What is risk pooling in car insurance? It’s like a giant, slightly chaotic potluck where everyone brings their car accident woes to the table, hoping the total doesn’t bankrupt the whole party. Insurance companies are the hosts, juggling claims and premiums like they’re juggling flaming bowling pins. This potluck, or rather, risk pool, is designed to spread the financial burden of accidents among many drivers, ensuring everyone can afford insurance without breaking the bank.

Imagine a world where every driver’s insurance premiums were calculated based solely on their individual accident risk. It would be a wild ride, with some drivers paying exorbitant amounts, and others getting off scot-free. Risk pooling, however, is like a safety net, creating a more predictable and fairer system for everyone. It’s all about spreading the risk and ensuring a smoother, less bumpy ride for all parties involved.

Introduction to Risk Pooling

Yo, peeps! Ever wondered how car insurance premiums stay relatively stable even with crazy accidents happening all the time? It’s all about risk pooling! Basically, it’s a smart way to share the financial burden of unexpected car accidents among a big group of drivers. Imagine a big, collective pot where everyone chips in a bit, and when one person has a big claim, the pot helps cover it.Risk pooling is a fundamental principle in car insurance, essentially a group effort to manage uncertainty.

It’s like a safety net where everyone contributes a small amount to cover the potential risks of a few unlucky individuals. This way, nobody has to shoulder the entire cost of a major claim on their own, keeping premiums affordable for everyone.Risk pooling directly tackles the problem of unpredictable car insurance claims. Since accidents are, well, unpredictable, some months will have a bunch of claims, while others might be pretty calm.

Risk pooling smooths out these fluctuations, ensuring the insurance company can pay out claims consistently, without going bankrupt. It’s a win-win for everyone involved!Historically, risk pooling has been a cornerstone of insurance. Early forms of mutual aid societies, where individuals pooled resources to protect each other from financial losses, were the forerunners of modern insurance. This concept evolved into the complex risk-sharing mechanisms we see in insurance today.

The core idea remains the same: sharing the burden to ensure stability.

Key Benefits of Risk Pooling

Risk pooling isn’t just about covering claims; it also benefits everyone in the system. Here’s a breakdown of the key advantages for car insurance customers:

| Benefit | Explanation | Example | Impact on premiums |

|---|---|---|---|

| Affordable Premiums | By sharing risk, the insurance company can spread out the cost of claims across a large group of policyholders. This leads to lower premiums for everyone. | Imagine 100 drivers pooling their risks. If 5 drivers have accidents, the cost is spread across all 100, making the individual cost lower than if each driver had to cover their own accidents. | Lower premiums, making insurance more accessible to a wider range of drivers. |

| Financial Security | Risk pooling ensures that even if an individual experiences a high-cost claim, the insurance company is able to pay out. This protects drivers from catastrophic financial losses. | A driver has a major accident with substantial repair costs. Risk pooling ensures the claim is covered, preventing the driver from facing the full financial burden. | Reduced financial stress for policyholders, knowing their claims will be covered. |

| Stability of the Insurance Industry | By spreading the risk across many policyholders, risk pooling creates stability for the insurance industry. This prevents large fluctuations in claims from impacting the company’s financial health. | A sudden spike in accidents in a specific region wouldn’t cause an enormous financial strain on the insurance company because the risk is spread across the entire pool of policyholders. | A more stable insurance market, reducing the chance of premium increases due to unexpected claim spikes. |

| Protection from Catastrophic Events | Risk pooling plays a vital role in mitigating the impact of major events, like natural disasters or widespread accidents. By spreading the cost across many policyholders, insurance companies can handle large-scale claims. | During a major earthquake that damages many vehicles, risk pooling ensures the insurance company can cover all the claims without collapsing. | Protection against significant financial shocks, ensuring insurance remains accessible during crisis situations. |

How Risk Pooling Works in Car Insurance

Risk pooling in car insurance is like a group savings plan for unexpected car accidents. Instead of each person saving individually, everyone contributes a little bit to a shared fund. This shared fund, or pool, is used to pay for claims from accidents, making sure everyone’s covered no matter what. It’s a smart way to manage risk and make car insurance more affordable for everyone.Risk pooling is a fundamental concept in insurance.

