What is a stock insurer? They’re a critical part of the insurance landscape, distinct from mutual insurers. This lecture will unveil the intricacies of their operations, from their capital structure to profitability models, and ultimately, how they operate in the market. Prepare to gain a comprehensive understanding of this crucial insurance sector.

Stock insurers, driven by profit and shareholder returns, operate differently from mutual insurers. Their ownership structure, operational processes, and regulatory compliance create a unique dynamic within the industry. We will explore the various factors that shape their performance and the strategies they employ to succeed.

Defining Stock Insurers

Stock insurers are a vital part of the global insurance landscape, playing a crucial role in protecting individuals and businesses from financial risks. Their structure and operations are distinct from other types of insurers, offering a unique approach to risk management. Understanding these differences is key to appreciating the multifaceted nature of the insurance industry.A stock insurer, also known as a proprietary insurer, is a company that sells insurance policies and uses the premiums collected to pay claims and cover operating costs.

So, like, a stock insurer, right? Basically, it’s a company that sells insurance policies and uses the money from premiums to invest in stocks and stuff. It’s a pretty common way to run an insurance company, and if you’re looking for a local place like, say, Heritage Gardens Funeral Home Niceville FL , you might be interested in how they handle their financial stuff.

Basically, they’re just a different type of insurance player, you know?

Unlike mutual insurers, the ownership of stock insurers is held by shareholders. This fundamental difference impacts how the company operates and distributes profits.

Definition of a Stock Insurer

A stock insurer is a type of insurance company that is owned by shareholders who purchase stock in the company. These shareholders invest in the company with the expectation of receiving a return on their investment in the form of dividends. The company’s profits are distributed to these shareholders, rather than being returned to policyholders.

Key Characteristics of Stock Insurers

Stock insurers are distinguished from other types of insurers primarily by their ownership structure. This fundamental difference influences various aspects of their operations, including profit distribution and regulatory oversight. Their structure fosters a competitive environment, driving innovation and efficiency within the industry.

Ownership Structure of a Stock Insurer

Stock insurers are owned by shareholders who purchase stock in the company. These shareholders elect a board of directors to oversee the company’s operations and ensure it remains financially sound. The board of directors hires executives to manage the day-to-day operations of the company, including the underwriting and claims processes. The shareholders’ investment in the company’s stock is reflected in the company’s financial performance, with profits being distributed as dividends to shareholders.

Comparison of Stock and Mutual Insurers

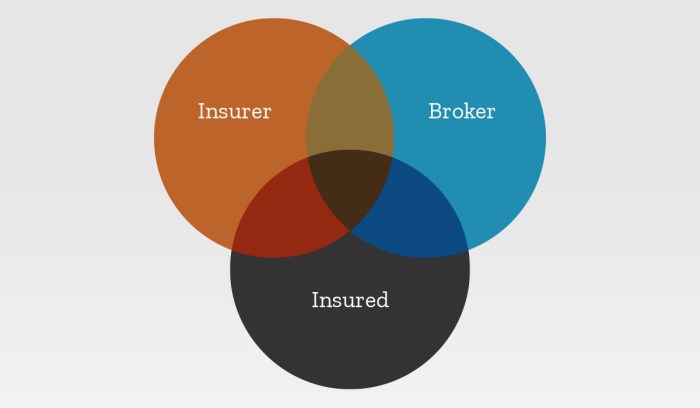

The structure of a stock insurer contrasts significantly with that of a mutual insurer. A mutual insurer, unlike a stock insurer, is owned by its policyholders. This fundamental difference impacts the company’s profitability and distribution of profits.

So, like, a stock insurer? Basically, they’re a company that pools risk from tons of different policies, kind of like a giant insurance club. Think of it like a recipe for caramel apple butter – you’re combining all these different apples into one delicious, smooth spread. And just like that, they’re able to spread the risk and provide coverage to a ton of people.

