How much is gap insurance for a car? Figuring out the cost can be a bit of a minefield. It’s all about how much your car is worth, compared to how much you owe on it. A low-value car with a tiny loan might only need a tiny amount of gap cover, while a top-end ride with a hefty loan could demand a hefty premium.

Understanding the factors influencing the price is key to getting the right protection for your wheels.

This guide dives deep into the factors impacting gap insurance costs for cars, from vehicle valuation to loan amounts and the role of your insurer. We’ll break down the calculations and give you clear examples so you can estimate your own needs.

Defining Gap Insurance

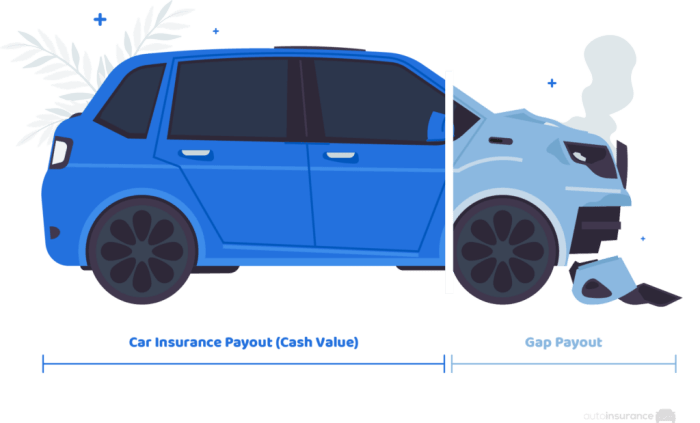

Gap insurance, a crucial yet often overlooked component of vehicle ownership, provides financial protection against unforeseen circumstances that can leave you significantly out of pocket. It acts as a safety net, bridging the gap between the amount your car insurance pays out and the actual value of your vehicle. Understanding its intricacies and when it’s essential is key to responsible car ownership.Gap insurance specifically addresses the difference between the outstanding loan amount on a vehicle and the market value of the vehicle.

This difference, often significant, can arise in instances of total loss or significant damage, leaving the borrower responsible for the remaining debt. Gap insurance steps in to cover this shortfall, ensuring the lender is repaid even if the vehicle’s value is less than the loan amount. This critical feature protects you from unexpected financial burden and provides peace of mind.

Gap Insurance Necessity

Gap insurance is particularly vital when the value of a vehicle depreciates rapidly or when the loan amount exceeds the vehicle’s market value. This situation is more common than you might think, as depreciation can significantly impact the value of a car, particularly newer models. The need for gap insurance is heightened when purchasing a vehicle with a significant loan.

Gap Insurance vs. Comprehensive Coverage

Gap insurance differs fundamentally from comprehensive coverage, a standard component of most car insurance policies. Comprehensive coverage primarily addresses damage from perils like vandalism, theft, or weather-related events. Gap insurance, however, focuses on the financial difference between the vehicle’s loan value and its diminished market value in the event of a total loss or significant damage. While comprehensive coverage protects the vehicle itself, gap insurance protects the financial responsibility of the loan.

Examples of Gap Insurance Protection

Consider a scenario where a policyholder owns a car with a $25,000 loan balance. The vehicle’s current market value is $20,000. In a total loss accident, the comprehensive insurance might cover only $20,000. Without gap insurance, the policyholder would still owe $5,000 to the lender. Gap insurance covers this remaining amount, relieving the policyholder of this financial burden.

Comparison Table: Gap Insurance and Other Car Insurance Types

| Characteristic | Gap Insurance | Comprehensive Coverage | Collision Coverage |

|---|---|---|---|

| Coverage Focus | Financial responsibility for outstanding loan amounts exceeding vehicle value in case of significant loss or damage. | Damage to the vehicle from perils like vandalism, theft, or weather-related events. | Damage to the vehicle in a collision with another vehicle or object. |

| Coverage Trigger | Total loss or significant damage resulting in vehicle value falling below loan amount. | Damage from covered perils. | Collision with another vehicle or object. |

| Relationship to Loan | Directly related to outstanding loan amount. | No direct relationship to loan amount. | No direct relationship to loan amount. |

| Payment for Loss | Covers the difference between the loan amount and the vehicle’s market value. | Pays for the repair or replacement of the damaged vehicle. | Pays for the repair or replacement of the damaged vehicle. |

Factors Influencing Gap Insurance Costs

Gap insurance premiums are not a fixed amount; they fluctuate based on several crucial factors. Understanding these variables is key to accurately estimating the cost and making informed decisions about purchasing this type of coverage. A comprehensive understanding allows drivers to select the most suitable policy for their financial situation and vehicle.