It leverages the principle of diversification to reduce the financial impact of potential losses. By spreading the risk across a large group of policyholders, the likelihood of a catastrophic event affecting any single insurer is minimized. This translates into more stable premiums and better affordability for everyone.

Mechanics of Premium Contributions

Individual premiums are calculated based on a variety of factors, including the driver’s age, driving history, the type of car, and location. A young driver with a clean record, driving a small car in a low-accident area, will likely pay less than an older driver with several accidents, driving a large SUV in a high-accident zone. These factors are used to estimate the probability of a claim.

Higher-risk drivers contribute more to the pool, while lower-risk drivers contribute less. This ensures that the pool has enough funds to pay for claims while also reflecting the actual risk each driver poses.

Claims Payment from the Pool

When a claim is filed, the insurance company assesses the damage and verifies the policyholder’s eligibility. If the claim is legitimate, the money is drawn from the risk pool. The amount paid depends on the details of the claim, such as the severity of the damage and the policy coverage. This system ensures that everyone benefits from the pooling effect, regardless of whether they have an accident or not.

Role of Actuarial Science

Actuarial science is crucial in risk pooling. Actuaries use statistical models and data analysis to estimate the likelihood of claims and the amount needed to cover them. They consider various factors such as historical accident rates, demographics, and vehicle types to determine the appropriate premium for each driver. By predicting the future needs of the pool, actuaries help maintain the financial stability of the insurance company.

For example, an increase in the average cost of repairs due to newer technologies can be factored into the calculations.

Calculating Individual Premiums

The process of calculating individual premiums is complex, incorporating many variables. Actuaries use sophisticated algorithms and statistical models to calculate premiums based on risk assessments. These models often involve intricate formulas and calculations to predict future claims based on factors like age, location, and driving record. Consider a driver in Jogja with a clean record. Their premium will be lower compared to a driver in a higher accident area.

Claim Processing Flowchart

+-----------------+

| Claim is Filed |

+-----------------+

|

V

+-----------------+

| Claim Assessment |

+-----------------+

|

V

+-----------------+

| Policy Verification|

+-----------------+

|

V

+-----------------+

| Claim Validation |

+-----------------+

|

V

+-----------------+

| Payment from Pool|

+-----------------+

|

V

+-----------------+

| Claim Resolved |

+-----------------+

This flowchart illustrates the basic steps involved in processing a claim using risk pooling.

Each step is critical in ensuring that claims are processed fairly and efficiently, using the collective resources of the risk pool.

Benefits and Advantages of Risk Pooling

Risk pooling in car insurance is like a super-cooperative group. Instead of everyone facing the financial risk of accidents individually, they pool their resources together. This approach, as you’ll see, offers a lot of advantages for both the insurance companies and the policyholders. It’s a smart way to manage risk and keep premiums reasonable.

Advantages for Insurance Companies

Risk pooling significantly reduces the volatility of insurance company earnings. By spreading the financial burden of claims across a large group of policyholders, the company mitigates the impact of a few major accidents or a sudden spike in claims. This makes their financial situation more stable and predictable, which is super important for long-term sustainability. Imagine a huge wave of accidents—risk pooling helps the company ride it out without sinking.

It allows them to better manage their investment portfolios and plan for the future.

Stabilizing Insurance Company Finances

Risk pooling creates a buffer against catastrophic events. When a few policyholders have accidents, the pooled funds can cover those claims. This protects the insurance company from insolvency, especially during periods of high accident rates or unexpected disasters. This stability allows them to offer consistent and reliable coverage to all policyholders, even during tough times. This predictability is crucial for their business operations.

Benefits for Individual Policyholders

Risk pooling often leads to more affordable premiums. Because the insurance company shares the risk, the cost of insurance is spread across a larger pool of people. This translates into lower premiums for individual policyholders, making car insurance more accessible. Think of it like a group discount—everyone benefits from the collective protection. This makes it easier for people to afford insurance.

