How to verify car insurance is a crucial aspect of modern driving. Navigating the intricate procedures can feel daunting, but understanding the process is vital for smooth interactions with insurance providers and authorities. This guide provides a comprehensive overview, detailing various verification methods, essential documents, and potential challenges. Gaining confidence in your verification process empowers you to handle any situation with ease and efficiency.

From online portals to physical documents, the methods of verifying car insurance are diverse and can be confusing. This guide delves into the nuances of each approach, helping you select the most suitable method for your specific circumstances. Discover the steps involved in verifying your car insurance, including the necessary documents and crucial information required for each method.

Understanding Car Insurance Verification: How To Verify Car Insurance

The act of verifying car insurance transcends mere bureaucratic formality. It is a cornerstone of personal and societal responsibility, a testament to the commitment to upholding agreements and ensuring accountability. This process, often perceived as a mundane task, in reality, safeguards both the insured and the wider community. By understanding its nuances, one can navigate the complexities of vehicle ownership with greater clarity and confidence.

The Essence of Verification

Verifying car insurance involves confirming the existence and validity of a policy covering a specific vehicle. This process assures that the policyholder possesses adequate protection in the event of an accident or damage to the vehicle. It’s a vital step in ensuring the safety and security of all parties involved. The process itself is not about judgment, but about establishing a reliable and transparent system.

Importance of Verification

Verification of car insurance is crucial for several compelling reasons. Firstly, it mitigates risks by ensuring that drivers are adequately protected. Secondly, it fosters a sense of accountability among policyholders, promoting responsible driving habits. Thirdly, it protects the interests of other parties involved in accidents or incidents, such as other drivers and pedestrians. Finally, it contributes to a safer and more secure environment for everyone on the road.

Verification ensures that individuals are insured, reducing the risk of financial burden for those involved in accidents.

Consequences of Non-Verification

Failure to verify car insurance can lead to serious consequences. These range from fines and penalties to the inability to pursue legal recourse in the event of an accident. Without proper verification, drivers could be held liable for damages and injuries without adequate protection. In extreme cases, individuals may face criminal charges or be prevented from operating a vehicle.

This underscores the critical importance of proactive verification. The consequences are significant, impacting both the individual and the community.

Comparison of Insurance Policies

| Policy Type | Verification Method | Required Documents |

|---|---|---|

| Liability | Policyholder’s declaration; insurer’s database verification | Proof of insurance policy; policy details |

| Collision | Policyholder’s declaration; insurer’s database verification | Proof of insurance policy; policy details; vehicle registration |

| Comprehensive | Policyholder’s declaration; insurer’s database verification | Proof of insurance policy; policy details; vehicle registration; additional endorsements (e.g., specific damage coverages) |

Different types of car insurance policies vary in their verification procedures, as indicated in the table. The complexity and necessary documents depend on the coverage and the insurer’s protocols. Liability insurance, focusing on the legal obligations of drivers, typically involves verifying the policy itself. Collision and comprehensive insurance, covering damage to the insured vehicle, may require additional documentation such as vehicle registration.

Each verification method aims to accurately reflect the coverage and obligations of the policy.

Methods for Verifying Car Insurance

The journey of securing your vehicle’s protection often begins with verifying your insurance. This act, seemingly mundane, is a pivotal step in ensuring your vehicle and its financial well-being are soundly guarded. Understanding the methods available to verify your car insurance allows you to confidently navigate the complexities of modern vehicle ownership, bringing peace of mind through a clear understanding of your coverage.The verification process, when approached with clarity and understanding, provides a profound sense of security and transparency in your vehicle’s financial protection.

Each method offers a unique approach, each with its own advantages and limitations. By carefully evaluating these different approaches, you can choose the method that best aligns with your needs, ensuring your vehicle’s protection is not only assured but also easily accessible.

