Loss of use coverage car insurance provides financial support when your vehicle is unusable due to damage or accident. This critical component of your policy often covers expenses like rental cars, lost wages, and other associated costs, ensuring a smooth transition when your vehicle is out of commission. Understanding the nuances of this coverage is essential for navigating unforeseen circumstances, ensuring financial security and minimizing disruptions.

The interplay of various factors, from the type of damage to the specifics of your policy, determines the extent of your coverage. Understanding these intricacies allows for informed decisions and proactive planning, mitigating potential financial burdens.

This guide delves into the intricacies of loss of use coverage, exploring its various facets, from its definition and types to claim procedures and exclusions. By examining the interplay between coverage options, exclusions, and the claim process, you gain a deeper understanding of how this coverage functions within the broader context of car insurance.

Defining Loss of Use Coverage: Loss Of Use Coverage Car Insurance

Loss of use coverage in car insurance is like a safety net, providing financial assistance when your car is out of commission due to an accident or covered event. It’s a crucial component of comprehensive insurance, helping you navigate the unexpected costs while your vehicle is being repaired or replaced. Imagine a sudden breakdown, preventing you from commuting to work.

This coverage can help you cover the costs of alternative transportation, keeping your life on track.This coverage helps you manage expenses while your vehicle is out of action. It’s designed to ease the financial burden of being unable to use your car, offering various benefits tailored to your specific needs. Different types of loss of use coverage provide varying degrees of financial assistance.

Loss of Use Coverage Types

Loss of use coverage often includes several options to help with transportation expenses during a covered incident. These options cater to different needs and circumstances.

- Rental Reimbursement: This type of coverage compensates for the cost of renting a temporary vehicle while your car is being repaired. This can be extremely helpful for maintaining your daily routine, whether for work, errands, or personal commitments. It’s a direct and tangible benefit of loss of use coverage. This benefit can help ease the financial strain associated with replacing your transportation needs.

- Other Options: Besides rental reimbursement, some policies might include coverage for additional expenses like temporary transportation costs, such as using a ride-sharing service or a public transport system. This could be especially valuable if you have to transport goods or people. This can provide additional support, making the situation more manageable during the repair or replacement period.

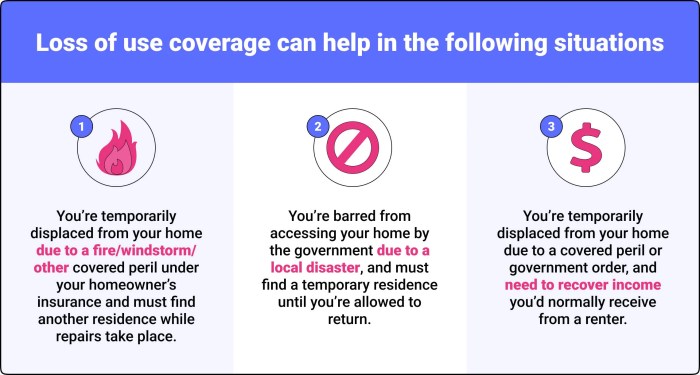

Circumstances for Loss of Use Coverage

Loss of use coverage typically applies when your car is deemed unusable due to a covered event. These events are often accidents, but can also include things like vandalism or even natural disasters. For example, if your car is damaged beyond repair in a fire, loss of use coverage would likely apply. It is always best to check your policy details for specific exclusions and limitations.

Comparison of Loss of Use Coverage Options

| Coverage Type | Description | Benefits | Limitations |

|---|---|---|---|

| Rental Reimbursement | Covers the cost of renting a substitute vehicle while your car is being repaired or replaced. | Provides a convenient and reliable alternative transportation during the repair period. | May have daily or weekly limits on rental reimbursement amounts. Policies might specify the types of vehicles that qualify for reimbursement. |

| Other | Covers additional transportation expenses like ride-sharing or public transport. | Offers flexibility in choosing transportation options, especially if a rental is unavailable or unsuitable. | The reimbursement amount is typically based on the actual expenses incurred, but policies may set limits on total reimbursement. The specific method of reimbursement might vary. |

Coverage Exclusions and Limitations

Loss of use coverage, while a helpful perk, ain’t a magic bullet. It’s got some limitations, just like everything else in this world. Understanding these exclusions and limitations is key to making sure you’re not caught off guard when a mishap strikes. Like a smart palemban merchant, you need to know the deal before you sign the contract!