Impact on Car Insurance Premiums

Risk pooling, in essence, creates a more stable and predictable cost structure for car insurance premiums. The impact on individual premiums depends on various factors like the individual’s driving record, location, and the specific terms of their policy. However, the general effect is a more affordable and manageable price. By lowering the cost of insurance, risk pooling makes it easier for people to afford car insurance, which in turn helps to increase car insurance coverage.

Comparison to Alternative Risk Management Methods

| Method | Cost | Coverage | Risk Management |

|---|---|---|---|

| Risk Pooling | Generally lower premiums | Comprehensive coverage for a wider range of risks | Reduces financial volatility for the company |

| Individual Risk Retention | Potentially higher premiums | Coverage limited to what individuals can afford | Full responsibility for financial losses |

| Separate Insurance Policies for High-Risk Drivers | Higher premiums | Coverage catered to the specific risks | Management of risk from high-risk individuals |

Risk pooling is a more efficient and equitable way to handle car insurance risk compared to the other methods. It’s a win-win for both insurance companies and policyholders.

Factors Affecting Risk Pooling in Car Insurance

Yo, peeps! So, we’ve talked about how risk pooling works in car insurance, and how it’s all about spreading the risk among a bunch of drivers. But what actually

-influences* the prices? It’s not just a random number generator, trust me. There are tons of factors at play. Let’s dive in!

Factors Influencing Premium Calculation

Risk pooling in car insurance isn’t magic. It’s based on real-world data about how likely different drivers are to get into accidents. Insurance companies analyze tons of info to figure out the best way to price policies fairly for everyone involved. This helps them to ensure the company is profitable, while also offering affordable premiums for customers.

Role of Demographics in Premium Determination

Your age, gender, and even where you live can impact your car insurance premiums. Insurance companies use statistical data to see how certain demographics tend to be involved in accidents more often. For example, younger drivers often have higher accident rates than older drivers, which explains why their premiums tend to be higher. This isn’t about discrimination, it’s about managing risk based on observed patterns.

Impact of Driving History on Premium Calculation

Your driving record is a HUGE factor. If you have a history of accidents or violations, your premiums will likely be higher. This is because you represent a higher risk to the insurance company. Insurance companies use this information to assess how much risk you pose, and the pricing is adjusted accordingly. A clean driving record is key to getting a lower premium!

Role of Location in Premium Determination

Where you live plays a significant part in your insurance costs. Areas with higher accident rates generally have higher insurance premiums. This is because the risk of accidents is statistically higher in certain regions. For instance, areas with more traffic congestion or higher speeds often see more accidents, which directly impacts insurance prices.

Impact of Accident Rates on Overall Insurance Costs

Accident rates in a specific area or for a particular group are a huge driver in setting premiums. If accidents are more frequent, the overall cost of insurance for the entire risk pool increases. Insurance companies must factor this in when determining premiums. High accident rates make it more expensive to provide coverage for everyone in the pool.

Frequency and Severity of Car Accidents and Premiums

The frequency (how often) and severity (how bad) of car accidents in a risk pool directly influence premium costs. More frequent and severe accidents lead to higher premiums for everyone in the pool. This is a way to account for the increased financial burden on the company. The insurance company needs to cover the cost of more claims.

Table: Risk Factors and Impact on Premiums

| Risk Factor | Description | Impact on Premium | Example |

|---|---|---|---|

| Age | Younger drivers often have higher accident rates. | Higher premiums | A 20-year-old driver might pay more than a 50-year-old driver. |

| Driving Record | Accidents and violations increase risk. | Higher premiums | A driver with multiple speeding tickets will pay more than a driver with a clean record. |

| Location | Areas with higher accident rates have higher premiums. | Higher premiums | A driver living in a city with high traffic congestion might pay more than a driver in a rural area. |

| Vehicle Type | Certain vehicles are more prone to damage or theft. | Higher or lower premiums | A sports car might have a higher premium than a compact car due to its higher repair costs. |

Limitations and Challenges of Risk Pooling: What Is Risk Pooling In Car Insurance

Risk pooling, while a solid concept, isn’t without its hurdles in the car insurance game. It’s like a big group project—everyone chips in, but some unexpected issues can crop up. Understanding these limitations is key to navigating the complexities of car insurance.