Check out this amazing recipe for caramel apple butter for a sweet treat that’s totally worth trying. Stock insurers are, like, the ultimate risk-sharing pros, man.

| Characteristic | Stock Insurer | Mutual Insurer |

|---|---|---|

| Ownership | Owned by shareholders who purchase stock in the company. | Owned by its policyholders. |

| Profit Distribution | Profits are distributed to shareholders as dividends. | Profits are returned to policyholders as dividends or lower premiums. |

| Regulatory Oversight | Subject to the same regulatory oversight as other insurance companies. | Subject to the same regulatory oversight as other insurance companies. |

The table above clearly Artikels the key distinctions between stock and mutual insurers. Understanding these distinctions is crucial for making informed decisions about insurance products and services. Each structure has its own unique benefits and drawbacks, and consumers should carefully evaluate their needs before choosing an insurance company.

Operations and Functions

Stock insurers play a vital role in the financial landscape, providing crucial protection and security for individuals and businesses alike. Their operations are meticulously structured to efficiently manage risks and deliver exceptional service to policyholders. This section delves into the operational processes, key functions, and departmental roles within a stock insurer, highlighting the diverse range of insurance products they offer.Operational processes within a stock insurer are designed with efficiency and accuracy in mind.

These processes typically involve rigorous underwriting procedures, meticulous claims handling, and transparent communication with policyholders. The focus is on ensuring a seamless and secure experience for all stakeholders.

Operational Processes

The core operational processes of a stock insurer revolve around risk assessment, policy issuance, claim settlement, and financial management. Risk assessment is a critical initial step, meticulously evaluating potential risks associated with each policy application. This involves detailed analysis of the insured’s circumstances, historical data, and potential exposures. Subsequent policy issuance procedures are designed to be streamlined and transparent, ensuring swift processing and clear communication to policyholders.

Efficient claim settlement procedures are equally crucial, with a focus on fairness, transparency, and timely resolution. Financial management is paramount to maintaining financial stability and solvency, enabling the insurer to meet its obligations and continue providing exceptional service.

Key Functions

Stock insurers perform a multitude of crucial functions to fulfill their mission. These functions encompass risk management, policy administration, claims processing, investment management, and regulatory compliance. Risk management involves proactively identifying and mitigating potential financial losses, safeguarding the insurer’s assets and interests. Policy administration ensures the smooth and efficient processing of insurance policies, ensuring accurate record-keeping and compliance with regulations.

Claims processing is vital for handling claims effectively, ensuring fair and timely settlement. Investment management plays a critical role in managing assets and maximizing returns to support the insurer’s financial obligations. Regulatory compliance ensures the insurer operates within the boundaries of applicable laws and regulations, maintaining ethical and transparent practices.

Departmental Roles and Responsibilities

Different departments within a stock insurer have specific roles and responsibilities that contribute to the overall operational efficiency. The underwriting department assesses risks and approves policies. The claims department handles claims processing and settlement. The actuarial department analyzes risks and forecasts future financial obligations. The investment department manages investments and secures returns.

The legal department ensures compliance with regulations and contracts. The marketing and sales department identifies and acquires new customers. Each department plays a crucial role in the insurer’s success, working together to provide comprehensive insurance solutions.

Insurance Products Offered

Stock insurers provide a wide array of insurance products catering to diverse needs. These products are designed to protect against various risks, ranging from property damage to personal liability. The specific products offered vary depending on the insurer’s strategic focus and market conditions. Examples of common insurance products include property insurance, casualty insurance, life insurance, health insurance, and liability insurance.

