key features and comparisons to competitors.

Insurance Package Options

Hertz provides a range of insurance options, allowing you to choose the level of coverage that best fits your needs and anticipated risk. Each package has different levels of protection and excess amounts. Carefully considering these options is essential to avoid unnecessary financial burdens.

| Package Name | Coverage | Excess | Price |

|---|---|---|---|

| Basic Insurance | Covers damage to the vehicle, theft, and third-party liability. | €1,500 | €15-€25 per day (dependent on rental period and car type). |

| Enhanced Insurance | Provides comprehensive coverage including damage, theft, third-party liability, and personal accident insurance. | €0 | €20-€30 per day (dependent on rental period and car type). |

| Premium Insurance | Covers all aspects of the Basic and Enhanced package, plus additional benefits such as windscreen damage and fire damage. | €0 | €25-€35 per day (dependent on rental period and car type). |

Excess Amounts Explained

The excess amount is the portion of the damage or loss that you’re responsible for paying. Understanding this is crucial when choosing your insurance package. Lower excesses typically mean you pay less if something goes wrong, but this often comes with a higher daily insurance cost.

Purchasing Insurance Directly from Hertz

You can purchase insurance directly from Hertz at the time of booking your rental. This is often the most convenient and straightforward approach, ensuring you’re covered from the start. Hertz also provides online booking facilities and phone support to assist you.

Comparison to Competitors

Comparing Hertz’s insurance packages with those of competitors like Enterprise or Avis is essential. Look at the specific coverage, excess amounts, and prices. Hertz often provides competitive pricing, but you should check specific deals and promotions for the best overall value.

Purchasing Insurance

The process for purchasing insurance directly from Hertz is generally straightforward. During the online booking process, you’ll be presented with various insurance options. Select the one that best fits your needs and complete the booking. You can also contact Hertz directly for further assistance.

Comparing Hertz to Other Rental Companies

Choosing the right car rental insurance in Ireland can feel like navigating a maze. Different companies have different policies, excess fees, and pricing structures. Understanding how Hertz stacks up against other major players can save you money and headaches.Comparing Hertz’s insurance packages to those of rivals like Enterprise, Avis, and Budget reveals a mixed bag. Factors like excess charges, add-on options, and overall pricing vary significantly.

Understanding these nuances is key to getting the best deal.

Insurance Policy Differences

Different rental companies tailor their insurance offerings to suit various customer needs and risk profiles. Some companies emphasize comprehensive coverage, while others focus on more basic protection. Understanding these differences is crucial for making an informed decision. Hertz, like other major rental firms, offers a range of options, including optional extras, each with its own set of limitations and costs.

Excess Charges

Excess charges are a significant factor in insurance costs. They represent the amount you’re responsible for paying if your rental vehicle is damaged or stolen. Hertz’s excess policies can vary depending on the type of insurance package you select. Other companies might have similar structures, but the specific amounts and associated conditions often differ. It’s vital to compare the excess amounts across various rental agencies.

Pricing Strategies

Rental companies employ diverse pricing strategies for insurance. Some companies offer a base insurance package that includes liability coverage. Others offer a more comprehensive coverage at a higher price. Hertz’s pricing model for insurance is one example. Knowing the pricing structure of the different rental agencies allows you to choose the most cost-effective option.

Factors like your driving history, the type of vehicle, and the duration of the rental can influence the cost.

Comparison Table

| Rental Company | Insurance Option | Excess | Price |

|---|---|---|---|

| Hertz | Basic Insurance | €1,500 | €25 per day |

| Hertz | Enhanced Insurance | €0 | €40 per day |

| Enterprise | Basic Insurance | €1,000 | €20 per day |

| Avis | Basic Insurance | €1,200 | €22 per day |

| Budget | Basic Insurance | €1,800 | €28 per day |

Note: Prices are estimated and may vary based on specific rental conditions and dates.

Understanding Ireland’s Driving Regulations: Hertz Ireland Car Rental Insurance

Ireland’s driving regulations are pretty straightforward, but knowing them is crucial for a smooth and stress-free trip. These rules apply to all drivers, regardless of their nationality. Understanding these rules ensures you’re compliant and avoid potential issues with the law.Ireland takes road safety seriously, and having adequate insurance is a key component of that. This section dives into the specifics of Irish driving regulations, focusing on the insurance aspects, and the implications of not meeting these requirements.