Potential Limitations of Risk Pooling

Risk pooling relies on the idea that a large group of drivers will balance out the risk. However, this isn’t always the case. Certain segments of the population, or specific geographic areas, might have higher-than-average accident rates. This can create an imbalance in the pooling system. For example, a young driver with a history of reckless driving might disproportionately raise the premiums for everyone else in the pool.

Challenges of Managing a Large and Diverse Risk Pool

Managing a huge and diverse group of drivers is a massive logistical challenge. Insurers need sophisticated systems to collect, analyze, and manage data for each driver, keeping track of their driving records, locations, and more. This massive data management and analysis requires substantial resources and advanced technology. Data breaches or errors in the system can lead to significant problems for the entire risk pool.

Impact of Fraud and Abuse on Risk Pooling

Fraud and abuse can severely disrupt the balance of risk pooling. Fake claims or inflated damage reports throw off the entire calculation. Insurance companies often use advanced techniques to detect and prevent fraud, but it’s an ongoing struggle. This can ultimately increase premiums for honest policyholders. For instance, a widespread fraudulent claim scheme can lead to significant premium increases for everyone involved.

Adverse Selection in Risk Pooling

Adverse selection is a significant threat to risk pooling. It occurs when individuals with a higher risk of accidents or claims are more likely to purchase insurance. This can cause the average risk level of the pool to increase, potentially leading to premium hikes for everyone. For example, drivers with a history of accidents or high-risk driving habits may be more motivated to buy insurance, thus pushing up the average risk profile of the pool.

Potential Problems Arising from Risk Pooling

- Uneven Premium Distribution: Drivers in low-risk categories might feel their premiums are unfairly high, while those in high-risk categories may be frustrated with premiums they perceive as too low. This can lead to dissatisfaction and potentially regulatory scrutiny.

- Data Security Concerns: Insurance companies handle sensitive personal data. A data breach or inadequate security measures can lead to significant problems for policyholders and cause distrust in the system.

- Increased Premiums for All: If a significant portion of the risk pool has a higher-than-average risk profile, the premiums for everyone in the pool can rise. This can be a hardship for low-risk drivers.

- Complexity of Claims Management: Managing a large volume of claims, particularly in a diverse risk pool, can be complex. This can lead to delays in processing claims and create frustrations for policyholders.

- Difficulty in Identifying and Addressing Emerging Risks: Keeping up with emerging risks, such as new technologies, driving habits, and environmental factors, can be a significant challenge for insurance companies. Changes in driving behaviour and usage patterns might need adjustment to risk pooling models.

Risk Pooling and Insurance Premiums

Risk pooling is like a group hug for car insurance. It’s a system where everyone in the group shares the financial burden of potential claims. This shared responsibility is crucial in setting fair and affordable insurance premiums. It’s a fundamental concept that shapes how much you pay for your car insurance.

Impact on Car Insurance Policy Pricing

Risk pooling directly affects how much car insurance costs. By pooling risks, insurers can predict the overall frequency and severity of claims more accurately. This prediction is crucial for calculating premiums that are both reasonable for the insurer and affordable for the insured. A more accurate prediction translates to more accurate premiums.

Impact on Premium Rates for Different Driver Groups

Different driver groups have varying risk profiles. For example, younger drivers often have higher accident rates than older, more experienced drivers. Risk pooling allows insurers to reflect these differences in premium rates. This is a fair way to distribute the costs of insurance among different groups. Premiums are adjusted to reflect the likelihood of a driver needing insurance coverage.