Common Insurance Products

| Product Type | Coverage Details | Target Audience |

|---|---|---|

| Property Insurance | Covers damage or loss to buildings, structures, and personal property. | Homeowners, businesses, landlords |

| Casualty Insurance | Protects against accidents and injuries, including liability for bodily harm or property damage. | Individuals, businesses, and organizations |

| Life Insurance | Provides financial protection to beneficiaries in case of death. | Individuals seeking life insurance coverage |

| Health Insurance | Covers medical expenses incurred due to illness or injury. | Individuals and families seeking health coverage |

| Liability Insurance | Protects against legal liability for harm caused to others. | Individuals and businesses |

Capital Structure and Financial Performance

Stock insurers, driven by the pursuit of robust financial health, meticulously manage their capital structure to ensure stability and profitability. This careful balancing act underpins their ability to meet obligations and thrive in a dynamic market environment. A strong capital base, coupled with astute financial management, fosters investor confidence and facilitates the insurer’s continued growth and success.

Capital Structure of a Stock Insurer

A stock insurer’s capital structure comprises various sources of funding, carefully interwoven to achieve optimal financial stability. This structure reflects a commitment to financial prudence and a deep understanding of the risks inherent in the insurance industry. The composition of the capital structure is a critical factor in determining the insurer’s financial strength and long-term viability.

Sources of Capital for a Stock Insurer

Stock insurers draw capital from a variety of sources, each contributing to the overall financial strength of the organization. These diverse funding streams are vital for supporting operational activities, managing risks, and ensuring financial solvency.

- Equity Capital: This crucial component represents the ownership stake of shareholders. Equity capital is often a significant source of funding, providing a solid foundation for the insurer’s long-term operations and growth. Increased equity capital can demonstrate investor confidence and the insurer’s commitment to its stakeholders.

- Debt Capital: Debt financing, in the form of bonds or other debt instruments, is another vital source of capital. This strategy allows the insurer to leverage borrowed funds to support its operations, enabling growth and expansion while carefully managing financial obligations.

- Reinsurance Agreements: Insurers often utilize reinsurance agreements to transfer portions of their risk to other insurers. This strategic approach helps manage large or complex risks, safeguarding the insurer’s financial position and mitigating potential losses.

Factors Influencing Financial Performance

Numerous factors influence the financial performance of a stock insurer. Understanding these elements is critical for assessing the insurer’s overall health and predicting future success.

- Interest Rate Fluctuations: Changes in interest rates directly impact the insurer’s investment returns and borrowing costs. Navigating these fluctuations requires strategic investment decisions and careful management of debt portfolios.

- Economic Conditions: The broader economic environment plays a significant role in the insurer’s financial performance. Strong economic growth often leads to increased premiums and investment opportunities, while economic downturns can pose challenges to the insurer’s financial stability.

- Claims Frequency and Severity: The frequency and severity of claims significantly impact the insurer’s expenses. A thorough understanding of risk assessment and effective claims management strategies are critical to maintaining profitability.

- Investment Performance: The insurer’s investment portfolio is a critical driver of profitability. Strategic asset allocation and skillful portfolio management are essential for maximizing returns and mitigating risks.

- Regulatory Environment: Government regulations and supervisory oversight play a critical role in shaping the insurer’s operations and financial performance. Understanding and complying with regulatory requirements is crucial for maintaining stability and trust.

Key Financial Metrics for Evaluating Performance

A range of key metrics provides insight into the financial health and performance of a stock insurer. These metrics help stakeholders assess the insurer’s ability to manage risks, generate profits, and meet its obligations.

| Metric Name | Calculation | Interpretation |

|---|---|---|

| Return on Equity (ROE) | Net Income / Shareholders’ Equity | Measures profitability relative to the shareholders’ investment. A higher ROE indicates greater efficiency in generating profits. |

| Solvency Ratio | Capital and Surplus / Total Liabilities | Indicates the insurer’s ability to meet its financial obligations. A higher ratio signifies greater financial strength. |

| Combined Ratio | (Incurred Losses + Loss Adjusting Expenses + Underwriting Expenses) / Premiums Written | Measures the efficiency of the underwriting process. A lower combined ratio indicates greater profitability. |

| Expense Ratio | Underwriting Expenses / Premiums Written | Indicates the insurer’s operational efficiency in managing administrative and other expenses. A lower expense ratio suggests more efficient operations. |

| Investment Income Ratio | Investment Income / Premiums Written | Highlights the profitability derived from investments. A higher ratio indicates a more lucrative investment strategy. |