Vehicle Value

The market value of the vehicle directly influences the gap insurance premium. Higher-value vehicles typically result in higher premiums. This correlation is logical; a more expensive vehicle has a greater potential gap between its actual value and the outstanding loan amount. For instance, a luxury car with a significant loan balance will likely command a higher gap insurance premium compared to a more modestly priced vehicle.

The insurer assesses the current market value of the vehicle using various methods, including manufacturer suggested retail price (MSRP), independent appraisals, and online market data.

Loan Amount

The amount borrowed to purchase the vehicle significantly impacts the gap insurance premium. A larger loan translates to a larger potential gap, leading to a higher premium. The insurance company calculates the difference between the vehicle’s value and the outstanding loan balance to determine the gap coverage amount. This calculation is a critical component of the gap insurance premium determination.

For example, a loan of $30,000 on a vehicle worth $25,000 would result in a smaller gap than a loan of $40,000 on the same vehicle, requiring a different premium.

Insurance Provider

Different insurance providers have varying pricing strategies for gap insurance. Factors like overhead costs, operational efficiency, and profit margins contribute to the price. Additionally, their market positioning and competitive pressures influence the premium they charge. Comparing quotes from different insurance providers is essential for obtaining the most competitive rate.

Figuring out how much gap insurance costs for your car can be tricky, right? Well, if you’re in the Newark, New Jersey area, you might want to check out Gary’s Insurance, a reputable company offering car insurance solutions. gary’s insurance newark new jersey They can give you a personalized quote and help you understand your options.

Ultimately, the cost of gap insurance depends on factors like your car’s make and model, but it’s a crucial policy to consider for peace of mind.

Comparison of Gap Insurance Costs Across Companies

Comparing gap insurance costs across different insurance companies is crucial for obtaining the most competitive rate. A comparison should consider not only the premium amount but also the coverage details and any additional benefits offered by each provider. By comparing quotes from multiple companies, drivers can identify the most favorable coverage options.

Factors Affecting Gap Insurance Costs

| Factor | Influence on Cost |

|---|---|

| Vehicle Value | Higher value vehicles typically result in higher premiums. |

| Loan Amount | Larger loan amounts lead to higher premiums due to the increased potential gap. |

| Insurance Provider | Different providers have varying pricing strategies based on factors such as overhead, operational efficiency, and profit margins. |

| Vehicle Age | Older vehicles may have lower premiums, but this depends on their current market value. |

| Vehicle Make and Model | Certain makes and models might have higher premiums due to their popularity or historical repair costs. |

Calculating Gap Insurance Premiums

Navigating the complexities of auto insurance can feel daunting. Understanding how gap insurance premiums are calculated is crucial for making informed decisions. This process involves evaluating several factors to determine the appropriate coverage amount and premium.Calculating gap insurance premiums is a straightforward process when you break it down. The premium reflects the difference between the vehicle’s loan amount and its depreciated value.

This crucial aspect ensures the lender is fully protected against financial loss if the vehicle’s market value drops below the outstanding loan balance.

Determining the Gap Insurance Coverage Amount

The gap insurance coverage amount represents the difference between the vehicle’s loan amount and its anticipated depreciated value. This amount is critical for calculating the premium, as it directly impacts the cost of the insurance. The calculation typically involves assessing the vehicle’s initial value, the loan amount, and projected depreciation over time. Accurate estimation of these factors is paramount to ensure appropriate coverage.