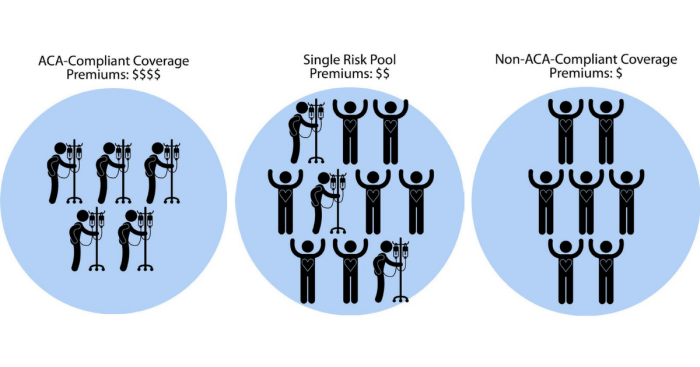

Comparison of Premiums Between Risk-Pooling and Non-Risk-Pooling Models

In a non-risk-pooling model, each driver would be responsible for their own claims. This could lead to significantly higher premiums for individuals with a higher risk of accidents. Risk pooling, however, spreads the cost across a larger group, making premiums more manageable for everyone. Premiums in risk-pooling models are generally lower compared to individual responsibility models.

Impact on Affordability of Car Insurance

Risk pooling is essential for making car insurance more affordable for the average person. By spreading the cost of claims among a larger group, the individual premium is often lower than it would be in a non-risk-pooling system. This makes car insurance more accessible to a wider range of drivers. It’s a system that levels the playing field and makes insurance more manageable for all involved.

Table: Impact of Factors on Premium Amounts

| Factor | Description | Impact on Premium | Example |

|---|---|---|---|

| Driver Age | Younger drivers often have higher accident rates. | Higher premiums for younger drivers. | A 20-year-old driver might pay more than a 40-year-old driver. |

| Driving History | Drivers with a history of accidents or violations face higher risk. | Higher premiums for drivers with accidents or violations. | A driver with multiple speeding tickets might pay a higher premium. |

| Vehicle Type | Certain vehicle types are more prone to theft or damage. | Premiums adjusted based on vehicle type. | A sports car might have a higher premium than a standard sedan due to higher theft risk. |

| Location | Areas with higher accident rates or crime rates will have higher premiums. | Higher premiums in high-risk areas. | Living in a city with high traffic density might increase your premium. |

Risk Pooling and Insurance Products

Risk pooling isn’t just about sharing the financial burden of claims; it fundamentally shapes the very design of insurance products. It’s like a giant, collaborative effort to manage risk, influencing everything from premium rates to the coverage offered. Understanding how risk pooling impacts insurance products is key to navigating the car insurance landscape, especially if you’re looking for the best deal.

Risk pooling significantly affects how car insurance products are structured and offered. It creates a framework for managing diverse risk profiles, leading to products that are more tailored to specific needs and preferences. This is especially crucial in the world of car insurance, where drivers have different risk levels based on factors like age, driving history, and the type of car they own.

Impact on Insurance Product Design

Risk pooling fundamentally reshapes the design of car insurance products by creating different tiers and levels of coverage. This is done to manage the inherent risk variations amongst drivers. For instance, young drivers, statistically, have a higher likelihood of accidents than older, more experienced drivers. This difference in risk is directly reflected in the premium structure, making insurance more affordable for those with a lower likelihood of accidents.

Examples of Tailored Insurance Products

Different risk pools lead to various insurance products designed to cater to specific driver characteristics. One prominent example is the availability of “young driver” packages. These packages often come with higher premiums but might include additional features like accident forgiveness or discounts on defensive driving courses. Conversely, experienced drivers with a clean record may qualify for lower premiums with more comprehensive coverage options.

New Product Development Driven by Risk Pooling

Risk pooling can also spark the development of entirely new insurance products. For example, the rise of telematics-based insurance, which uses data from a driver’s driving habits to assess risk, is a direct result of risk pooling. These systems allow insurers to identify and reward safe driving behavior, leading to more personalized and cost-effective insurance solutions.

Risk-Based Pricing in Car Insurance Products

Risk-based pricing is a key component of car insurance, deeply intertwined with risk pooling. By analyzing different risk factors, insurers can set premiums that reflect the likelihood of a claim for a particular driver. For example, a driver with a history of speeding tickets might pay a higher premium compared to a driver with a clean driving record.