Regulatory Environment and Compliance

Navigating the complex landscape of the insurance industry requires a robust regulatory framework to ensure fair practices, protect policyholders, and maintain market stability. Stock insurers, as vital components of this system, are subject to a rigorous set of regulations, ensuring responsible operations and fostering public trust. Compliance with these regulations is paramount to their long-term success and sustainability.

Regulatory Framework Governing Stock Insurers

The regulatory framework for stock insurers is a multifaceted system designed to safeguard policyholders’ interests and maintain the integrity of the insurance market. It encompasses a comprehensive set of laws, rules, and regulations that dictate various aspects of insurer operations, from capital adequacy to investment strategies. This framework is crucial for establishing a level playing field, promoting transparency, and fostering trust among stakeholders.

The goal is to create a system where stock insurers operate responsibly and ethically, contributing to the overall health and resilience of the financial system.

Compliance Requirements for Stock Insurers

Meeting the demands of the regulatory framework necessitates a commitment to compliance. Stock insurers must adhere to numerous requirements, including maintaining sufficient capital reserves, adhering to investment guidelines, and accurately reporting financial information. This commitment to compliance underpins the stability and trustworthiness of the insurance sector, ensuring the reliability of insurance products and services. These requirements are critical for protecting policyholders and maintaining the integrity of the insurance market.

Role of Regulatory Bodies in Overseeing Stock Insurers

Regulatory bodies play a pivotal role in overseeing stock insurers. They act as guardians of the insurance market, monitoring insurer activities, ensuring adherence to regulations, and intervening when necessary to maintain market stability. This proactive approach fosters a strong regulatory environment where insurers operate with transparency and accountability. Regulatory bodies help to safeguard policyholders and maintain public trust in the insurance sector.

Legal and Ethical Considerations for Stock Insurers

Legal and ethical considerations are interwoven throughout the operations of stock insurers. Insurers must act in the best interests of their policyholders, adhering to principles of fairness, transparency, and accountability. This commitment extends to complying with relevant laws, regulations, and industry best practices, fostering a culture of ethical conduct and responsible decision-making. It is essential for the continued growth and reputation of the insurance sector.

Key Regulatory Bodies and Their Responsibilities

Understanding the role of regulatory bodies is vital for comprehending the regulatory landscape. These bodies oversee and monitor stock insurers to ensure compliance with regulations and uphold market integrity. The table below Artikels some key regulatory bodies and their primary responsibilities.

| Regulatory Body | Jurisdiction | Primary Responsibilities |

|---|---|---|

| Insurance Regulatory and Development Authority (IRDA) | India | Regulating and supervising the insurance sector, including stock insurers, ensuring compliance with regulations, and promoting fair practices. |

| National Insurance Commission (NIC) | Nigeria | Supervising and regulating insurance companies in Nigeria, ensuring compliance with relevant laws and regulations. |

| Insurance Authority of Ireland | Ireland | Regulating and supervising insurance companies operating in Ireland, ensuring compliance with relevant laws and regulations. |

| Financial Conduct Authority (FCA) | United Kingdom | Regulating the financial services industry in the UK, including the insurance sector, ensuring compliance with regulations, and protecting consumers. |

Profitability and Dividend Distribution

Stock insurers, driven by a commitment to their shareholders, meticulously manage their operations to achieve sustainable profitability. This translates into strong financial performance, attracting investor confidence and fostering long-term growth. A healthy profit margin is vital for the company’s continued success and allows for generous dividend distributions, rewarding investors for their trust.