Irish Driving Regulations Regarding Insurance

Irish law mandates that all vehicles on the road have valid insurance. This is not just a suggestion; it’s a legal requirement. This insurance covers potential damage to other people’s property or injury to other people in case of an accident. Failure to comply with this regulation has serious consequences.

Implications of Insufficient Insurance

Failing to carry sufficient insurance can lead to hefty fines, potentially even criminal charges. Driving without insurance can result in a substantial penalty. You could face immediate action from the authorities and even the potential seizure of your vehicle.

Penalties for Driving Without Proper Insurance

The penalties for driving without proper insurance in Ireland are significant. Fines are substantial and can vary depending on the specific circumstances, but are usually in the hundreds or even thousands of Euros. In some cases, a court order to pay compensation could also be issued to the injured party. Furthermore, driving without insurance could impact your ability to obtain insurance in the future, making it harder and more expensive to obtain in the future.

Requirements for International Drivers

International drivers need to adhere to the same insurance regulations as Irish drivers. If you’re renting a car, ensure that the rental company’s insurance covers you. Even if you have insurance from your home country, you’ll likely need to prove this meets the Irish standard and be aware of any limitations in coverage. If you are uncertain, always contact the relevant authorities for clarification.

Summary of Legal Obligations for Car Rental Insurance in Ireland

In summary, all drivers in Ireland, including international visitors, must ensure their vehicle is covered by valid insurance. Renting a car obligates the rental company to provide insurance coverage. This insurance needs to meet the standards of Irish law. Failure to meet these obligations can result in significant legal and financial consequences.

Tips for Choosing the Right Insurance

Picking the right car rental insurance in Ireland is crucial for a smooth and stress-free trip. It protects you from unexpected costs and ensures you’re covered in case of accidents, damage, or theft. Understanding the various options available and how they apply to your specific needs is key.

Factors to Consider When Selecting Insurance

Careful consideration of several factors is essential when choosing car rental insurance. These factors range from the specific terms of the policy to the overall costs involved. Understanding these details will help you make an informed decision.

- Coverage Extent: Evaluate the scope of the insurance package. Does it cover damage to the rental car, personal injury, or third-party liability? Policies differ significantly, and a comprehensive understanding of what’s included is paramount.

- Excess (Deductible): The excess is the amount you’ll pay out-of-pocket if you make a claim. A lower excess usually means a higher premium. Think about your budget and how much you’re comfortable paying in the event of an accident or damage.

- Rental Duration: The length of your rental period will influence the cost of the insurance. A longer rental period often results in a higher premium. Factor this into your overall budget.

- Driver Profile: Consider the driver’s experience and driving record. A novice driver might require a higher level of coverage and a higher premium. Be aware of your driver profile and adjust your insurance choice accordingly.

- Pre-existing Conditions: If you have any pre-existing conditions or a history of accidents, it’s important to be aware of the implications on insurance coverage. Review the specific terms and conditions.

Comparing Prices and Coverage Across Options

Comparing car rental insurance across different providers is a critical step in finding the best deal. There are several methods to efficiently compare policies and prices.

- Use Comparison Websites: Online comparison websites can provide an overview of various insurance packages from different rental companies. This allows you to quickly compare prices and coverage without needing to contact each provider individually.

- Contact Rental Companies Directly: Don’t hesitate to contact the rental companies directly for quotes. This allows for a personalized discussion of your needs and can lead to better-tailored insurance packages.

- Check Third-Party Providers: Consider third-party insurance providers who offer supplementary or alternative options. They might offer competitive rates or specific coverages.

Reading the Fine Print of Insurance Policies

Thoroughly reviewing the fine print is vital to fully understanding the terms and conditions of your chosen insurance policy. This meticulous review will prevent unexpected issues down the road.

- Understand Exclusions: Policies often contain exclusions, such as pre-existing damage or specific types of usage. Carefully review these exclusions to ensure you understand what isn’t covered.