Factors Influencing Gap Insurance Premium Calculation

Several factors influence the final gap insurance premium. The most significant include the vehicle’s initial value, the loan amount, and the projected rate of depreciation. The specific depreciation rate will vary based on the vehicle’s make, model, year, and mileage. Insurers often use industry-standard depreciation schedules to determine this value. Furthermore, the loan terms, including the loan duration, play a role in calculating the premium.

A longer loan term typically results in a higher premium due to the extended period of potential depreciation.

A Step-by-Step Guide for Estimating Gap Insurance Costs

Estimating gap insurance costs involves a systematic approach. Understanding the elements of the calculation will enable informed decisions.

- Assess the vehicle’s initial value: Determine the vehicle’s market value at the time of purchase. This can be obtained from online resources, dealerships, or independent appraisals. This step sets the baseline for the calculation.

- Determine the loan amount: Obtain the total amount financed for the vehicle. This is the loan amount that will be used in the calculation.

- Estimate the projected depreciation: This involves forecasting the decline in the vehicle’s value over time. Insurers often use industry-standard depreciation schedules to estimate this value. Consider factors such as the vehicle’s age, mileage, condition, and market trends.

- Calculate the gap amount: Subtract the estimated depreciated value from the loan amount. This is the gap that needs to be covered.

- Determine the premium: The premium is calculated based on the gap amount and the coverage period. The premium is often a percentage of the gap amount, or a flat rate per year. This step depends on the insurance provider.

The Role of Depreciation in Calculating Gap Insurance Premium

Depreciation is the key factor in calculating the gap insurance premium. It reflects the decrease in a vehicle’s value over time. This decline is influenced by factors like wear and tear, technological advancements, and market trends. A vehicle that depreciates quickly will have a higher gap amount and, consequently, a higher premium.

Illustrative Calculation

Imagine a $30,000 car with a $25,000 loan. If the estimated depreciation after three years is $5,000, the gap amount is $5,000. A 1% annual premium on the gap amount would result in a $50 annual premium.

Table: Calculation Steps

| Step | Description |

|---|---|

| 1 | Determine vehicle’s initial value. |

| 2 | Obtain the loan amount. |

| 3 | Estimate projected depreciation over the loan term. |

| 4 | Calculate the gap amount (loan amount – depreciated value). |

| 5 | Determine the premium based on the gap amount and coverage period. |

Comparing Gap Insurance Policies

Navigating the landscape of gap insurance policies can feel like deciphering a complex code. Understanding the nuances of coverage, exclusions, and provider differences is crucial for securing the best possible protection for your vehicle. This section delves into the comparative analysis of gap insurance policies, highlighting key features and potential limitations to empower informed decision-making.

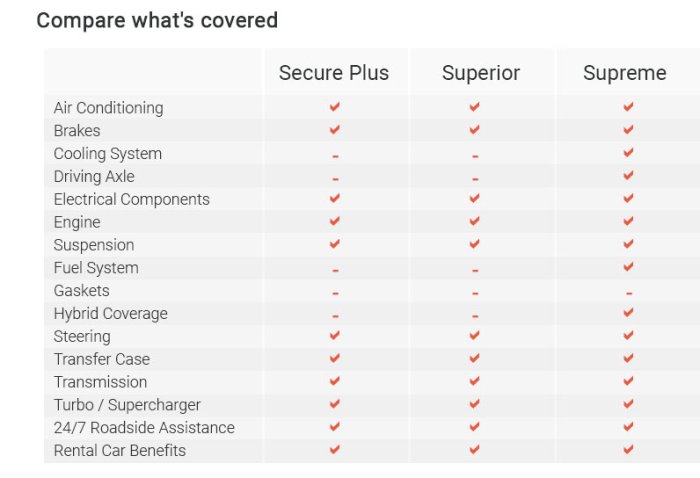

Key Features and Benefits of Different Policies, How much is gap insurance for a car

Various insurers offer gap insurance policies with varying features. Understanding these features empowers you to select a policy aligning with your specific needs and financial circumstances. A policy might offer coverage for depreciation beyond your loan amount, ensuring you’re not liable for the difference between the vehicle’s value and what you owe. Some policies may offer optional add-ons, such as coverage for damage exceeding the deductible.