Common Exclusions

Loss of use coverage often comes with a list of exclusions. These are situations where the coverage won’t kick in, so it’s vital to know what they are. It’s like knowing the “no-go” zones in your insurance policy.

- Pre-existing damage: If your car already had a pre-existing issue that’s now making it unusable, the loss of use coverage might not cover it. Imagine you had a leaky radiator for a while and it finally caused your car to break down. The coverage might not cover the time you couldn’t use the car if it was a pre-existing problem.

- Damage caused by your actions: If the damage to your car is a result of your own negligence or recklessness, loss of use coverage might not apply. Like if you parked your car in a flood zone and it got flooded, the insurance company might not cover the time you couldn’t use it.

- Damage caused by war or terrorism: Coverage usually excludes events like war or terrorism. This is a pretty common exclusion in most insurance policies, as the risks are massive and unpredictable.

- Damage caused by wear and tear: Regular wear and tear on your car, like normal use and aging, isn’t typically covered by loss of use coverage. Think of it like normal car maintenance, like changing your oil.

- Damage caused by neglect or lack of maintenance: If your car isn’t maintained properly and that leads to damage, loss of use coverage probably won’t cover the time you can’t use it.

Limitations in Specific Scenarios

The amount of time loss of use coverage applies can vary depending on the circumstances. It’s not always a straight-forward “this many days” type of deal.

- Repair time: The coverage often only applies for the time it takes to repair your car, not for any extra time you might need to arrange transportation. It’s like if your car needs a new engine, the coverage might only pay for the time it takes to install the new engine, not the extra time you need to find alternative transportation.

- Alternative transportation: If you have other transportation options (like a spare car or public transport), the amount of time covered for loss of use might be reduced. This is because you have a way to get around while your car is being fixed.

- Total loss: If your car is deemed a total loss, the loss of use coverage might only cover a specific period, or it might not cover it at all. This is because the insurance company is essentially replacing the car, and the value of using the old one isn’t as high as if it’s just being repaired.

Situations Where Coverage Might Not Apply

There are situations where loss of use coverage simply won’t cover your expenses.

- Delays in repair: If there are unexpected delays in getting your car repaired, the loss of use coverage might not extend beyond a certain period. This could be due to parts shortages or unforeseen complications during the repair process.

- Unforeseen circumstances: If you experience issues that weren’t anticipated (like a major weather event that affects the repair process), the coverage might not apply to the extra time it takes to get your car back on the road. This is because the insurance company isn’t responsible for issues beyond their control.

Summary Table

| Exclusion Category | Example | Explanation |

|---|---|---|

| Pre-existing Damage | Leaking radiator causing breakdown | Damage present before the covered event. |

| Negligence | Parking in a flood zone | Damage caused by your actions. |

| Acts of War/Terrorism | Damage during a war | Coverage usually excludes these events. |

| Wear and Tear | Normal car deterioration | Regular use and aging aren’t covered. |

| Lack of Maintenance | Ignoring necessary maintenance | Damage caused by neglecting car care. |

Claim Process and Procedures

Filing a loss of use claim can be a bit like navigating a Palembang river, sometimes winding and sometimes straightforward. But don’t worry, we’ll guide you through the process step-by-step, making it as smooth as a traditional Palembang boat ride. Understanding the claim process ensures a hassle-free experience and a swift resolution.This section details the process of filing a loss of use claim, from the initial steps to the expected timeframe.

We’ll Artikel the required documentation and clarify the timeline, ensuring a transparent and efficient claim resolution. This will make the whole process less daunting and more understandable.

Claim Filing Steps

The claim process is structured in a way that’s easy to follow. Each step is designed to streamline the process and ensure a timely resolution. We’ve laid out the steps for clarity.