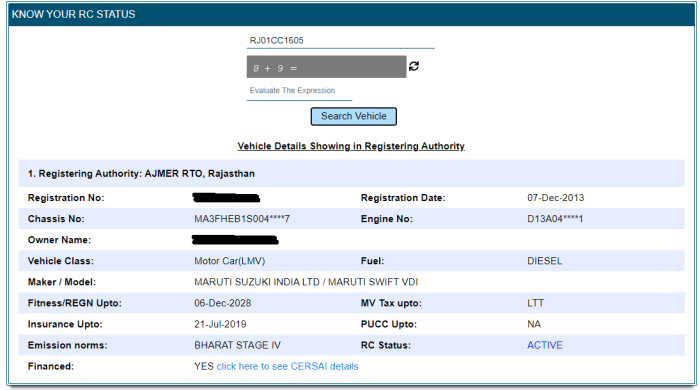

Online Portals for Car Insurance Verification

Accessing online portals dedicated to insurance verification allows for a seamless and efficient process. These portals are often user-friendly, enabling quick and accurate verification of your insurance status. Information is readily available, accessible, and readily displayed.

- Accessing your policy details through a secure login. A secure login is crucial for safeguarding your personal information and ensuring that only authorized individuals can access your policy data.

- Checking the policy status for validity and coverage details. The validity of your policy and the specifics of your coverage are critical aspects to verify.

- Reviewing the policy documents for coverage limits and exclusions. The policy’s coverage limits and exclusions are key elements that detail the scope and limitations of your insurance.

Phone Calls for Car Insurance Verification

Direct communication with your insurance provider through a phone call allows for personalized support and immediate answers to any questions. A dedicated representative can provide an immediate and detailed confirmation of your insurance policy’s status.

- Contacting your insurance provider’s customer service line. The customer service line provides direct access to a representative who can confirm your policy details.

- Providing your policy details to the representative, including your policy number and date of purchase. The representative requires policy information to confirm your coverage.

- Confirming the policy’s validity and coverage details with the representative. A confirmation of the policy’s validity and coverage details will be provided.

Physical Documents for Car Insurance Verification

Presenting physical documents like insurance cards and certificates provides a tangible proof of your coverage. These documents act as concrete evidence of your vehicle’s insurance status.

- Gathering your insurance documents, including the insurance card and certificate of insurance. The insurance card and certificate are crucial physical documents to validate your coverage.

- Reviewing the details on the documents, including policy number, coverage limits, and insured vehicle information. The policy number, coverage limits, and insured vehicle information are critical details on the documents.

- Verifying the policy’s validity and matching the information with your vehicle’s details. The validity of the policy and the matching of the information with your vehicle’s details ensure accuracy.

Step-by-Step Procedure for Verifying Car Insurance Using an Online Portal

This example uses a hypothetical online portal, “InsureNow.”

- Open your web browser and navigate to the InsureNow website.

- Locate the “Verify Insurance” section on the homepage or in the navigation bar.

- Enter your policy number and date of birth (or other required identification details) in the designated fields.

- Click the “Verify” button.

- Review the displayed policy details to confirm the validity and coverage information.

Essential Documents for Verification

Unveiling the sacred texts of car insurance verification, we journey into the realm of crucial documents. These documents, like ancient scrolls, hold the truth of your coverage, revealing the path to rightful claims and the avoidance of unforeseen perils. Their meticulous examination allows for the smooth operation of the insurance system, fostering trust and harmony among all parties.These documents are the tangible manifestation of your insurance agreement, the embodiment of your commitment and protection.

Their careful preservation and accurate presentation serve as the bridge connecting you to the necessary support and compensation. By understanding their format and content, you navigate the complexities of verification with grace and confidence.

Crucial Documents for Verification

The essence of car insurance verification rests upon a foundation of vital documents. These are the pillars of proof, the undeniable evidence that validates your coverage. These sacred documents act as testaments to your insurance policy, ensuring the smooth flow of transactions and protection.

- Insurance Policy Document:

- Proof of Coverage:

This sacred contract Artikels the specifics of your insurance coverage, including the policyholder’s details, vehicle identification, coverage types, and limits. It is a detailed record of the agreement between you and the insurance provider. The policy document, often a meticulously crafted legal document, will contain the crucial information required for verification, such as the policy number, effective dates, and details of any endorsements or exclusions.