- Verify Claim Procedures: Knowing the steps for making a claim will prove invaluable in case of an incident. Ensure you are comfortable with the procedures and the timeframe.

- Look for Limitations: Insurance policies may have limitations on the amount of coverage or the duration of the protection. Ensure the limitations align with your needs.

Maximizing Protection Without Overspending

Finding a balance between comprehensive coverage and cost-effectiveness is crucial. There are ways to maximize protection without breaking the bank.

- Consider Excess Options: Evaluate the potential for increasing the excess (deductible) to lower the premium. If you are confident in your ability to manage the financial responsibility, this can save you money.

- Evaluate Coverage Levels: Carefully consider the level of coverage you require. While comprehensive insurance is valuable, it might not be necessary if you are only traveling for a short duration.

- Compare Add-ons: Look for add-ons that can supplement the basic policy, such as roadside assistance or additional driver coverage, and carefully weigh whether they are necessary.

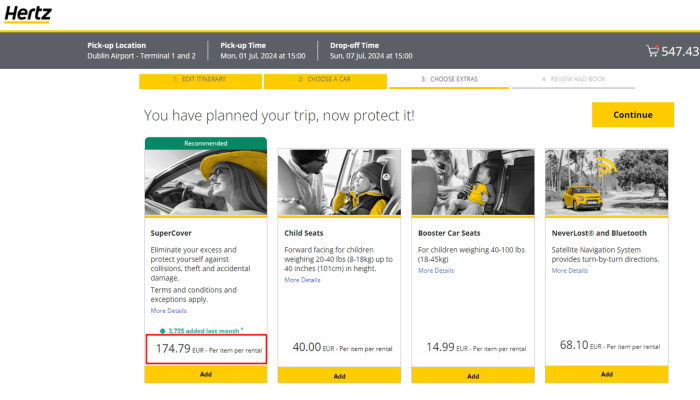

Additional Coverage Options

Picking the right insurance for your rental car goes beyond the basics. Sometimes, standard policies don’t cover everything you might need. That’s where optional add-ons come in handy, offering peace of mind for various situations.These extra coverages can protect you from unexpected expenses and ensure a smoother rental experience. Understanding these options is key to making an informed decision.

Optional Add-on Coverages

Additional coverages are crucial to complement your base insurance. They often address specific scenarios or provide broader protection. These extras can be customized to your needs and budget.

- Personal Accident Insurance: This coverage protects you and your passengers in case of injury during your rental. It’s an important addition, especially for longer trips or when traveling with others. It usually covers medical expenses and potential lost wages due to injury. For instance, a sudden accident on a winding Irish road could result in significant medical bills, and this insurance would help offset those costs.

- Child Seat Insurance: If you’re renting a car with children, child seat insurance is essential. It’s important to confirm with the rental company if a child seat is required for your journey. This coverage often protects the rental company from any damage or liability related to the child seat. This is critical to ensure your trip is compliant with local regulations, and that the child is properly secured.

- GPS Device or Navigation Coverage: A GPS or navigation system can make your Irish road trip easier. Some rental companies might charge extra if you damage the equipment. Optional coverage would cover any costs related to the GPS if it’s damaged during the rental period. This is particularly helpful for unfamiliar routes or for tourists unfamiliar with the Irish road network.

Additional Costs

It’s crucial to understand the extra cost of these options. The prices can vary based on the rental period, the type of car, and the specific coverage. Rental companies usually list the exact price breakdown of these additional coverages on their websites.

| Coverage | Typical Cost Example (per day) |

|---|---|

| Personal Accident Insurance | €5-€10 |

| Child Seat Insurance | €2-€5 |

| GPS Device Coverage | €3-€7 |

Additional costs can be substantial. Comparing quotes from different rental companies is a good way to get the best deal.

Insurance Claims Process

Filing a claim with Hertz Ireland car rental insurance is straightforward, but having the right information and documentation ready will speed up the process. Understanding the steps involved beforehand can ease any stress or confusion during the claim procedure. Follow these steps to ensure a smooth and efficient claim resolution.The Hertz Ireland car rental insurance claim process is designed to be efficient and transparent.