- Report the Loss: Immediately report the incident to your insurance provider. This is crucial for initiating the claim process. Contact the insurance company using the number on your policy document or the designated channels. A timely report ensures a smooth process. For example, if your car is damaged in a traffic accident, report it immediately to your insurer.

- Gather Required Documents: This is like assembling the ingredients for a delicious Palembang dish. The necessary paperwork makes the claim process run smoothly. You’ll need your policy details, proof of ownership, and a detailed report of the incident. If there are witnesses, their statements are helpful too.

- Submit the Claim Form: Fill out the loss of use claim form accurately and completely. This form is your official request to the insurance company. Ensure you provide all the required details to avoid any delays in processing.

- Provide Supporting Documents: Attach any supporting documents, such as police reports, repair estimates, or medical bills if applicable. These documents support your claim and provide a clear picture of the situation.

- Await Evaluation: The insurance company will evaluate your claim based on the provided information and documents. This evaluation process can take time. Be patient and follow up with your insurer if necessary. Like a patiently crafted Palembang batik, the evaluation process takes time to complete.

- Settlement: Once the claim is approved, the insurance company will arrange the settlement. This could involve providing compensation for loss of use, or arranging temporary transportation. The settlement amount will depend on the details of your claim.

Documentation Required

To expedite the claim process, ensure you have the necessary documents readily available. The following documents are crucial for a loss of use claim:

- Policy Details: Your insurance policy document, including policy number, coverage details, and contact information.

- Proof of Ownership: Vehicle registration, ownership certificate, or any other relevant document proving your ownership of the vehicle.

- Incident Report: A detailed report of the incident, including date, time, location, and description of the event. This might include a police report if one was filed.

- Repair Estimates: If applicable, repair estimates for the damaged vehicle, or a letter from the mechanic describing the damage. This helps in assessing the total repair cost and the loss of use.

- Medical Bills (if applicable): In cases where the accident involves injuries, medical bills are essential to support the claim.

Timeline for Processing

The timeline for processing a loss of use claim can vary depending on several factors. These factors include the complexity of the claim, the availability of supporting documents, and the insurer’s internal procedures.

| Step | Description | Required Documents | Timeline |

|---|---|---|---|

| Report the Loss | Initial contact with the insurance company | Policy details | Within 24 hours |

| Claim Submission | Submission of the claim form and supporting documents | Claim form, supporting documents | Within 5 business days |

| Evaluation | Review and assessment of the claim by the insurer | All supporting documents | 7-14 business days |

| Settlement | Settlement of the claim | Approved claim documents | 7-21 business days |

Comparing with Other Coverages

Hai, kawan-kawan! Kita mau bahas lebih dalam nih, tentang perbandingan antara asuransi kehilangan penggunaan (loss of use) dengan jenis asuransi mobil lainnya, seperti comprehensive dan collision. Penting banget nih buat kita semua, supaya kita paham mana yang paling cocok buat mobil kesayangan kita.Understanding the nuances of different car insurance coverages is crucial for making informed decisions. Knowing which coverage best suits your needs helps you avoid financial burdens and maintain peace of mind.

Loss of Use Coverage Compared to Comprehensive

Loss of use coverage and comprehensive coverage address different aspects of car ownership. Comprehensive coverage, on the other hand, primarily focuses on damages caused by perils like storms, vandalism, or accidents involving animals. Loss of use coverage, in contrast, steps in when your vehicle is damaged and unavailable for use, regardless of the cause.

- Loss of use coverage kicks in when your car is damaged and unusable, irrespective of who caused the damage. This could be due to a comprehensive claim event, or a myriad of other situations.

- Comprehensive coverage, on the other hand, directly addresses the repair or replacement of the damaged vehicle. It’s like a direct fix for the damage.

Loss of Use Coverage Compared to Collision

Collision coverage and loss of use coverage are both triggered by accidents, but they have distinct roles. Collision coverage primarily deals with the physical damage caused by a collision, while loss of use coverage addresses the consequential financial losses from not being able to use your vehicle.

- Collision coverage specifically focuses on the repairs or replacement costs if your vehicle is damaged in a collision, no matter whose fault it is.

- Loss of use coverage, however, steps in to compensate for the financial hardship you face due to not having access to your car. This could include things like transportation costs or lost wages.