- Comprehensive Coverage Options: Some policies may offer broader coverage, encompassing various types of damage, from accidents to theft or natural disasters. Others may focus on specific perils, like collision or comprehensive damage.

- Loan-Specific Coverage: Policies often tailor coverage to your outstanding loan balance. This ensures your coverage aligns precisely with the amount you owe, minimizing gaps in protection.

- Add-on Protections: Beyond the standard gap coverage, certain policies may include add-ons like rental car reimbursement, towing services, or even temporary vehicle replacement during repair.

Exclusions and Limitations of Different Policies

Gap insurance policies, like any insurance product, have exclusions and limitations. Carefully reviewing these aspects is crucial for avoiding unpleasant surprises. Some policies may exclude coverage for certain types of damage, such as those resulting from intentional acts or modifications that significantly reduce the vehicle’s value. Specific usage restrictions, like off-roading, may also limit coverage.

- Specific Damage Exclusions: Some policies may exclude coverage for damage caused by certain events, such as vandalism, or even if the vehicle is used for commercial purposes. These exclusions are typically Artikeld in the policy’s fine print.

- Deductibles and Waiting Periods: Deductibles and waiting periods may apply before coverage kicks in, impacting your out-of-pocket expenses in certain situations. Understanding these details is essential before signing up.

- Geographical Limitations: Certain policies might have geographical restrictions, limiting coverage to specific regions or countries. This can be important if you plan to travel extensively with your insured vehicle.

Policy Comparison Table

This table presents a simplified comparison of gap insurance policies from different providers, highlighting key features and costs. A more comprehensive comparison should be done with individual insurers.

| Provider | Coverage Amount | Deductible | Exclusions | Additional Benefits | Premium |

|---|---|---|---|---|---|

| Insurer A | $15,000 | $500 | Vandalism, intentional damage | Rental car coverage | $99/year |

| Insurer B | $20,000 | $250 | Commercial use, modifications reducing value | Towing assistance | $125/year |

| Insurer C | $18,000 | $300 | Off-road use, certain accidents | Temporary vehicle replacement | $110/year |

Understanding Coverage Amounts

Gap insurance, a crucial component of comprehensive auto protection, safeguards against the financial shortfall when a vehicle’s value drops below its outstanding loan amount. Accurately determining the coverage amount is paramount to ensure the policy effectively addresses potential losses.The coverage amount for gap insurance is not a fixed value; rather, it’s dynamically calculated based on several critical factors, ultimately reflecting the difference between the vehicle’s depreciated value and the outstanding loan balance.

This precise calculation is essential for providing appropriate financial protection.

Determining Coverage Amounts

Gap insurance policies are designed to cover the “gap” between the vehicle’s actual cash value (ACV) and the outstanding loan amount. This ACV is often determined by a combination of factors, including the vehicle’s make, model, year, mileage, condition, and market value. Independent appraisers or insurers may use sophisticated valuation methodologies, incorporating current market trends and sales data, to arrive at the most accurate ACV.

Importance of Understanding Coverage Limits

Understanding the coverage limits of a gap insurance policy is vital for informed decision-making. This understanding allows policyholders to anticipate potential financial burdens and to ensure the policy aligns with their individual needs. Knowing the maximum amount the policy will pay is critical for budgeting and financial planning.

Impact of Vehicle Market Value

The vehicle’s market value significantly influences the coverage amount. A vehicle with a higher market value at the time of purchase may depreciate more slowly, leading to a smaller gap. Conversely, a vehicle with a high rate of depreciation might have a substantial difference between its purchase price and market value, resulting in a higher coverage amount. For instance, luxury vehicles or those in high demand may have lower depreciation rates, whereas those considered more common might depreciate more quickly.

Relationship Between Loan Amount and Coverage Limits

The outstanding loan amount directly correlates with the coverage amount. A larger loan amount generally means a larger potential gap between the vehicle’s value and the amount owed. This gap is the very essence of what gap insurance protects against. A smaller loan balance will result in a smaller coverage amount. This direct correlation underscores the importance of matching the policy’s coverage to the specific loan terms.