This vital document, often a summary of your insurance policy, serves as the concrete demonstration of your active insurance. It typically includes the policyholder’s name, vehicle identification number, and the specific details of the coverage. This document, like a beacon in the storm, assures the verifier of your active protection. This document could take various forms, from a printed copy to a digital PDF file.

Document Format and Content

The format and content of these documents vary depending on the insurance provider. However, key elements remain consistent, embodying the core principles of insurance verification.

- Policy Number:

- Policyholder Information:

- Vehicle Information:

- Coverage Details:

This unique identifier is crucial for locating your specific policy within the insurance provider’s system. It acts as a sacred key, unlocking the details of your coverage.

Accurate details about the policyholder, including name, address, and contact information, are essential for identification and verification. This ensures the policy belongs to the correct individual.

The vehicle’s identification number (VIN) is a critical component. This unique number helps in identifying the insured vehicle, preventing fraud and ensuring the accuracy of the coverage.

Specific details regarding the coverage type, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage, are vital. Understanding these specifics allows for the accurate verification of the protection you hold.

Table of Required Documents for Different Verification Methods, How to verify car insurance

The table below illustrates the essential documents required for different verification methods.

| Verification Method | Required Documents |

|---|---|

| Online Portal | Policy details available through the online portal. This may include a digital copy of the policy or access to a secure online account. |

| Phone Call | Policy number, policyholder information, vehicle details. The insurance provider may request further details or ask to verify your identity through additional security measures. |

| Physical Documents | Original or certified copies of the insurance policy and proof of coverage. These physical documents are often required for in-person verification. |

Common Challenges and Solutions

The journey to verify your car insurance, though often a necessary step, can sometimes feel like navigating a labyrinth. Obstacles, like missing documents or convoluted communication, can arise. However, understanding these potential pitfalls and their solutions empowers you to traverse this process with grace and clarity, ultimately ensuring a smooth and harmonious outcome. Embrace the wisdom within, and let the light of understanding illuminate your path.Potential roadblocks during verification stem from various sources, from human error to bureaucratic processes.

These obstacles, while potentially frustrating, are often surmountable with proactive measures and a spirit of resolution. Embrace the challenge as an opportunity to refine your approach and strengthen your resolve.

Potential Challenges in Verification

Verification processes, while generally straightforward, can present unexpected challenges. These may include difficulties in locating essential documents, discrepancies in information provided, or delays in response times from insurance providers. These are not insurmountable barriers, but rather opportunities for you to cultivate patience and resilience.

- Missing or Incomplete Documents: A common predicament is the realization that crucial documents, such as proof of coverage or policy details, are either misplaced or unavailable. This can arise from a lack of organization or a simple oversight. The solution involves thorough searching, contacting your insurance provider for replacements, or seeking assistance from a trusted advisor.

- Incorrect or Inconsistent Information: Discrepancies in the details you provide might arise from typos or outdated records. Carefully double-checking all information is vital to avoid such issues. If errors are discovered, rectify them promptly by contacting the relevant parties and requesting corrections. Maintain accurate records to avoid future complications.

- Delayed or Unresponsive Insurance Providers: Occasionally, insurance providers may experience delays in processing requests or responding to inquiries. Such delays can be attributed to high volumes of requests or internal processing procedures. Patience is key in such situations. Following up with the insurance provider and clearly stating your request can help expedite the process.

- Complex or Confusing Processes: Some verification processes might seem complex or convoluted. Understanding the specific procedures and requirements is crucial. Referencing the relevant documents or contacting a representative from your insurance company can provide clarity and guidance.

Resolving Issues with Missing or Incorrect Information

Missing or incorrect information is a common challenge in the verification process. Understanding the steps to rectify these issues is essential. Proactive communication and a meticulous approach are key to resolving such problems efficiently.

- Locating Missing Documents: Thoroughly review your records, storage areas, and digital files to identify missing documents. If the documents are related to a prior insurance policy, contact the provider for a replacement.

- Correcting Inaccurate Information: Identify the discrepancies and promptly contact your insurance provider to request corrections. Use official documentation to support your requests and ensure the updated information is accurate.