Comparative Table

| Coverage Type | Key Features | Advantages | Disadvantages |

|---|---|---|---|

| Loss of Use | Covers lost income, transportation expenses, and other costs when your car is unusable due to damage. | Provides financial protection during a period of vehicle unavailability. Very useful if you depend on your car for work or other essential activities. | Doesn’t directly cover the cost of repairs or replacement. It’s a supplementary coverage. |

| Comprehensive | Covers damages from various perils, such as weather events, vandalism, or accidents with animals. | Provides broad protection against unexpected damages. | Doesn’t cover the costs associated with the time your vehicle is unusable. |

| Collision | Covers damages resulting from collisions with other vehicles or objects. | Provides protection for damages from accidents. | Doesn’t cover the costs associated with the time your vehicle is unusable. |

Illustrative Scenarios

Loss of use coverage, a vital part of your car insurance, steps in when your vehicle is unavailable for use due to unforeseen circumstances. Understanding these scenarios will help you appreciate the peace of mind this coverage offers. Imagine being able to continue your daily life without the financial strain of a car mishap, thanks to the support of your policy!Loss of use coverage kicks in when your vehicle is out of commission due to events like accidents, theft, or damage requiring repair.

It helps compensate for the expenses you incur while your car is unusable. Understanding how it works in different situations will provide valuable insights into the benefits and limitations of this coverage.

Vehicle Totaled in an Accident

Loss of use coverage is particularly useful when your vehicle is deemed a total loss in an accident. This means the repair cost exceeds the vehicle’s value, making repairs impractical.

-

Your car is completely totaled in a fender bender. You need to get around, and the repair costs are astronomical. Loss of use coverage will help you cover the cost of alternative transportation, like taxis or ride-sharing services, while your vehicle is being replaced. This coverage can also help you cover the cost of any necessary expenses.

The specific amount of compensation will depend on your policy terms and the expenses incurred.

- The insurance company deems the vehicle beyond repair after a significant accident. This coverage helps you cover the cost of a rental car, public transport, or ride-sharing services while the insurance company processes the claim and arranges for a new vehicle. The potential costs include rental fees, gas expenses, and potential inconvenience.

- The accident involves substantial damage. If your car is totaled, your loss of use coverage will provide you with a monetary compensation to cover the temporary inconvenience caused by the inability to use your car. The benefit lies in avoiding the disruption in your daily life while the claim is being processed and a new vehicle is being acquired.

Theft of Your Vehicle

Even if your car is stolen, loss of use coverage is there to help you. This coverage will assist you with the financial implications while your vehicle is recovered or replaced.

- Your car is stolen, leaving you stranded. Loss of use coverage will provide compensation for alternative transportation expenses, including ride-sharing services, taxis, or public transportation. This coverage will help you maintain your daily routine while waiting for the authorities to recover your car or the insurance company to settle the claim.

- Your car is stolen and damaged. The coverage provides assistance with temporary transportation costs while the police investigate and your vehicle is recovered or repaired. It can also help with any additional costs associated with the theft, such as temporary accommodation or other expenses.

- The vehicle is stolen and unrecoverable. Loss of use coverage can help you with the temporary transportation costs while you obtain a new vehicle or until the police find the stolen vehicle. This coverage will assist you in maintaining your daily life and routine.

Vehicle Damage Requiring Extended Repair

Sometimes, a car accident or incident necessitates extensive repairs.

- Your car needs extensive repairs. Loss of use coverage will help cover the cost of temporary transportation while your vehicle is in the shop. This can help you avoid financial burdens and ensure you can continue your daily routines.

- The car is damaged beyond repair, or a new part is unavailable. Loss of use coverage provides temporary transportation solutions while the vehicle is under repair. The potential costs include transportation expenses and other incidental costs.

- The repairs take longer than expected. Loss of use coverage can cover temporary transportation expenses during the extended repair period. This coverage can prevent financial hardship during a lengthy repair process.

Importance of Understanding Terms and Conditions

Understanding the specific terms and conditions of your loss of use coverage is crucial.