This approach aims to ensure that everyone pays a fair price based on their individual risk profile.

“Risk-based pricing aims to reflect the actual risk a driver poses to the insurer.”

Customization of Car Insurance Policies

Risk pooling allows for greater customization of car insurance policies. Insurers can offer various add-on coverages or specific discounts that cater to different risk pools. For instance, a driver living in an area with a high incidence of theft might opt for enhanced anti-theft coverage, reflecting their unique risk profile. The ability to customize policies based on individual needs is a significant advantage of risk pooling, making the insurance process more flexible and tailored.

Future Trends in Risk Pooling

Risk pooling in car insurance is about to get a major upgrade, guys. It’s not just about combining risks anymore; it’s about using super-smart tech to make things way more efficient and accurate. This means better deals for everyone involved, from the insurance companies to the drivers. Get ready for a future where risk pooling is smoother, faster, and fairer.

Emerging Trends in Risk Pooling

The car insurance game is evolving rapidly. We’re seeing new approaches to risk assessment, and the use of data is changing how we calculate premiums and manage risks. Insurance companies are looking at more than just driving records; they’re using things like location data, driving habits (from apps!), and even weather patterns to get a more comprehensive picture of risk.

Innovations in Risk Pooling Techniques

New technologies are paving the way for fresh approaches to risk pooling. For example, usage-based insurance is becoming increasingly popular. This means premiums are adjusted based on how a driver actually drives, using data from telematics devices. Imagine getting a discount for being a smooth, safe driver! Another innovative technique is predictive modeling. By analyzing vast amounts of data, insurance companies can predict future risks with more accuracy, allowing for more targeted risk management.

Technology’s Role in Improving Risk Pooling Models, What is risk pooling in car insurance

Technology is the key to unlocking a more precise and personalized risk pooling model. Sophisticated algorithms can analyze massive datasets, identifying patterns and trends that were previously impossible to detect. Machine learning is being utilized to refine risk assessment models, making them more accurate and reliable. This leads to more fair and transparent pricing for drivers.

Future Evolution of Risk Pooling

The future of risk pooling in car insurance is looking bright, with a strong emphasis on personalized risk profiles. Expect more personalized insurance products, tailored to individual driving styles and risk factors. Imagine policies adjusting in real-time based on your driving behavior. Think about a system where you earn rewards for safe driving, leading to even lower premiums.

Advancements in Technology and Risk Pooling

The impact of technological advancements on risk pooling is significant. Data from connected cars and mobile devices provides a wealth of information, allowing for more precise risk assessment and pricing. This data-driven approach leads to more efficient risk management, and could significantly reduce insurance premiums. The introduction of AI and machine learning algorithms will revolutionize how insurance companies analyze data and adjust pricing.

Imagine algorithms predicting potential accidents before they happen!

Concluding Remarks

So, what is risk pooling in car insurance? Essentially, it’s a smart way to share the financial burden of car accidents, making insurance more affordable and sustainable. Think of it as a community effort, where everyone pitches in to cover the inevitable mishaps on the road. It’s a system that benefits both insurers and drivers, ensuring that everyone can drive with peace of mind, without the fear of being overwhelmed by astronomical premiums.

It’s like a big, collective hug for everyone involved.

FAQ Compilation

What if my accident is exceptionally expensive?

The risk pool is designed to absorb these high-cost claims. The premiums collected from everyone in the pool help pay for these expensive accidents, so you don’t have to shoulder the entire financial burden.

Can I influence my premium through risk pooling?

Absolutely! Your driving history, location, and even the type of car you drive can all impact your premium. The more responsible you are, the lower your premium could be.

How does risk pooling affect the price of insurance for different driver groups?

Risk pooling usually leads to lower premiums for safe drivers. Conversely, drivers with a history of accidents will likely pay more. It’s a fair system, really.

What happens if the pool doesn’t have enough money to cover all the claims?

Insurance companies have reserve funds and strategies in place to handle situations where the risk pool might not cover all the claims. This is why actuarial science is so important in calculating the appropriate premiums.