Examples of Coverage Amount Variations

Coverage amounts fluctuate based on a multitude of factors. For example, a new, high-end sports car with a substantial loan may have a significantly higher coverage amount compared to a used, more common model with a lower loan. Moreover, a vehicle’s condition, usage, and maintenance history also influence its market value and consequently, the gap insurance coverage amount.

Table of Different Scenarios and Coverage Amounts

| Scenario | Vehicle Type | Loan Amount | Estimated Market Value | Coverage Amount |

|---|---|---|---|---|

| New Luxury Car | Luxury Sedan | $50,000 | $48,000 | $2,000 |

| Used Compact Car | Compact Sedan | $15,000 | $12,000 | $3,000 |

| High-Mileage SUV | SUV | $25,000 | $18,000 | $7,000 |

Illustrative Scenarios

Bridging the gap between the value of your car and its depreciated worth is where gap insurance truly shines. Understanding its application in various situations is key to making informed decisions about your vehicle protection. This section delves into practical examples demonstrating the necessity and value of gap insurance.

Scenario 1: The Unexpected Total Loss

A catastrophic accident leaves a meticulously maintained, $35,000 sports car totaled. The insurance company’s payout, however, reflects the vehicle’s current market value of $28,000, leaving a $7,000 gap. In this instance, gap insurance seamlessly covers the difference, ensuring the owner receives the full purchase price value.

Scenario 2: The Unforeseen Repair Bill

A young professional’s daily driver, valued at $20,000, suffers significant damage in a collision. While the insurance covers the repair costs, the car is now worth $18,000. Without gap insurance, the owner is stuck with a car that has depreciated more than expected.

Scenario 3: The New Car, The Quick Depreciation

A new car, purchased for $40,000, experiences a significant decline in market value due to the rapid pace of technology. Within a year, the market value drops to $35,000. If the vehicle is totaled, the insurance payout may not reflect the original purchase price. Gap insurance safeguards the buyer from such financial loss.

Scenario 4: The Accidental Damage Claim

A family’s meticulously maintained, $25,000 sedan experiences an accident due to a mechanical failure. The repair cost is significant, and the market value depreciates to $22,000. Gap insurance ensures the owner receives the full replacement cost.

Scenario 5: The Non-Beneficial Gap Insurance Case

A used car, purchased for $10,000 and insured for $8,000, experiences minor damage in a fender bender. The repair cost is relatively low, and the insurance company’s payout is significantly higher than the current market value of the car. In this instance, gap insurance is not needed, as the difference between the original purchase price and the current market value is minimal.

Case Study: The 2022 Toyota Camry

A 2022 Toyota Camry, valued at $27,000, was purchased new. Within six months, a fire completely destroyed the vehicle. The insurance payout was $20,000, reflecting the current market value. Gap insurance would have compensated the owner for the full $27,000 purchase price, preventing financial loss.

Story: The Young Entrepreneur’s Dilemma

A young entrepreneur’s company car, valued at $32,000, was totaled in a highway accident. The insurance company’s payout was only $25,000. Without gap insurance, the entrepreneur faced a significant financial loss, impacting his business operations. Gap insurance acted as a safety net, protecting his investment and ensuring business continuity.

Figuring out how much gap insurance costs for your car can feel like navigating a maze, but it’s actually pretty straightforward. You’ll need to factor in the difference between your car’s current value and what your loan amount covers. For example, if you want to secure your finances and get a clear understanding of your options, consider consulting with experts at Frandsen Bank and Trust Grand Forks.