Profit Generation Mechanisms

Stock insurers generate profits through a variety of carefully orchestrated strategies. These include shrewd underwriting practices, where risk assessment and premium pricing are meticulously balanced. Efficient claims handling procedures, minimizing unnecessary expenses, are crucial in maintaining healthy profit margins. Furthermore, effective investment strategies deployed with strong risk management protocols maximize returns on investments, thereby augmenting overall profitability.

Dividend Distribution Strategies

Dividend distribution strategies are a critical aspect of shareholder value creation. Insurers employ various approaches, adapting their strategies to align with market conditions, company performance, and shareholder preferences. These approaches are often tailored to specific circumstances.

- Regular Dividends: A consistent dividend payment schedule provides stability and predictability for shareholders. This approach fosters confidence and builds a strong investor base. Companies with a history of stable, consistent dividend payments are generally viewed as more trustworthy and reliable investments.

- Special Dividends: These one-time dividend payments often reflect a company’s exceptional financial performance in a specific period. They could be a reward for surpassing targets or a testament to exceptional operational efficiency.

- Stock Dividends: Instead of cash, stock dividends distribute additional company shares to shareholders. This can provide investors with a higher ownership stake, increasing their long-term investment potential.

- Dividend Reinvestment Plans (DRIPs): These programs enable shareholders to reinvest their dividends back into the company, acquiring more shares. This approach accelerates shareholder participation and can amplify long-term investment returns.

Comparison with Mutual Insurers

Stock insurers and mutual insurers differ significantly in their profit distribution mechanisms. Stock insurers distribute profits primarily as dividends to shareholders, whereas mutual insurers retain profits to improve policyholder benefits or enhance the company’s operational strength. This fundamental difference impacts the ownership structure and the way the companies are run.

Impact on Stock Price

Profitability directly correlates with the stock price of a stock insurer. A company consistently achieving strong profitability, evident in strong financial reports and steady dividend payouts, usually commands a higher stock price. This is because investors are confident in the company’s ability to generate future profits and reward them with dividends. Conversely, poor profitability often leads to a decrease in the stock price as investors lose faith in the company’s future potential.

Companies exhibiting consistent, healthy growth, and strong dividend payments tend to see their stock prices reflect this positive outlook. Consider the example of a well-known insurer whose strong performance led to a substantial increase in its stock price, demonstrating a direct link between profitability and market value.

Customer Service and Claims Management

Stock insurers understand that exceptional customer service and efficient claims management are paramount to building trust and fostering long-term relationships. These elements are not just operational necessities; they are strategic differentiators in a competitive market. A positive customer experience translates directly into brand loyalty, positive word-of-mouth referrals, and ultimately, sustainable growth.

Customer Service Processes in Stock Insurers

Stock insurers employ a multi-faceted approach to customer service, encompassing various channels and touchpoints. This includes readily available online portals, dedicated phone lines, and well-trained representatives to address inquiries and concerns promptly and effectively. The aim is to provide a seamless and personalized experience that anticipates customer needs and ensures satisfaction. For example, many insurers offer 24/7 access to policy information and claim status updates through mobile apps, demonstrating a commitment to accessibility and convenience.

Claims Management Procedures in Stock Insurers, What is a stock insurer

Claims management procedures are meticulously designed to be efficient and transparent. Insurers utilize a combination of automated systems and human intervention to ensure claims are processed promptly and fairly. This often involves a clear and concise communication plan with the policyholder, outlining each step in the process, and keeping them updated on progress. This transparent process helps mitigate potential frustration and fosters trust.

A streamlined claims process, including digital documentation and online claim filing, is crucial for enhancing efficiency and speed.

Factors Influencing Customer Satisfaction in Stock Insurers

Several factors contribute to customer satisfaction in stock insurers. These include the speed and efficiency of claim processing, the responsiveness and helpfulness of customer service representatives, and the clarity and transparency of communication throughout the claims process. A comprehensive understanding of customer needs, a proactive approach to resolving issues, and the establishment of clear communication channels are essential for building a positive customer experience.