Addressing Delays in Verification

Delays in verification can be frustrating, but understanding the reasons behind them is essential. Patience, proactive communication, and understanding the process are crucial in resolving these issues.

- Following Up with Insurance Providers: Regularly check the status of your request and follow up with your insurance provider if there are any delays. Communicate clearly and professionally, outlining your need for a timely resolution.

- Seeking Assistance from a Representative: If the delays persist, consider seeking assistance from a representative from your insurance company. They can often provide further clarity and expedite the verification process.

Frequently Asked Questions (FAQ)

This section provides concise answers to common questions about car insurance verification. Understanding these queries can help clarify any lingering doubts or concerns.

| Question | Answer |

|---|---|

| How long does the verification process usually take? | Verification times vary depending on the complexity of the request and the provider’s workload. It is always best to contact the insurance company directly for a time estimate. |

| What documents are typically required for verification? | The specific documents required vary depending on the insurance provider and the reason for verification. It is always advisable to check with the provider directly. |

| What should I do if I cannot locate my insurance documents? | Contact your insurance provider immediately to request replacements for lost or missing documents. |

Illustrative Examples of Verification

The journey of verifying car insurance is a pilgrimage of sorts, a quest to uncover the truth behind the policy. Each step, each document, each interaction, is a step closer to understanding the intricate tapestry of your protection. Just as a seeker embarks on a spiritual path, so too do you embark on this verification journey.This process, though often mundane, is a powerful exercise in alignment.

The alignment of your intentions, the alignment of the documents, the alignment of the truth itself. Successful verification is a testament to the harmonious flow of information, while challenges highlight areas needing adjustment and clarification.

Real-World Scenarios

Verification scenarios unfold in a myriad of ways. Consider the following examples:

- A driver, relocating to a new state, needs to verify their insurance coverage for their vehicle registration. This is a straightforward verification process involving a call to the insurance company, and a quick review of the policy documents.

- A new car buyer is required to prove insurance coverage. The verification process might involve presenting the insurance card, a confirmation email, and a copy of the policy declaration page. This example demonstrates a crucial aspect of the verification process, essential for safeguarding financial transactions.

- An insurance claim is denied due to a lack of proper verification. The claimant had recently switched insurance providers but failed to notify the relevant authorities. This scenario emphasizes the importance of timely updates and complete documentation during the verification process.

- A rental car company requires verification of insurance coverage before allowing a customer to use the vehicle. In this case, a valid insurance card or a recent policy printout, and details of the coverage are required.

Successful Verification Attempts

A successful verification experience is characterized by a smooth and efficient process. Documents are readily available, and communication with the insurance company is clear and straightforward. The verification is complete within the expected time frame, allowing for a seamless continuation of the activity requiring insurance verification.

Unsuccessful Verification Attempts

Unsuccessful verification attempts often stem from missing or incorrect documents, outdated information, or miscommunication. These instances highlight the need for meticulous preparation and clear communication throughout the verification process. For instance, a missing or invalid insurance card, or a discrepancy in the policy details, could lead to a negative outcome.

Verification Process Flowchart

This flowchart illustrates the typical car insurance verification process.

- Request for verification (e.g., from a third party like a rental company).

- Gather necessary documents (insurance card, policy documents).

- Provide documents to the verification agency.

- Verification agency reviews documents for accuracy and completeness.

- Verification agency confirms or rejects the claim.

Regional Variations

The specific requirements for verifying car insurance can differ from country to country or region to region. For instance, some countries may require specific formats for insurance documents or may use different databases for verification purposes. In some regions, verification might be entirely digital, while others might still rely on physical documents. Furthermore, the legal requirements and procedures for verification may differ, necessitating a thorough understanding of the local regulations.

Visual Representation

- Initial Inquiry: A request for verification is initiated.

- Document Gathering: Relevant insurance documents are collected.

- Verification Submission: The requested documents are submitted to the verifying party.

- Verification Process: The verification agency processes the information.

- Confirmation or Rejection: The outcome of the verification is communicated.