It is crucial to gather all required documentation to expedite the process and avoid delays. This comprehensive guide Artikels the necessary steps and information to help you file a claim effectively.

Claim Procedure Overview

This section provides a step-by-step guide to help you navigate the Hertz Ireland car rental insurance claim process.

- Initial Contact and Report: Immediately after an incident, contact Hertz Ireland customer service or your designated contact person. Provide them with a detailed account of the event, including the time, location, and nature of the damage or incident. Documenting the event with photos or videos is strongly recommended to support your claim. This initial report is critical in initiating the claim process and ensuring a timely response.

- Gathering Documentation: Collect all necessary documentation. This typically includes your rental agreement, proof of purchase, police report (if applicable), and any relevant repair quotes. Detailed photos and videos of the damage to the vehicle are essential evidence. It’s recommended to get a written statement from any witnesses if possible.

- Claim Submission: Hertz will guide you on the necessary steps for submitting your claim online or via a designated form. Ensure you provide all the required information accurately and completely. Complying with the provided instructions will expedite the process.

- Evaluation and Assessment: Hertz will evaluate the claim based on the provided documentation. This may involve an inspection of the damaged vehicle. They may contact you for further information or clarification. Be prepared to answer any questions and provide additional documents if necessary.

- Claim Resolution: Upon claim approval, Hertz will inform you of the next steps. This may include repairs or a settlement, depending on the nature of the claim and the policy coverage. You’ll be kept updated throughout the process.

Required Documentation

Providing the correct documentation is vital for a smooth claim process. Ensure that you have the necessary materials ready to avoid delays.

- Rental Agreement: This document details the rental terms, including the vehicle’s condition at the start of the rental period.

- Proof of Purchase: Evidence of your payment for the rental, showing the rental dates and amount paid.

- Police Report (if applicable): A police report is often required for incidents involving accidents or damage requiring police intervention. It’s crucial for legal purposes.

- Repair Quotes: Estimates for repairs to the vehicle from a trusted mechanic. These quotes will be used to assess the cost of the damage.

- Photos and Videos: Comprehensive visual documentation of the damage to the vehicle, taken immediately after the incident.

- Witness Statements (if applicable): Written statements from any witnesses to the incident can be extremely helpful.

Tips for a Smooth Claim Process, Hertz ireland car rental insurance

Following these tips can help you navigate the claim process efficiently.

- Communicate Effectively: Maintain open communication with Hertz throughout the claim process. Promptly respond to any requests for information or clarification.

- Be Accurate and Detailed: Provide precise details about the incident and damage to the vehicle. Accurate information will expedite the claim process.

- Keep Copies: Retain copies of all documents submitted for your records. This is crucial for future reference.

- Be Patient: The claim process may take time, depending on the complexity of the claim. Stay patient and cooperative throughout the process.

Ultimate Conclusion

In conclusion, Hertz Ireland car rental insurance is a critical aspect of the Irish rental car experience. Careful consideration of coverage levels, excess fees, and comparative pricing among rental agencies is paramount. Understanding Ireland’s driving regulations and the claims process are equally important. By thoroughly evaluating these factors, travelers can select the optimal insurance package, balancing protection with cost-effectiveness.

Additional coverage options, such as personal accident insurance, should also be considered to ensure comprehensive protection. This guide provides a comprehensive overview to empower informed decision-making for rental car insurance in Ireland.

Q&A

What is the typical excess amount for a basic Hertz insurance package?

The excess amount for a basic Hertz insurance package varies depending on the specific vehicle and rental period. Refer to the Hertz Ireland website for the most up-to-date information.

What documentation is required for a Hertz insurance claim?

Documentation requirements for a Hertz insurance claim typically include the rental agreement, police report (if applicable), and proof of damage to the vehicle.

What are the penalties for driving without adequate insurance in Ireland?

Driving without adequate insurance in Ireland carries potential penalties, including fines and potential legal action. Consult the relevant Irish government websites for precise details.

Are there any specific requirements for international drivers regarding insurance in Ireland?

International drivers renting a car in Ireland are subject to the same insurance requirements as Irish residents. Verification of adequate coverage is essential.