For instance, insurers often utilize surveys and feedback mechanisms to gauge customer satisfaction and identify areas for improvement.

Importance of Customer Service in Building a Strong Brand Reputation

Customer service plays a critical role in shaping a company’s brand reputation. Positive experiences with customer service lead to increased brand loyalty and advocacy. Customers are more likely to recommend a company to others when they have experienced exceptional service. By prioritizing customer needs and consistently providing excellent service, stock insurers build a positive image that resonates with their target market.

This translates to increased market share, enhanced brand equity, and sustained profitability.

Comparison of Claim Handling Processes

| Process Type | Speed (Days) | Customer Feedback (Average Rating) |

|---|---|---|

| Traditional Paper-Based | 14-28 | 3.5/5 |

| Semi-Automated (Hybrid) | 7-14 | 4.0/5 |

| Fully Automated (Digital) | 3-7 | 4.5/5 |

This table provides a comparative overview of various claim handling processes. Fully automated processes, leveraging digital tools and technologies, tend to deliver faster processing times and higher customer satisfaction. The data represents an average across different stock insurers and customer demographics.

Future Trends and Challenges

The stock insurance industry is poised for exciting transformation, driven by technological advancements and evolving consumer expectations. Navigating these shifts requires a proactive and innovative approach, embracing change as an opportunity for growth and enhanced customer experience. Insurers who adapt to the changing landscape will not only thrive but also lead the way in the future of insurance.

Potential Future Trends

The insurance industry is experiencing rapid evolution, marked by emerging trends that will shape its future. These trends encompass a diverse range of factors, including technological advancements, shifting consumer preferences, and evolving regulatory landscapes. Understanding and proactively responding to these trends will be crucial for success.

- Rise of Insurtech: Insurtech companies are revolutionizing the industry by leveraging technology to streamline processes, personalize products, and enhance customer engagement. Examples include digital platforms for policy purchasing, AI-powered claims processing, and mobile-first solutions. This trend signifies a fundamental shift towards greater efficiency and customer satisfaction.

- Data Analytics and AI: The ability to analyze vast amounts of data to gain insights into risk assessment, pricing models, and customer behavior is becoming increasingly important. AI-powered tools are automating tasks and identifying patterns, allowing insurers to provide more personalized and targeted coverage. For instance, AI can analyze driving data to offer customized car insurance rates based on individual driving habits.

- Increased Emphasis on Sustainability: Consumers are increasingly aware of environmental issues, and insurance companies are responding by incorporating sustainability into their products and practices. This includes offering green insurance options, promoting eco-friendly policies, and investing in sustainable ventures. Insurers that prioritize sustainability are better positioned to attract environmentally conscious customers.

- Focus on Customer Experience: Insurers are increasingly recognizing the importance of providing exceptional customer service and a seamless digital experience. This includes user-friendly websites, mobile apps, and 24/7 support channels. Companies are implementing customer relationship management (CRM) systems to build stronger customer relationships and tailor services.

Challenges Faced by Stock Insurers

Stock insurers face numerous challenges in the current market. These challenges range from competition to regulatory pressures and the need to adapt to changing consumer expectations. Overcoming these obstacles requires a strategic and innovative approach.

- Competition from Insurtech Companies: Insurtech startups are rapidly disrupting the traditional insurance market, presenting a significant challenge to established stock insurers. These new entrants offer innovative products and services at potentially lower costs. This necessitates stock insurers to embrace innovation and compete effectively.

- Regulatory Changes: Regulatory environments are evolving constantly, requiring insurers to adapt to new guidelines and compliance requirements. Compliance with evolving regulations can be resource-intensive and costly.

- Maintaining Profitability in a Competitive Landscape: The insurance industry is highly competitive. Insurers must constantly strive to control costs, manage risks effectively, and innovate to maintain profitability and competitiveness.