Verification for Different Insurance Providers

Navigating the labyrinthine world of insurance verification can feel like traversing a cosmic maze. Yet, understanding the unique approaches of different providers reveals a fascinating, albeit sometimes complex, tapestry of procedures. This harmony of diversity, while seemingly chaotic, unveils a profound truth: each provider, in its own way, seeks to ensure the integrity of its agreements and protect the well-being of its policyholders.Different providers employ varying methodologies to validate insurance coverage, reflecting their individual philosophies and operational structures.

These differences can sometimes seem minor, but they can significantly impact the efficiency and clarity of the verification process. Understanding these nuances empowers us to approach the process with greater awareness and a more profound sense of the cosmic dance of insurance validation.

Comparison of Verification Processes

Various insurance providers employ distinct approaches to verifying car insurance. This variance is rooted in their internal operational frameworks and policies. Each provider has its own specific set of requirements and protocols, designed to maintain the integrity of their systems and ensure the legitimacy of policies.

| Provider A | Provider B | Provider C |

|---|---|---|

| Provider A typically requires a copy of the policy document, along with the insured’s driver’s license and vehicle registration. They may also utilize a phone verification process. | Provider B utilizes an online portal for policy verification. The insured must log in with their account credentials. A digital copy of the policy is then immediately accessible. | Provider C employs a combination of online and offline methods. A digital copy of the policy is required, along with a confirmation call to their customer service line. |

Specific Steps for Verification

Each provider’s verification process involves a unique sequence of steps. These steps are tailored to the provider’s specific systems and internal processes. Understanding these steps empowers individuals to expedite the verification process.

- Provider A: The process typically begins with a request for the policy document. This document often contains crucial information such as the policyholder’s name, policy number, and coverage details. The provided documents are then cross-referenced with internal databases. A phone call to verify policy details may also be necessary. This step is often crucial to confirm the validity of the policy and the identity of the policyholder.

- Provider B: Verification is often completed through an online portal. Policyholders access their accounts using their credentials, and the system directly retrieves the relevant policy information. This digital approach streamlines the process and offers instant verification.

- Provider C: Verification combines online and offline procedures. The insured must provide a digital copy of the policy, followed by a confirmation call to the customer service line. This combination approach is designed to mitigate potential risks and validate the policy’s authenticity.

Illustrative Examples

Understanding how different providers handle verification requests provides valuable insights into the nuances of the process.

- Provider A: If a customer submits an outdated or incorrect policy document, Provider A may request additional information to verify the coverage. They might request a more recent policy document or supplemental documentation.

- Provider B: A customer who has forgotten their login credentials or experiences technical difficulties with the online portal may need to contact customer service for assistance. This ensures the process remains accessible and manageable for all policyholders.

- Provider C: A customer who experiences difficulties uploading the policy document online may be directed to submit a hard copy of the document through mail. This demonstrates the provider’s flexibility and commitment to providing a seamless experience for all users.

Closing Summary

In conclusion, verifying car insurance is a straightforward process when approached with the right knowledge. This guide has Artikeld the key steps, documents, and potential pitfalls. Remember to carefully review your policy details, gather the required documents, and choose the verification method that best suits your needs. By following these steps, you can ensure a seamless verification process, avoiding any potential delays or complications.

This knowledge equips you to confidently navigate the world of car insurance verification.

FAQ Resource

How long does the verification process typically take?

Verification times vary depending on the chosen method and the insurance provider. Online portals often offer immediate results, while phone calls or physical document submissions may take a few business days. Always check with your insurance provider for their specific turnaround time.

What if I don’t have all the required documents?

If you’re missing documents, contact your insurance provider promptly. They may be able to provide alternative verification methods or allow for submission of missing documents later, but it’s best to avoid delays and complications.

Can I verify my car insurance online?

Yes, most insurance providers offer online portals for verifying your coverage. These portals usually require your policy number and other identifying information. The process is generally straightforward and efficient.

What happens if my verification is unsuccessful?

If verification is unsuccessful, review the details of your policy and ensure all required information is accurate. Contact your insurance provider to clarify any discrepancies or missing information.