Frandsen Bank and Trust Grand Forks is a great resource for getting the right information to make informed decisions. Ultimately, the price of gap insurance will vary depending on your specific situation, but knowing your options and potential loan amounts is key.

| Scenario | Gap Insurance Implications |

|---|---|

| Total Loss of a high-value vehicle | Gap insurance is highly beneficial, covering the difference between the insurance payout and the original purchase price. |

| Significant damage to a vehicle with substantial depreciation | Gap insurance is beneficial as it mitigates the financial impact of the depreciation on the car’s value. |

| Minor damage to a vehicle with minimal depreciation | Gap insurance may not be necessary as the insurance payout often exceeds the current market value. |

| New vehicle with rapid depreciation | Gap insurance provides protection against significant financial loss due to the depreciation of a new vehicle. |

Additional Considerations

Navigating the world of gap insurance requires a nuanced understanding beyond just the initial premium. This section delves into crucial aspects like negotiating costs, scrutinizing policy terms, and effectively managing claims, empowering you to make informed decisions.Negotiating gap insurance premiums isn’t always a straightforward process, but it’s certainly worthwhile exploring. Understanding the market rates for similar coverage in your area can be a powerful tool.

Contacting multiple providers and comparing quotes is a practical approach. Demonstrating a strong understanding of your vehicle’s value and the coverage you require can often lead to favorable premium negotiations.

Negotiating Gap Insurance Premiums

A proactive approach to negotiating can potentially lower your premium. Researching prevailing market rates for comparable policies and presenting this information to insurers can be beneficial. Thorough understanding of your vehicle’s condition and value can strengthen your position. Contacting multiple insurers and comparing quotes will help determine the best possible premium.

Reviewing Policy Terms and Conditions

Carefully reviewing policy terms and conditions is paramount. Pay close attention to the definitions of “total loss,” the specific coverage limits, and any exclusions or limitations. A comprehensive understanding of these terms will help avoid unforeseen complications during a claim. Look for clauses related to the deductible, and how it will affect your payout.

Filing a Gap Insurance Claim

The process of filing a gap insurance claim varies depending on the insurer. Typically, a detailed report outlining the circumstances of the vehicle’s damage or total loss is required. Be prepared to provide documentation such as repair estimates, police reports, and any other relevant evidence. Maintain clear and concise communication with your insurer throughout the claim process.

Document all communication, and maintain accurate records.

Resources for Further Information

Accessing credible sources for more information on gap insurance can be beneficial. These resources can offer a deeper understanding of policy nuances, claim procedures, and potential costs. Comprehensive research helps make informed decisions about coverage.

- Insurance Regulatory Bodies: State insurance departments provide valuable information about gap insurance regulations and consumer rights. They often publish consumer guides and FAQs. This is a critical step in ensuring you are covered appropriately.

- Consumer Protection Agencies: Federal and state consumer protection agencies provide resources on insurance claims and dispute resolution. They are helpful in understanding your rights as a consumer and navigating potentially challenging situations.

- Independent Insurance Advisors: Independent insurance advisors offer unbiased advice on various insurance policies, including gap insurance. They can provide valuable insights and guidance specific to your needs.

- Online Insurance Comparison Websites: Websites dedicated to comparing insurance policies offer a valuable resource for researching and comparing gap insurance options. This will enable you to gain an understanding of various market offerings.

- Financial Institutions: Financial institutions that provide financing for vehicles may also offer gap insurance options. This provides a one-stop shop for comprehensive financial solutions.

Final Summary

In short, figuring out how much gap insurance costs boils down to understanding your vehicle’s value, the outstanding loan amount, and the specific policies of different insurers. Knowing these factors empowers you to make an informed decision and protect yourself from financial losses in case of a mishap. Remember to compare quotes and read the fine print before signing on the dotted line.

Your ride deserves the best protection you can afford.

Popular Questions: How Much Is Gap Insurance For A Car

What if my car is totaled but I still owe money on it?

If your car is written off and you still owe money, gap insurance kicks in. It pays the difference between the car’s value and what you owe, protecting you from a potential financial loss.

How does the vehicle’s market value affect gap insurance costs?

A higher market value generally means a higher gap insurance premium. The bigger the difference between the car’s worth and what you owe, the more expensive the gap insurance will likely be.

Can I negotiate the cost of gap insurance?

Sometimes, you might be able to negotiate the cost of gap insurance. Comparing quotes from different insurers is a good starting point, and you might be able to haggle a better deal if you’re a loyal customer or have a strong bargaining position.