- Attracting and Retaining Talent: Attracting and retaining skilled professionals in the digital age is crucial. Insurers need to adapt their work culture to attract and retain top talent.

Innovative Approaches to Address Industry Challenges

Stock insurers are adopting various innovative approaches to overcome industry challenges and seize opportunities. These approaches include leveraging technology, improving customer experiences, and adapting to evolving consumer needs.

- Implementation of Technology: Stock insurers are using data analytics, machine learning, and AI to improve risk assessment, pricing, and customer service. This includes implementing AI-powered chatbots for customer support and personalized pricing models based on risk assessment.

- Focus on Customer-Centric Strategies: Stock insurers are emphasizing customer-centric strategies by improving their digital platforms and providing personalized services. This is achieved through improved user interfaces, proactive communication, and personalized product offerings. Customer satisfaction and retention are paramount.

- Adapting to Changing Consumer Preferences: Stock insurers are increasingly recognizing the importance of offering products and services that align with evolving consumer preferences. This includes providing tailored products, leveraging digital channels, and offering transparent and accessible information.

Importance of Adapting to Changing Consumer Needs

The insurance sector is facing a paradigm shift as consumers increasingly expect personalized, efficient, and transparent services. Insurers that fail to adapt to these changing expectations risk losing market share. Adapting to these needs is vital for long-term success.

- Meeting Evolving Expectations: Consumers are demanding seamless digital experiences, personalized products, and transparent pricing. Meeting these expectations requires a proactive approach, leveraging technology to deliver personalized service and transparency.

- Building Stronger Relationships: Insurers need to build stronger relationships with customers by providing proactive support, personalized service, and transparent communication. This strengthens customer loyalty and fosters trust.

Technological Advancements and the Stock Insurance Industry

Technological advancements are transforming the stock insurance industry in significant ways. These advancements include the use of big data, AI, and automation to improve efficiency, reduce costs, and enhance customer experiences. Embracing these changes is vital for insurers to remain competitive.

- Big Data Analytics: Big data analytics allows insurers to process vast amounts of data to identify patterns and insights, leading to more accurate risk assessments and better pricing models. This improves pricing accuracy and helps insurers identify potential risks more effectively.

- AI-Driven Automation: AI-powered automation is transforming various aspects of insurance operations, from claims processing to customer service. This automation increases efficiency and reduces operational costs, allowing insurers to focus on strategic initiatives.

- Enhanced Customer Engagement: Technological advancements empower insurers to provide a more personalized and engaging experience for customers. This includes digital platforms, mobile apps, and personalized communication, fostering customer loyalty.

Ultimate Conclusion

In conclusion, stock insurers are a vital component of the insurance market, playing a significant role in providing coverage and managing risk. Their unique ownership structure, operational methods, and regulatory framework set them apart. Understanding their intricacies is key to comprehending the broader insurance landscape. This lecture has provided a strong foundation, enabling a deeper understanding of stock insurers and their future in the market.

Question Bank: What Is A Stock Insurer

What are the key differences between stock and mutual insurers?

Stock insurers are for-profit entities owned by shareholders, distributing profits as dividends. Mutual insurers are owned by their policyholders, and profits are typically returned to policyholders in the form of lower premiums or dividends.

How do stock insurers generate profits?

Stock insurers generate profits by carefully managing expenses, efficiently pricing risks, and investing premiums wisely. Their ability to generate returns on investments is a crucial aspect of profitability.

What are the typical insurance products offered by stock insurers?

Stock insurers offer a wide range of insurance products, including auto, homeowners, life, health, and commercial insurance, tailoring their offerings to meet diverse customer needs.

What are the major challenges faced by stock insurers in the current market?

Challenges include maintaining profitability amidst rising claims costs, adapting to technological advancements, and attracting and retaining customers in a competitive market. Competition from other insurance providers is also a factor.