Review your policy carefully to know the coverage limits, exclusions, and procedures. This will help you make informed decisions and ensure you get the most out of your coverage.

Consumer Advice and Tips

Hai semuanya! Choosing the right car insurance loss of use coverage can be a bit tricky, but don’t worry, we’re here to help you navigate the process with ease, like a seasoned Palembang driver! Understanding your options and knowing your rights is key to getting the best possible protection.This section will provide practical advice, ensuring you’re well-equipped to make informed decisions about loss of use coverage and navigate claims processes like a pro.

Choosing the Right Loss of Use Coverage

Selecting the right loss of use coverage is crucial for protecting your financial well-being in case of an accident. Consider the value of your car, the extent of the repairs, and your potential income loss during the repair period. A comprehensive coverage can provide a safety net in case your car is unusable for an extended period due to an accident or other covered event.

Don’t just grab the cheapest option; evaluate the coverage limits to ensure it aligns with your needs and expectations.

Reading Your Policy Documents Carefully

Thoroughly reviewing your policy documents is essential to understanding your rights and responsibilities. Pay close attention to the specifics of loss of use coverage, including the conditions under which it applies, the maximum payout amount, and any exclusions. Understanding these details will prevent any unpleasant surprises during a claim process. Look for clarity and specifics, not just broad statements.

Ask questions if something isn’t clear.

Negotiating with Insurance Companies During a Claim

When filing a claim, a polite and assertive approach can significantly improve your chances of a favourable outcome. Clearly and concisely present your case, documenting all relevant information, such as repair estimates and income loss. Be prepared to provide supporting evidence. If you feel the insurance company isn’t being fair, seek professional guidance. Remember, you have rights, and it’s essential to protect them.

Be professional and persistent, but also patient and understanding.

Seeking Legal Advice, Loss of use coverage car insurance

There are instances where seeking legal counsel is recommended. If you encounter significant obstacles during the claim process, or if you feel the insurance company isn’t fulfilling their contractual obligations, seeking legal advice can be beneficial. For example, if the insurance company delays or denies your claim without valid justification, consulting a legal professional is a smart step.

Don’t hesitate to seek help when necessary. Your rights are important, and legal representation can protect them.

Illustrative Examples of Situations Requiring Legal Advice

Here are some examples where seeking legal advice is wise:

- The insurance company denies your claim without a clear explanation or justification, leading to significant financial hardship.

- The insurance company offers a settlement amount that falls significantly short of the actual damages incurred, including the loss of use.

- The insurance company refuses to compensate for lost income during the period of car repair, despite the coverage explicitly including such losses.

- The insurance company misrepresents or ignores relevant policy clauses or provisions related to your loss of use claim.

End of Discussion

In conclusion, loss of use coverage car insurance is a vital component of any comprehensive vehicle insurance policy. Understanding the scope of this coverage, its potential benefits, and the accompanying limitations empowers you to make informed decisions about your insurance needs. Thorough research and careful consideration of your specific circumstances are key to maximizing the protection this coverage offers.

Remember, each policy is unique, and consulting your insurance provider is crucial for personalized guidance.

Questions Often Asked

What are common exclusions for loss of use coverage?

Common exclusions often include pre-existing conditions, intentional damage, or use of the vehicle for illegal activities. Policy specifics vary, so always consult your policy documents for complete details.

How long does the claim process typically take?

Claim processing timelines depend on the insurance company and the complexity of the claim. Generally, it can range from a few weeks to several months. Factors like the completeness of documentation and the need for appraisals can impact the timeframe.

What documents are needed for a loss of use claim?

Essential documents usually include police reports (if applicable), repair estimates, and proof of rental car expenses. Specific requirements vary by insurance company; refer to your policy for precise details.

How does loss of use coverage compare to comprehensive coverage?

Loss of use coverage addresses the financial impact of a vehicle being unusable, while comprehensive coverage typically pays for damage to your vehicle, regardless of fault. Loss of use is an ancillary benefit that complements comprehensive coverage. They function independently, with loss of use covering consequential costs related to the vehicle’s unavailability and comprehensive coverage addressing the physical damage to the vehicle itself.